Swiss Franc The Euro has fallen by 0.08% to 1.1539 CHF. EUR/CHF and USD/CHF, June 26(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The global capital markets have stabilized today after yesterday’s rout in equities, softer yields, and US dollar. The implementation of US tariffs on China and China’s retaliatory tariffs on the US is still ten days off. The immediate...

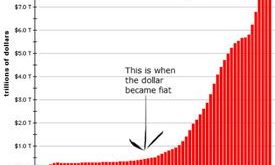

Read More »Sound Money Needed Now More Than Ever

The sound money movement reemerged on the national political scene a decade ago. In 2008, the financial crisis brought in a fresh wave of U.S. gold and silver investors. Ron Paul and the Tea Party advocated for limiting government and ending the Federal Reserve system. Sound money advocates made real inroads in recruiting Americans to their cause based on evidence that the nation is headed for bankruptcy. The...

Read More »Nearly 1 in 20 in Switzerland are millionaires, according wealth to report

© Andrii Chernykh | Dreamstime.com The 2017, a wealth report, published by Capgemini, shows there were 389,000 US$ millionaires in Switzerland, around 4.5% of the population, or close to 1 in 20. If children under the age of 15 are excluded, Switzerland’s millionaire percentage rises to 7.3%. In addition, these figures include only investable wealth, which does not include the value of family homes. If this wealth was...

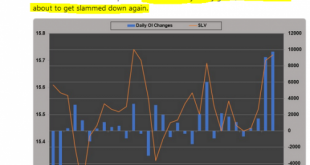

Read More »Manipulation of Gold and Silver Is “Undeniable”

Manipulation of Gold and Silver by Bullion Banks Is “Undeniable” by David Brady via ZeroHedge Manipulation in precious metals is undeniable Now so chronic that it is obvious and therefore predictable Central banks around the world are repatriating their gold from the U.S. in preparation for some major event to come I want to be long … “when that event occurs” Silver Change - Click to enlarge As a former...

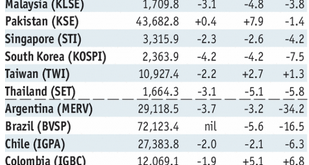

Read More »Emerging Markets: Preview of the Week Ahead

Stock Markets EM FX ended Friday mixed, and capped off a mixed week overall as the dollar’s broad-based rally was sidetracked. EM may start the week on an upbeat after PBOC cut reserve requirements over the weekend. Best EM performers last week were ARS, MXN, and TRY while the worst were THB, IDR, and BRL. Stock Markets Emerging Markets, June 20 - Click to enlarge Indonesia Indonesia reports May trade Monday....

Read More »Why do ethnic Albanians do the double-headed eagle?

Tama Vakeesan was born in Switzerland – to Tamil parents from Sri Lanka. Sometimes it's hard for Tama and her friends of different ethnic origins to stay true to family traditions. She asks Arjeta what being an ethnic Albanian means to her. (SRF Kulturplatz/swissinfo.ch) --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and...

Read More »RMR: Special Guest – Charles Hugh Smith – Of Two Minds (06/25/2018)

We are political scientists, editorial engineers, and radio show developers drawn together by a shared vision of bringing Alternative news through digital mediums that evangelize our civil liberties. Please subscribe for the latest shows daily! http://www.roguemoney.net https://www.facebook.com/ROGUEMONEY.NET/ https://twitter.com/theroguemoney

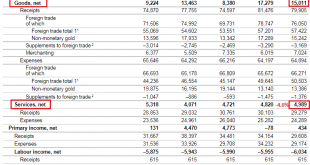

Read More »Swiss Balance of Payments and International Investment Position: Q1 2018

Current Account The current account surplus amounted to CHF 18 billion, a CHF 5 billion increase over the year-back quarter. It was calculated as the sum of all receipts (CHF 149 billion) minus the sum of all expenses (CHF 131 billion). Key figures: Current Account: Up 41% against Q1/2017 to 18.1 bn. CHF of which Goods Trade Balance: Up 62.7% against Q1/2017 to 15.1 bn. of which the Services Balance: Minus 6.2% to...

Read More »Strikes mooted over construction retirement age

Tools downed temporarily at a construction site earlier this year, there is a mood for strikes, unions say Unions on Friday threatened warning strikes for the building sector this autumn if the current retirement age of 60 for construction workers is dropped. At a press conference on Friday, Switzerland’s biggest trade union Uniaexternal link, and the union Synaexternal link called for early retirement, as well as more...

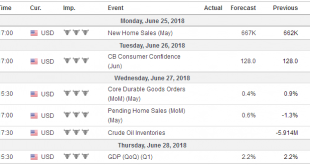

Read More »FX Weekly Preview: Trade Tensions and EU Summit Highlight Q2’s Last Week

We argue there are three major disruptive forces that are shaping the investment climate: the US policy mix in relative and absolute terms, the escalation of trade tensions, and immigration. In the week ahead, trade issues may eclipse the US policy mix, and immigration will compete with the economic and financial agenda at the European heads of state summit at the end of the week. China The People’s Bank of China made...

Read More » SNB & CHF

SNB & CHF