Preliminary estimates show that Japanese GDP surprised to the upside by a significant amount. According to Japan’s Cabinet Office, Real GDP expanded by 0.5% (seasonally-adjusted) in the first quarter of 2019 from the last quarter of 2018. That’s an annual rate of +2.1%. Most analysts had been expecting around a 0.2% contraction, which would’ve been the third quarterly minus out of the last five. Japan Real GDP,...

Read More »FX Daily, May 20: Politics Overshadows Economics Today, but Japan’s Economy Unexpectedly Expanded in Q1

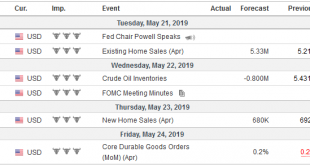

Swiss Franc The Euro has fallen by 0.11% at 1.1261 EUR/CHF and USD/CHF, May 20(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Encouraged by the election results, investors bid up Indian and Australian currencies and equities. Japan offered a pleasant surprise by reporting the world’s third-largest economy expanded in Q1. Most other equity markets in Asia...

Read More »FX Weekly Preview: The Week Ahead featuring the Battle for 7.0

The strategic objective is to integrate China into the world economy. The liberal international solution was trade, investment flows, and cultural exchanges. The rise of nationalism and China’s own willingness to flaunt the international rules are defeating the strategy. President Trump may suggest that China would prefer to negotiate with his main Democrat rival 18-months away from the election, by both Pelosi and...

Read More »Verschwörung gegen Schweiz: Was macht SNB?

„Verschwörung gegen die Schweiz?“ „Rekord-Wette von Spekulanten gegen Schweizer Franken.“ „Zur Zeit läuft die bisher grösste Währungs-Wette gegen den Schweizer Franken.“ So jüngst in Blick und Handelszeitung. Von 4 Milliarden Franken Short-Positionen gegen den Franken an der Börse in Chicago ist da die Rede. Und: Es seien dies Wetten auf die Schweizerische Nationalbank (SNB). Deren Chef Thomas Jordan habe beteuert, die...

Read More »Swiss workers open to the idea of raising retirement age

© Olena Yakobchuk | Dreamstime.com Employees Switzerland, an organisation representing Swiss workers, is resigned to the idea of raising the retirement age, according to Swiss broadcaster RTS. Speaking to the newspaper NZZ am Sonntag, Stefan Studer, director of the association, said raising the retirement age is inevitable because of the financial difficulties facing Switzerland’s state pension system, known as the...

Read More »The Normalization and Institutionalization of Fraud

Normalizing and institutionalizing fraud undermines the foundations of the economy and the financial system. I am indebted to Manoj Samanta (twitter: @flation_debate) for the insightful concept the commoditization of fraud. The first step in the commoditization of fraud is to normalize fraud as Business as Usual (BAU) to the point that it’s no longer viewed as “wrong,” destructive or an aberration of evil-doers but as...

Read More »Downward Mobility Matters More Than Liberal-Conservative Labels

The real heresy here is the American economy is now rigged for downward mobility. In the conventional narrative, one’s economic class is overshadowed by one’s political belief structure: liberal, conservative, libertarian, etc. In terms of economic class, the conventional narrative divides people into their ideological beliefs about economic ideologies: free market capitalism, socialism, etc. Economic class is one of...

Read More »Switzerland blacklisted by ILO

Delegates at the ILO’s annual conference in Geneva last year Employees who are active in trade unions are not sufficiently protected from being sacked in Switzerland, according to the International Labour Organization (ILO). The Geneva-based body has added Switzerland to a blacklist – just before a centenary conference in the Swiss city. The list comprises 40 countries that violate ILO conventions. Together with Greece...

Read More »Global Doves Expire: Fed Pause Fizzles (US Retail Sales)

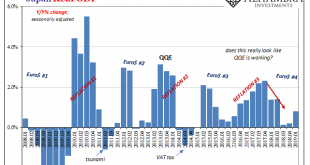

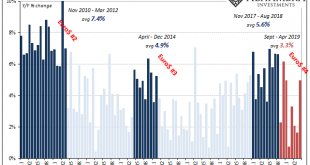

Before the stock market’s slide beginning in early October, for most people they heard the economy was booming, the labor market was unbelievably good, an inflationary breakout just over the horizon. Jay Powell did as much as anyone to foster this belief, chief caretaker to the narrative. He and his fellow central bankers couldn’t use the word “strong” enough. After the market slide through Christmas Eve, everything...

Read More »Government performs fighter jet U-turn

A Boeing F/A-18 Super Hornet lands during an assessment at the Swiss Army airbase in Payerne on April 30 The Federal Council has changed its approach to buying new combat aircraft and anti-aircraft missiles. Swiss voters will now be able to have a say only on the fighter jets, on which the government wants to spend no more than CHF6 billion ($5.95 billion). It has asked the defence ministry to present a planning...

Read More » SNB & CHF

SNB & CHF