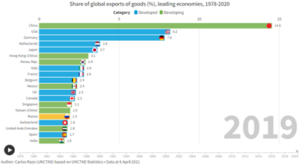

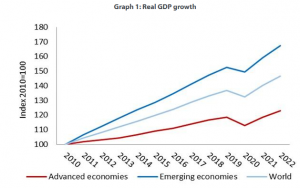

The West is getting increasingly worried about China’s export prowess as its companies are rapidly gaining market shares in green and high-tech industries. Recently, U.S. Treasury Secretary Janet Yellen accused China of industrial overcapacity and urged Europeans to respond jointly to the latter’s nonmarket practices. Allegedly, China is flooding international markets with cheap products of good quality primarily due to industrial subsidies. The U.S. and its allies are ramping up protectionist measures such as punitive tariffs, technology controls and a reinforcement of their own industrial policies. What if they are wrong and China is just providing better incentives to work, save and invest?Is overcapacity boosting China’s EV exports?Sales of Chinese electric

Read More »Articles by Mihai Macovei

Switzerland Still Cherishes its Traditional Neutrality

June 13, 2024What is the Mises Institute?

The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order. We believe that our foundational ideas are of permanent value, and oppose all efforts at compromise, sellout, and amalgamation of these ideas with fashionable political, cultural, and social doctrines inimical to their spirit.

[embedded content]

Read More »Switzerland Still Cherishes its Traditional Neutrality

May 30, 2024With more than 130,000 certified signatures, the “Pro Switzerland” civil movement asked the Swiss government to organize a national referendum on strengthening the country’s international neutrality. After the authorities followed the European Union’s sanctions on Russia and bolstered the cooperation with the North Atlantic Treaty Organization (NATO), the referendum organizers want to prevent a gradual erosion of Switzerland’s traditional neutrality.They also want to avoid Sweden’s fate, which all of a sudden asked to join NATO once Russia invaded Ukraine. The Swedish government was quick to overturn a position of neutrality stretching back to the Napoleonic period without even organizing a popular consultation. This cautionary tale offers interesting insights

Read More »The Rise of Populism Reflects the Decline in Individual Freedom

April 8, 2024So-called populist political parties and politicians gained considerable traction with Western voters in recent years, despite being dismissed in many cases as “a threat to democracy” and “extremists” by mainstream politicians. With the election of Donald Trump in the US and of Javier Milei in Argentina, the surge in polls and electoral wins of right and far-right parties in several European countries sent shockwaves through the political establishment.The Cambridge Dictionary defines populism as “political ideas and activities that are intended to get the support of ordinary people by giving them what they want.” If populism caters to the wishes of the people, then how could it be a threat for democracy? This sounds paradoxical together with the blunt refusal of

Read More »Fiscal Rules Do Not Undermine Investment, But Government Profligacy Does

February 18, 2024In the wake of the financial meltdown fifteen years ago, some countries placed strict limits on piling on public debt. Despite cries that this harms investment opportunities, the ”debt brakes” have worked well.

Original Article: Fiscal Rules Do Not Undermine Investment, But Government Profligacy Does

[embedded content]

Tags: Featured,newsletter

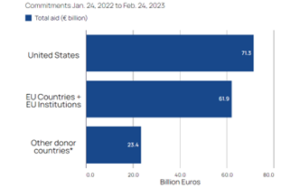

Read More »President Biden Is Wrong. Military Spending Does Not Produce Wealth

December 14, 2023So far, the White House has justified its unwavering support for Ukraine on lofty grounds such as defending democracy and freedom—both in Ukraine and in the West. However, with the American public—who bears the cost of the war in Ukraine—turning against it, several Republican lawmakers questioning its purpose and affordability, and elections approaching, the Biden administration has changed the messaging on the war. Its new line is that sending weapons to Ukraine is actually an investment in American industry, strengthening the economy and creating new jobs.

Joe Biden’s new argument fits well into the flawed Keynesian logic of “Bidenomics” in which economic prosperity is built upon generous public spending for infrastructure, semiconductors, and clean energy

How German Exports Lost the Race with China

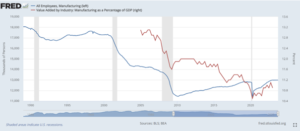

October 31, 2023Germany is the euro area’s economic powerhouse and most competitive economy. It accounts for close to 30 percent of the euro area gross domestic product (GDP) and has recorded sizable current account surpluses since the introduction of the euro. Substantial fiscal and labor market reforms in the early 2000s propelled the German economy.

However, these golden days seem all gone now. Years of misguided energy policies—part of the government’s interventionist green agenda—increased energy prices and uncertainty for investors. In addition, the business environment deteriorated due to heavy bureaucracy and taxation, seriously weakening Germany’s productivity and output growth. The real beneficiary of Germany’s economic woes seems to be China, which has replaced it as

There Is No Fed Magic Trick to Achieve a Soft Landing

September 24, 2023There are no more rabbits for the Fed monetary magicians to pull out of their hats. In an economy addicted to artificially low interest rates, any more moves by the Fed will trigger an economic downturn.

Original Article: There Is No Fed Magic Trick to Achieve a Soft Landing

[embedded content]

Tags: Featured,newsletter

Read More »There Is No Fed Magic Trick to Achieve a Soft Landing

September 1, 2023Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first quarter, and climbing well above the 1.8 percent rate predicted by economists. Many analysts are surprised that the US economy has continued to expand at a robust pace despite the Federal Reserve’s (Fed) aggressive tightening on monetary policy.

The Fed raised interest rates by more than 500 basis points (bps) since March 2022. And yet, the labor market remains tight with a very low unemployment rate at 3.6 percent while the Standard and Poor 500 stock index is up almost 20.0 percent since the beginning of the year. Economists are optimistic that the Fed could deliver a soft landing by reducing inflation close to

Rothbard Was Right: Wars Don’t Enhance Freedom. They Destroy Liberty.

May 13, 2023We hear ad nauseum from political and media elites that the war in Ukraine is about preserving "our freedoms." Murray Rothbard had something to say about this sophistry.

Original Article: "Rothbard Was Right: Wars Don’t Enhance Freedom. They Destroy Liberty."

[embedded content]

Tags: Featured,newsletter

Read More »Rothbard War Right: Wars Don’t Enhance Freedom. They Destroy Liberty.

April 27, 2023Since the beginning of the war in Ukraine, Western leaders have declared that Ukraine was defending not only its own freedom, but ours too. President Joe Biden, to whom apparently “freedom is priceless,” vowed to support Ukraine for “as long as it takes.”

In turn, President Volodymyr Zelenskyy stated that the American support for Ukraine is not charity but an “investment in global security”. Other commentators also argue that a Ukrainian victory would strengthen global freedom by deterring other aggressions from autocratic powers like China. Yet, these positions are at odds with the clear antiwar stance of Murray N. Rothbard, one of the most prominent American libertarians of the twentieth century.

Rothbard made a clear distinction between the interests of

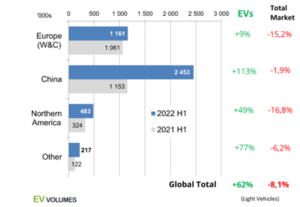

China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

March 4, 2023It is easy to dismiss Chinese advancements in electric vehicles as the result of government subsidies, but private entrepreneurship also is playing a major role.

Original Article: "China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market"

This Audio Mises Wire is generously sponsored by Christopher Condon.

[embedded content]

Tags: Featured,newsletter

Read More »China’s Emerging Global Leadership Isn’t Just the Result of Subsidies: Entrepreneurship Still Matters in This Market

February 24, 2023China has become a global leader in the electric vehicles (EVs) sector, and Western governments are worried that its comparative advantage will become entrenched. Once again, mainstream pundits blame China’s success on government subsidies and unfair competition. This is just a pretext to argue for more government support in a sector which, from the very beginning, has not been driven by genuine consumer demand but by a political green agenda.

China Leads in the Global EV Race

About a decade after overtaking the US automotive market, China has become the world’s largest EV market and producer. According to analyst forecasts, domestic EV sales are expected to surge to about eight to ten million cars in 2023, up from record sales of 6.5 million in 2022. This exceeds

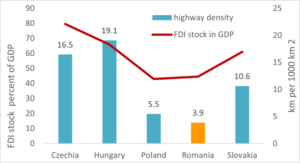

Government Malinvestment Is Endemic and Ceaușescu’s Socialist Romania Excelled in It

October 5, 2022Today’s intellectual framework considers government spending to be the solution to any economic and social problem. Be it helicopter money to households and businesses during the pandemic, subsidies for electric cars, or debt forgiveness to students, the government generosity must be growth and welfare enhancing by definition.

Government spending is even more praised if it is labeled an “investment” in green projects, in industries making countries self-sufficient in high-tech, or in military equipment to fend off foreign autocracies. However, Austrian economists are way more skeptical about the alleged benefits of government expenditures as they do not follow the market principle of being voluntary exchanges that satisfy genuine consumer needs.

For this reason,

Government Intervention into International Currency Exchange Rates: Japan as a Case Study

September 18, 2022The recent hefty depreciation of the yen to a twenty-four-year low against the dollar has raised eyebrows due to the yen’s traditional safe haven role in times of turmoil, such as the war in Ukraine. The yen’s decline had already started when major central banks signaled a tightening of monetary policy to fight inflation while the Bank of Japan (BoJ) doubled down on its loose monetary policy and zero target for ten-year bond yields. The depreciation accelerated further when oil and gas prices surged, weakening Japan’s terms of trade.

Mainstream analysts got wary about the yen’s tumble and its negative impact on import prices and consumption, but recommended the BoJ to continue its ultraloose monetary policy in order to reflate the economy and support growth.

What

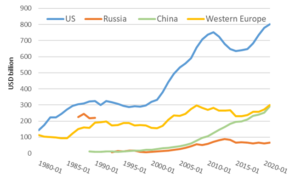

Peace through Strength? Excessive US Military Spending Encourages More War

May 28, 2022The Russian invasion of Ukraine has brought America’s foreign policy interventions under the limelight once again. Ryan McMaken argues that the US administration’s claim that countries should not have the right to a sphere of influence, implicitly addressing Russia, is hypocritical. The US opposes a sphere of influence for Russia and other regional powers, while at the same time has steadily expanded its own global outreach. Among other, one can judge how true this is by looking at the amount of US military spending and size of its foreign military interventions.

The USA not only spends a disproportionately high amount of money on military relative to the rest of the world, but has also continued doing so when the Cold War was over and it could have set in motion

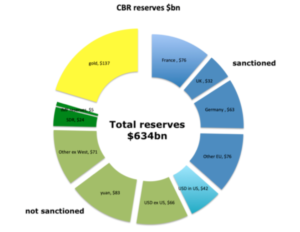

Heavy Sanctions against Russia Could Usher in a Wider Economic War

April 11, 2022Vladimir Putin’s invasion of Ukraine was met with unprecedented economic sanctions by the United States and its allies in order to cripple Russia’s capacity to wage war. Never before in post–World War II history has an economy of Russia’s size been reprimanded with such force. Moreover, the sanctions could remain in place after the war ends and reach other major economies too, in particular China. In this case, current sanctions could be the harbinger of a longer-term economic war with dire consequences for global productivity and welfare.

Sweeping Sanctions Invite Countersanctions

The round of sanctions imposed on Russia following the annexation of Crimea in 2014 were limited to travel bans, freezing of the assets of certain Russian officials, and a prohibition

China Needs to Pop Its Property Bubble

March 5, 2022The financial woes of the giant real estate developer Evergrande, which carries an estimated debt of $300 billion, have rekindled global fears that China’s property bubble is about to burst. Such predictions have occurred repeatedly in the past, in particular since 2010, and have been fueled by the rapid rise of property prices, construction volumes, and real estate debt. Today, many analysts fear that if the property bubble collapses, the impact on the real economy will be devastating. Some expect China’s growth potential to decrease dramatically, to 4 percent per year from about 8 percent during 2010–19, or even lower. Yet the current property market turmoil originates in regulatory action to reduce financial leverage, and it may not lead to a full-fledged

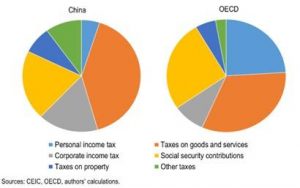

Read More »Cronyism, Not Welfare, Is China’s Big Problem

November 9, 2021After three decades of promarket reforms, extreme poverty in China has been virtually eradicated. So President Xi Jinping now has the leverage to shift his attention to reducing the wealth gap in Chinese society. In a speech to the Chinese Communist Party in August, Xi touted “common prosperity” for all Chinese as an essential requirement of socialism and modernization.

Western pundits have welcomed China’s drive for more income redistribution and consumption, but have also interpreted Xi’s move as an indicator of a possible descent into welfarism and a tightening of the regime’s control over the private sector.

But this is not necessarily the case. Rather the Chinese regime has shown a reluctance to sizably increase the size of its welfare state, even if its

“Shortages” Aren’t Causing Inflation. Money Creation Is.

October 14, 2021The current surge in inflation is not due to a shortage of supply as central banks want us to believe. It is primarily due to soaring consumer demand fueled by monetary creation.

Original Article:

For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price pressures are persisting longer than expected, the surge of inflation is allegedly due to supply bottlenecks caused by the pandemic. This superficial diagnosis serves as a convenient excuse for politicians to keep in place damaging growth stimuli and draconian public health measures.

Inflation Is Not

Read More »“Shortages” Aren’t Causing Inflation. Money Creation Is.

October 8, 2021For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price pressures are persisting longer than expected, the surge of inflation is allegedly due to supply bottlenecks caused by the pandemic. This superficial diagnosis serves as a convenient excuse for politicians to keep in place damaging growth stimuli and draconian public health measures.

Inflation Is Not Driven by a Shortage of Supply

Mainstream economists define inflation as an increase in consumer prices which occurs when the growth of money supply outpaces economic growth.1 In other words, too much

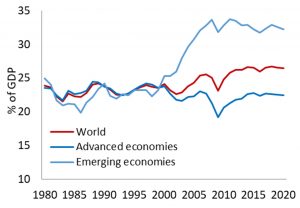

The Case Against the New “Secular Stagnation Hypothesis”

August 14, 2021Abstract: The new “secular stagnation hypothesis” developed by Lawrence H. Summers attempts to justify why the demand stimulus applied in the aftermath of the global financial crisis failed to revive growth in a satisfactory manner. Building on previous ideas of Keynes, Hansen, and Bernanke, Summers claims that excess savings together with feeble investment drove the natural rate of interest down to zero and advanced economies into stagnation. As the US monetary policy rate is not allowed to fall below the zero bound, Summers calls for “quantitative easing” and more expansionary fiscal policy to spur investment demand. This paper refutes Summers’s hypothesis by revealing its internal inconsistencies and presenting both theoretical arguments and empirical evidence

Read More »Forced Vaccinations in France Bring Both Repression and Protest

July 23, 2021[unable to retrieve full-text content]In a speech to the nation just ahead of Bastille Day on July 14 celebrating the French Revolution, President Emmanuel Macron delivered a paradoxical blow to the Republic’s famous slogan: Liberté, égalité, fraternité. He announced a series of measures to speed up the pace of covid-19 vaccinations which undermine individual liberties and threaten a strong political and economic backlash.

Read More »