For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price pressures are persisting longer than expected, the surge of inflation is allegedly due to supply bottlenecks caused by the pandemic. This superficial diagnosis serves as a convenient excuse for politicians to keep in place damaging growth stimuli and draconian public health measures. Inflation Is Not Driven by a Shortage of Supply Mainstream economists define inflation as an increase in consumer prices which occurs when the growth of money supply outpaces economic growth.1 In other words, too much

Topics:

Mihai Macovei considers the following as important: 6b) Mises.org, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

For central bankers and mainstream analysts the recent inflation outburst is only a transitory phenomenon which has nothing or very little to do with the massive monetary and fiscal stimuli unleashed during the pandemic. Although the Fed has recently conceded that price pressures are persisting longer than expected, the surge of inflation is allegedly due to supply bottlenecks caused by the pandemic. This superficial diagnosis serves as a convenient excuse for politicians to keep in place damaging growth stimuli and draconian public health measures.

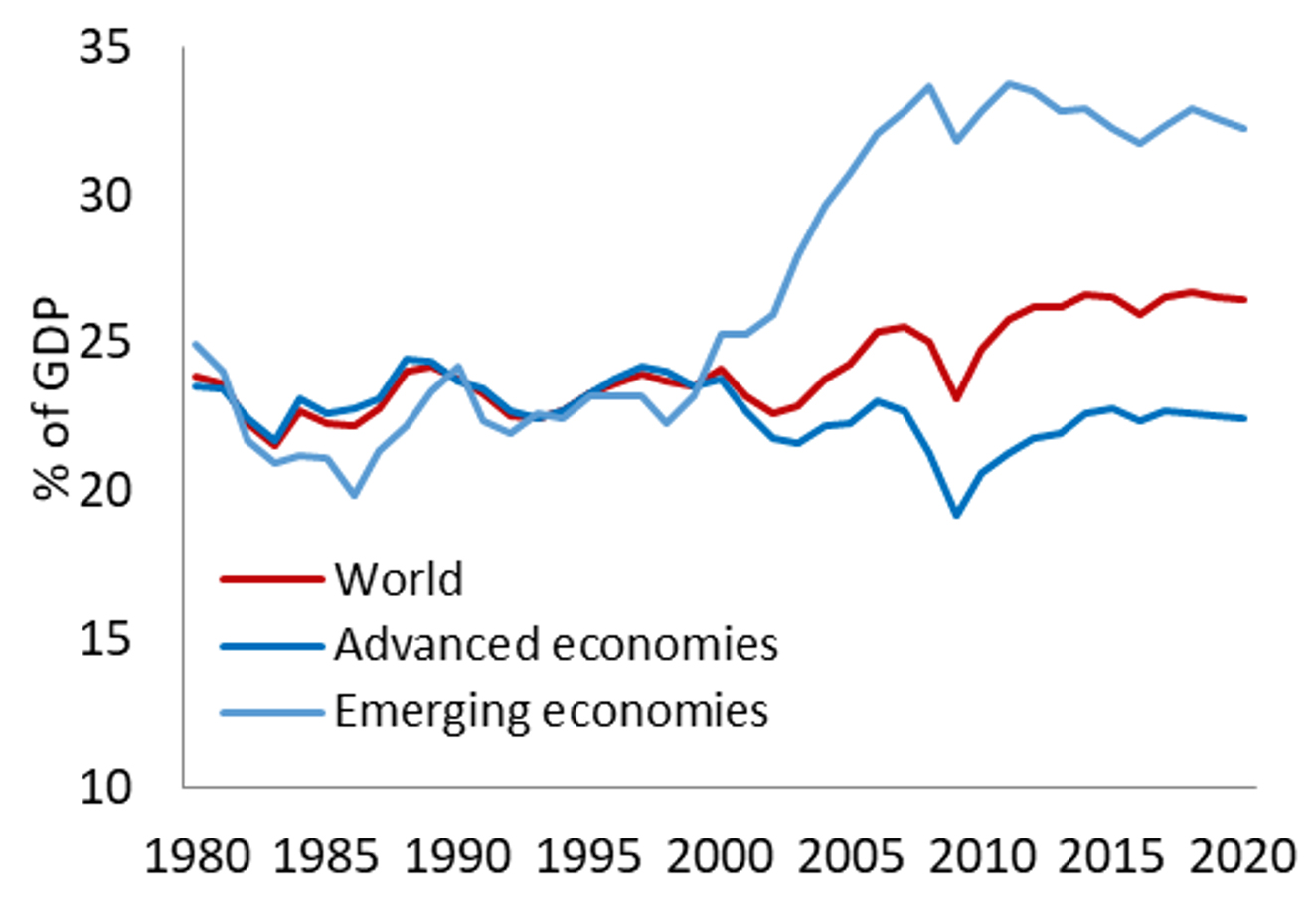

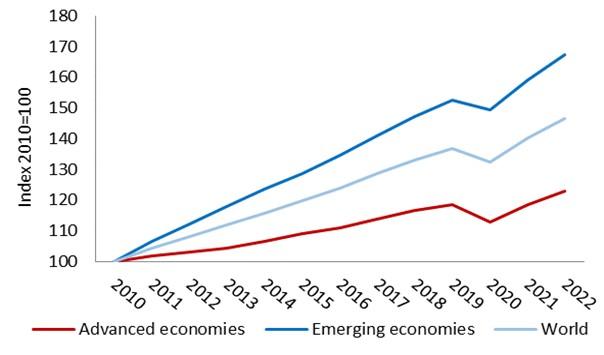

Inflation Is Not Driven by a Shortage of SupplyMainstream economists define inflation as an increase in consumer prices which occurs when the growth of money supply outpaces economic growth.1 In other words, too much money is chasing too few goods. If the recent surge in inflation were driven by a shortage of goods rather than an increase in the money supply, then aggregate output would be shrinking. But this is not the case, because global economic output is projected by the Organisation for Economic Co-operation and Development to grow by 5.7 percent in 2021 after having dropped by 3.4 percent in 2020. This year, the output lost during the pandemic is expected to be recovered in both advanced and emerging economies, including in the US (graph 1). |

Graph 1: Real GDP growth Source: IMF World Economic Outlook. - Click to enlarge |

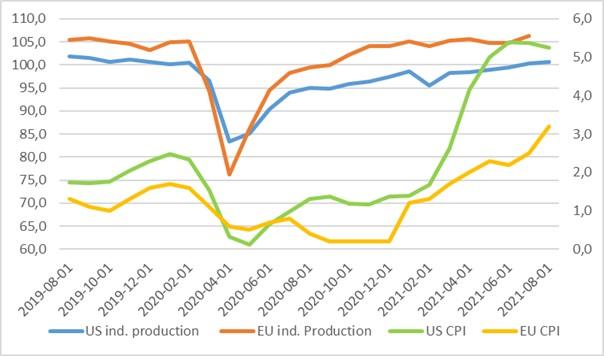

| As a matter of fact, inflation was accelerating this year at the same time that industrial production was recovering to prepandemic levels in both the US and the EU (graph 2). The alleged shortage of supply at an aggregate level appears to be a myth.

The invoked shortage of supply is primarily based on anecdotal evidence about unmet demand and rising prices in specific economic sectors, such as semiconductors, cars, furniture, and energy. But those who claim that supply is insufficient do not bother to analyze whether the squeeze of supply chains is due to chronic shortage of production or to excess demand. Moreover, even if supply were short for certain goods due to production lockdowns, changes in consumer schedules, or environmental greening policies, a surge in the aggregate price level would not take place if the money supply and aggregate demand remained broadly unchanged. The squeeze on some individual supply chains would be compensated for by lower demand for other goods and services, and only relative prices would change in the economy. |

Graph 2: Inflation and industrial production Source: FRED and Eurostat. - Click to enlarge |

| Let us have a closer look at specific cases of widely perceived supply bottlenecks. The shortage of shipping containers and logistic problems at several ports in the US and Asian countries seems central to many other supply chain bottlenecks. Shipping costs have soared indeed, but shipped volumes have increased as well (graph 3). |

Graph 3: Global TEU shipping volume and price index Source: Container Trades Statistics. - Click to enlarge |

| This does not indicate a lack of supply, but rather buoyant demand for international transport. Experts from leading shipping groups report that major US ports, container groups, and logistics companies can barely handle the surge in international trade. This is not surprising given that both US imports and its trade deficit surged by more than 20 percent year on year in the first seven months of 2021, as consumers rushed to spend their stimulus checks. United Nations Conference on Trade and Development experts claim that the global demand for manufactured consumer goods increased throughout the pandemic, boosting the demand for container shipping and raising transportation costs. The surge in global demand has not only rearranged international trade flows to the advantage of China and other Asian economies, but has also pushed international trade volumes to new highs (graph 4). |

Graph 4: Global volume of trade Source: World Trade Organization. - Click to enlarge |

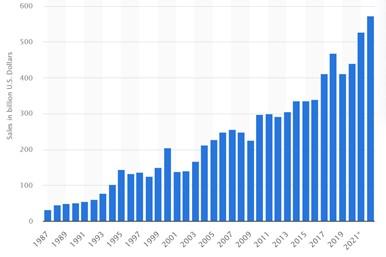

| The shortage of semiconductors, which affects car production, is also blamed on the inability of chip manufacturers to deal with an order backlog swollen by covid-19 and shipping disruptions. But the global semiconductor market expanded by 7 percent in 2020 and is projected to grow by another 20 percent this year (graph 5) and almost double in size by 2028. So, again, the shortage is being caused by a relatively rigid supply which cannot accommodate buoyant demand. The latter has increased not only from the automotive sector, in particular as electric vehicles use more chips, but also from manufacturers of computers and other consumer electronics, the consumption of which has surged during the pandemic. |

Graph 5: Global market for semiconductors Source: Statista 2021. - Click to enlarge |

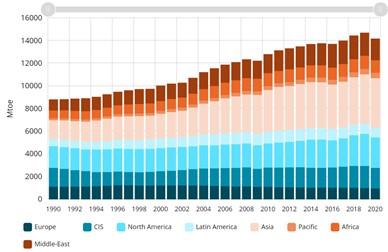

| The recent rally in energy prices, with coal and European gas hitting record highs and crude oil pushing above $80 a barrel, is also attributed to a constrained supply and perceived as a threat to the economic recovery. But the global supply has not shrunk; on the contrary, the world production of energy has been on a steady upward trend (graph 6). After growing by about 2.4 percent per year for the past three years, energy production fell by 3.5 percent in 2020 due to the lockdowns, but is expected to rebound by 4.1 percent in 2021.

The global energy supply would have been much higher and better balanced among sources and across regions had it not been for government-mandated green policies and carbon emission targets. In Europe, coal plants have been gradually phased out, as have nuclear power plants in Germany. They have been replaced by wind turbines and other renewable energy sources which underperformed recently due to adverse weather conditions. Together with lower gas deliveries from Russia, this has created a perfect storm in the European energy market. At the same time, China’s strict emissions targets and rising coal prices have also generated a power crunch, disrupting factory activity. In the same way that green government policies have undermined the production of energy, the lockdowns and stimulus paychecks generously handed out during the pandemic have created an artificial shortage of labor that is likely to exacerbate further inflationary pressures. Due to forced business closures, the US economy lost about 20 million jobs by April of last year. Despite the economic recovery, some 5 million jobs have not yet been filled, as millions of Americans have been paid to stay home or have left the labor force altogether. In Europe, trade unions are already asking for pay increases while surveys show that inflation expectations are rising. |

Graph 6: World energy production Source: Enerdata. - Click to enlarge |

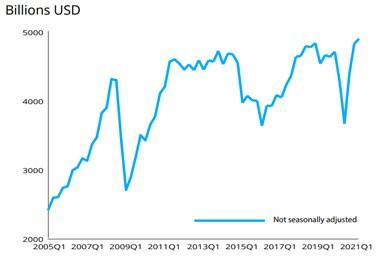

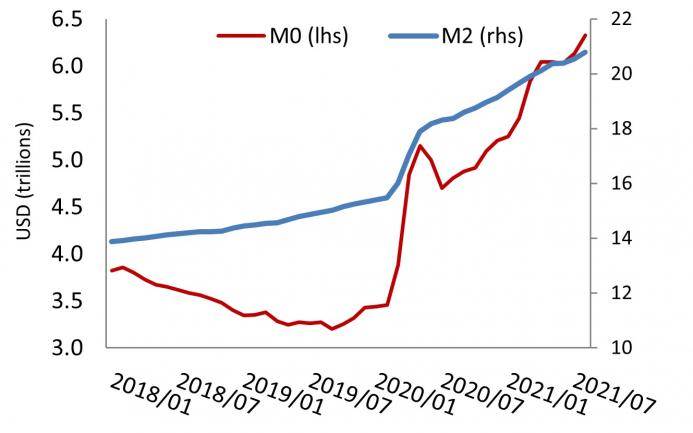

Excessive Demand Stimulus and Money Creation Are the Real CulpritThe growth stimuli applied during the pandemic have been truly unprecedented in size and outreach. Massive government support and budget deficits monetized by central banks have been poured over economies weakened by recurrent lockdowns. Despite the loss of jobs and market incomes, US household wealth has increased by a staggering $32 trillion since the beginning of the pandemic, fueling consumer spending and aggregate demand. Together with an increase in the broad money supply by more than a third over the same period (graph 7), this indicates that the inflation is actually driven by too much money rather than too few goods. The rapid rise in inflation is also raising inflation expectations.3 Inflation depends not only on the mechanical outcome of changes in the supplies of money and goods, but also on the demand for money. If the public realizes that its cash holdings are being eaten away by significant price increases, it will move away from cash. In this case, inflation would accelerate beyond the pace of money creation, which is obviously the nightmare of all central bankers. |

Graph 7: Money supply Source: FRED. - Click to enlarge |

Conclusions

The current surge in inflation is neither due to a shortage of supply nor transitory, as central banks want us to believe. It is primarily due to soaring consumer demand fueled by excessive growth stimuli and monetary creation. Government-imposed lockdowns and clean energy policies constraining output have exacerbated price increases. We are witnessing a consumption boom and persistent distortions in the structure of production, all bearing a striking resemblance to the boom that preceded the Great Recession.

- 1. This definition is disputed by Austrian economists because price inflation lumps together monetary and nonmonetary causal factors, which have different consequences for the structure of production, incomes, and individual wealth. Therefore, Austrian economists define inflation as an increase in the supply of money beyond an increase in specie, i.e., commodity money such as gold or silver.

- 2. According to the Financial Times, it costs more than $20,000 to ship a standard container from China to the East Coast of the US today, up from less than $3,000 two years ago.

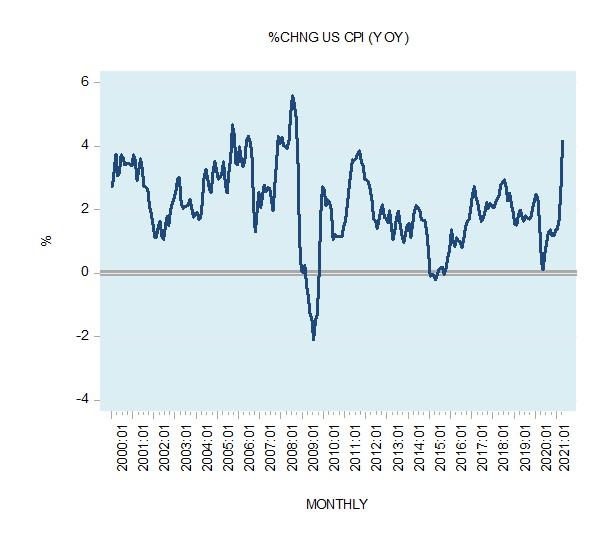

- 3. In the US, Consumer Price Index inflation advanced by 5.3 percent in August, housing prices grew by almost 20 percent year on year as of July, and the S&P 500 Index was up by almost 29 percent year on year at the end of September.

Tags: Featured,newsletter