Gold price advances to over a two-week high and draws support from a combination of factors.

Geopolitical risks, trade war fears and rate cuts by major central banks underpin the XAU/USD.

Rising US bond yields underpin the USD and cap the yellow metal ahead of the US CPI report.

Gold price (XAU/USD) prolongs its weekly uptrend for the third consecutive day on Wednesday and climbs to a two-and-half-week high during the Asian session. The commodity now looks to extend the momentum beyond the $2,700 mark and remains well supported by a combination of factors. Geopolitical risks stemming from the worsening Russia-Ukraine war and tensions in the Middle East, along with concerns over US President-elect Donald Trump’s tariff plans, continue to boost safe-haven demand.

Articles by Haresh Menghani

Gold price weekly uptrend remains uninterrupted despite positive risk tone

November 21, 2024Gold price attracts buyers for the fourth consecutive day and climbs to over a one-week high.

Geopolitical risks stemming from the Russia-Ukraine conflict benefit the safe-haven XAU/USD.

Elevated US bond yields could underpin the US Dollar and cap the non-yielding yellow metal.

Gold price (XAU/USD) adds to its intraday gains and climbs to a fresh one-and-half-week high, around the $2,664-2,665 area during the first half of the European session on Thursday. The uptrend witnessed since the beginning of the current week is fueled by geopolitical risks stemming from the worsening Russia-Ukraine war, which tends to benefit the safe-haven precious metal. Apart from this, a modest US Dollar (USD) downtick acts as a tailwind for the commodity.

Gold price remains on the defensive below $2,748-2,750 hurdle amid positive risk tone

October 28, 2024Gold price attracts some dip-buying on Monday and draws support from a combination of factors.

Middle East tensions, US election jitters and a modest USD pullback seem to benefit the XAU/USD.

Bets for smaller Fed rate cuts and rising US bond yields might cap the upside for the precious metal.

Gold price (XAU/USD) struggles to capitalize on its intraday bounce and remains below the $2,748-2,750 supply zone through the early part of the European session on Monday. Safe-haven demand stemming from Middle East tensions and US election jitters continues to act as a tailwind for the precious metal. Apart from this, a modest US Dollar (USD) pullback from its highest level since July 30 turns out to be another factor lending some support to the

Japanese Yen remains on the front foot against USD; lacks bullish conviction

October 8, 2024The Japanese Yen recovers further from a two-month trough touched against the USD on Monday.

Geopolitical tensions benefit the safe-haven JPY and exert downward pressure on the USD/JPY pair.

The BoJ rate hike uncertainty caps gains for the JPY and should limit any further losses for the major.

The Japanese Yen (JPY) remains on the front foot against its American counterpart for the second successive day on Tuesday, albeit it lacks bullish conviction. The overnight comments by Japanese officials revived intervention fears, which, along with escalating geopolitical tensions in the Middle East, turn out to be key factors underpinning the safe-haven JPY. Apart from this, a modest US Dollar (USD) downtick exerts some downward pressure on the

Gold price ticks lower amid positive risk tone and some repositioning ahead of US inflation

August 13, 2024Gold price pulls back from the vicinity of the monthly peak retested earlier this Tuesday.

Bulls opt to lighten their bets amid a positive risk tone and ahead of the US inflation data.

Geopolitical risks and bets for a 50-bps rate cut by the Fed should help limit the downside.

Gold price (XAU/USD) attracts some sellers following an Asian session uptick back closer to the monthly peak and erodes a part of the previous day’s strong gains of more than 1%. A generally positive tone around the equity markets turns out to be a key factor undermining demand for the safe-haven precious metal. Bulls further opt to lighten their bets ahead of the release of the key US inflation figures – the Producer Price Index (PPI) and the Consumer Price Index

Gold price remains on the defensive below 50-day SMA amid reviving USD demand

February 28, 2024Gold price remains confined in a narrow band heading into the European session.

Hawkish Fed expectations underpin the USD and act as a headwind for the metal.

The downside seems limited ahead of the crucial US PCE Price Index on Thursday.

Gold price (XAU/USD) extends its sideways consolidative price move around the 50-day Simple Moving Average (SMA) on Wednesday as traders await fresh catalyst before positioning for the next leg of a directional move. Hence, the focus remains glued to the US Personal Consumption Expenditures (PCE) Price Index on Thursday, which will provide cues about the Federal Reserve’s (Fed) rate-cut path and drive the non-yielding yellow metal.

In the meantime, the emergence of some US Dollar (USD) buying, bolstered by hawkish Federal

Gold price consolidates post-US CPI losses, seems vulnerable near two-month low

February 14, 2024Gold price hits a fresh two-month low amid bets that the Fed will keep rates higher for longer.

The expectations were reaffirmed by the stronger-than-expected US CPI released on Tuesday.

A softer risk tone lends support to the safe-haven XAU/USD and helps limit any further losses.

Gold price (XAU/USD) extends its sideways consolidative price move and remains depressed below the $2,000 psychological mark, or a two-month low heading into the European session on Monday. The stronger-than-expected US consumer inflation report released on Tuesday fueled speculations that the Federal Reserve (Fed) will wait until the June policy meeting before cutting interest rates. This remains supportive of elevated US Treasury bond yields and undermines the non-yielding yellow

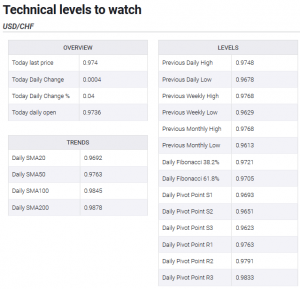

USD/CHF Price Analysis: Technical set-up remains tilted in favour of bullish traders

April 7, 2020USD/CHF traded with a positive bias for the sixth consecutive session on Monday.

Bulls are likely to wait for a sustained move beyond the very important 200-DMA.

The USD/CHF pair built on last week’s goodish positive move of around 300 pips and continued gaining traction for the sixth straight session on Monday.

The pair climbed to near two-week tops in the last hour, with bulls now looking to extend the momentum further beyond the 0.9800 round-figure mark.

The mentioned handle nears the very important 200-day SMA, around the 0.9810 region, which if cleared might be seen as a fresh trigger for bullish traders.

Meanwhile, technical indicators on the daily chart have just started moving into the positive territory and further reinforce prospects for an extension of

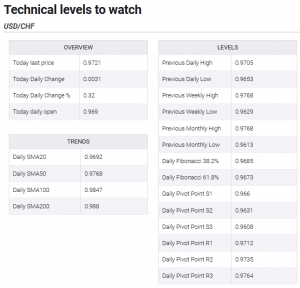

USD/CHF Price Analysis: Intraday positive move stalls near the 0.9590 confluence region

March 31, 2020USD/CHF finds decent support near 0.9500 mark and snaps four days of losing streak.

The set-up warrants some caution before positioning for any further recovery move.

The USD/CHF pair found a decent support near the key 0.9500 psychological mark and staged a goodish recovery on the first day of a new trading week, snapping four consecutive days of losing streak.

The positive move lifted the pair to a short-term descending trend-channel breakpoint, turned resistance, which coincides with 50-hour SMA and 23.6% Fibonacci level of the 0.9902-0.9502 downfall.

The mentioned confluence region might now act as a key pivotal point for short-term traders, above which the recovery momentum could further get extended towards 38.2% Fibo., around mid-0.9600s.

Given that

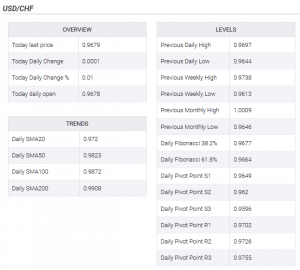

USD/CHF Price Analysis: Bulls await a sustained move beyond 0.9765-70 supply zone

February 7, 2020USD/CHF trades with a positive bias for the fourth consecutive session.

The 0.9700 mark might now act as a strong base for bullish traders.

The USD/CHF pair edged higher for the fourth consecutive session on Thursday and is currently placed near one-week tops, levels just below mid-0.9700s.

Any subsequent positive move is likely to confront stiff resistance near the 0.9765-70 region (testing twice in January) and kept a lid on any further gains.

The mentioned barrier coincides with 38.2% Fibonacci level of the 1.0024-0.9613 downfall, which if cleared might be seen as a key trigger for bullish traders.

Moreover, technical indicators on hourly/daily charts have been gaining positive traction and support prospects for an extension of the ongoing momentum.

Hence, some

USD/CHF sits near 1-week tops, just below mid-0.9700s

February 7, 2020USD/CHF edges higher for the fourth consecutive session on Thursday.

The risk-on mood weighed on the safe-haven CHF and remained supportive.

A pullback in the US bond yields kept a lid on the USD and capped gains.

The USD/CHF pair now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading band near one-week tops, just below mid-0.9700s.

The pair added to its positive momentum witnessed since the beginning of this week and edged higher for the fourth consecutive session on Thursday amid the prevailing risk-on mood, which tends to undermine the Swiss franc’s perceived safe-haven status.

USD/CAD remains supported by risk-on mood

More positive development surrounding the coronavirus saga, coupled with hopes the economic

USD/CHF clings to gains above 0.9700 mark, US data eyed for fresh impetus

February 6, 2020USD/CHF gains positive traction for the third consecutive session on Wednesday.

Optimism over coronavirus treatment triggered a fresh wave of global risk-on trade.

The USD benefitted from surging US bond yields and remained support ahead of data.

The USD/CHF pair surged through the 0.9700 round-figure mark and climbed to near one-week tops in the last hour, albeit retreated few pips thereafter.

The pair gained some follow-through traction for the third consecutive session on Wednesday and added to its recent positive move amid weakening demand for traditional safe-haven assets. Some positive developments in the coronavirus saga triggered a fresh wave of the global risk-on rally, which dented the Swiss franc’s perceived safe-haven status.

USD/CHF supported by

Read More »USD/CHF consolidates in a range, below 0.9700 handle

January 21, 2020USD/CHF consolidates Friday’s goodish intraday positive move.

The prevalent cautious mood seemed to have capped the upside.

The USD/CHF pair was seen oscillating in a narrow trading band below the 0.9700 mark on Monday and consolidated the previous session’s goodish positive move.

A combination of supporting factors helped the pair to gain some follow-through positive traction for the second consecutive session on Friday and build on the previous session’s modest recovery from multi-month lows.

Bulls seemed reluctant amid cautious mood

The latest optimism over the long-awaited US-China phase one trade deal remained supportive of the recent risk-on rally across the global financial markets and continued weighing on the Swiss franc’s perceived safe-haven status.

On

USD/CHF hammered down to sub-0.9900 levels, 2-week lows

December 3, 2019USD/CHF lost some additional ground for the second straight session on Tuesday.

A subdued USD demand, stability in equity markets did little to provide any respite.

Trump’s latest remarks opened the room for a further intraday depreciating move.

The USD/CHF pair witnessed some follow-through selling on Tuesday and dropped to near two-week lows, below the 0.9900 handle in the last hour.

Having repeatedly failed to find acceptance above the parity mark, the pair came under some aggressive selling pressure on the first day of a new trading week and was being weighed down by a combination of negative forces.

Trade uncertainty continues to exert pressure

The US President Donald Trump’s decision to re-impose tariffs on steel and aluminium from Brazil and Argentina

USD/CHF technical analysis: Bulls struggle to extend the recovery beyond 0.9900 handle

November 15, 2019Renewed US-China trade optimism helped regain some traction.

The uptick lacked bullish conviction and warrants some caution.

The USD/CHF pair stalled its recent pullback from levels beyond 200-day SMA and regained some traction on the last trading day of the week. Renewed trade optimism weighed on the Swiss franc’s safe-haven status and led to a modest recovery, though bulls struggled to extend the momentum beyond the 0.9900 handle.

On the daily chart, the pair has been oscillating between two converging trend-lines over the past two months or so and now seemed to have formed a symmetrical triangle.

Meanwhile, oscillators on 4-hourly/daily charts have been recovering but struggled for a firm direction, warranting some caution for aggressive traders.

Given the

USD/CHF technical analysis: Jumps back closer to over 1-week tops

October 26, 2019The intraday pullback finds decent support ahead of 0.9900 handle.

Move beyond 0.9935 will set the stage for additional near-term gains.

The USD/CHF pair did witness some intraday pullback but showed some resilience below 38.2% Fibonacci level of the 1.0028-0.9837 recent downfall. The pair managed to find decent support near 200-hour SMA and has now moved back closer to over one-week tops set earlier this Friday.

Meanwhile, technical indicators on the 4-hourly chart maintained their bullish bias and have again started gaining positive traction on the 1-hourly chart. This coupled with the fact that oscillators on the daily chart have just moved in the positive territory support prospects for additional gains.

However, traders are likely to wait for a sustained move

USD/CHF technical analysis: Breaks below 0.9940 confluence support, turns vulnerable

October 17, 2019The pair remains under some selling pressure for the second straight session.

The ongoing slide dragged it below a two-month-old ascending trend-channel.

Bears might now aim towards challenging the 0.9900 round-figure mark.

The USD/CHF pair extended this week’s rejection slide from the vicinity of the key parity mark and remained under some selling pressure for the second consecutive session.

The ongoing slide to one-week lows has now dragged the pair below a confluence support near the 0.9940 region, which might now be seen as a key trigger for bearish traders.

The mentioned support comprised of 23.6% Fibonacci level of the pair’s 0.9659-1.0028 recent strong move up and the lower end of a two-month-old ascending trend-channel.

Meanwhile, technical indicators on

USD/CHF technical analysis: Intraday uptick falters just ahead of parity mark

October 17, 2019Despite the intraday pullback, the pair has managed to hold above 200-DMA.

The near-term technical set-up support prospects for some dip-buying interest.

The USD/CHF pair failed to capitalize on its intraday positive move and faced rejection near the key parity mark, albeit has still managed to hold above the very important 200-day SMA.

Given the pair’s repeated bounce from a support marked by the lower end of a two-month-old ascending trend-channel, the near-term bias remains tilted in favour of bullish traders.

Moreover, technical indicators on hourly charts have been losing positive momentum but maintained their bullish bias on the daily chart, supporting prospects for some dip-buying interest. Hence, any meaningful slide might still be seen as an opportunity

USD/CHF technical analysis: Pivots around 200-day SMA, near mid-0.9900s

October 15, 2019Continued with its struggle to extend the momentum beyond 200-DMA.

Bears eye a decisive break below the ascending trend-channel support.

Bulls are likely to await a sustained strength above the key parity mark.

The USD/CHF pair failed to capitalize on last week’s attempted rebound from a support marked by the lower end of a two-month-old ascending trend-channel and met with some fresh supply on Monday.

The pair’s repeated failed attempts to extend the momentum further beyond the very important 200-day SMA now seemed to suggest that the recent positive move might have already run out of the steam.

Meanwhile, oscillators on hourly charts have struggled to gain any meaningful traction but managed to hold with a mild positive bias, warranting some caution before

USD/CHF technical analysis: Bulls trying to defend multi-week old ascending trend-channel

September 29, 2019Fading safe-haven demand undermined the CHF demand and extended some support.

Bears await a sustained weakness below short-term ascending channel support.

The USD/CHF pair struggled to register any meaningful recovery and remained well within the striking distance of near three-week lows set in the previous session, coinciding with the lower end of a multi-week-old ascending trend-channel.

Given that technical indicators on hourly charts maintained their bearish bias and have just started drifting into the negative territory on the daily chart, any follow-through selling will set the stage for an extension of the recent downward trajectory.

However, traders are likely to wait for a sustained break through the mentioned trend-channel support before positioning for

USD/CHF Technical Analysis: The ongoing corrective slide challenges 200-hour SMA support, around mid-0.9800s

September 5, 2019Extends overnight retracement slide from an ascending trend-channel resistance.

A follow-through selling has the potential to drag the pair towards channel support.

The USD/CHF pair remained under some selling pressure for the second consecutive session on Wednesday and retreated farther from over one-month tops set in the previous session.

The pair on Tuesday started retreating from a resistance marked by the top end of a short-term ascending trend-channel, extending from multi-month lows touched on August 13th.

The pullback, however, seems to have found some support near 200-hour SMA, which should now act as a key pivotal point and help traders to position for the pair’s intraday movement.

USD/CHF 1-hourly chart(see more posts on USD/CHF, ) – Click to

Read More »USD/CHF technical analysis: Manages to hold above 0.9800 handle, 200-hour SMA

August 28, 2019The USD/CHF pair struggled to sustain above 61.8% Fibo. level of the 0.9879-0.9714 recent slump and seems to have stalled this week’s recovery move from the 0.9700 neighbourhood.

The intraday downtick remained cushioned near the 0.9800 handle, which coincides with 100/200-hour SMA confluence region and should act as a key pivotal point for intraday traders.

Meanwhile, neutral technical indicators on hourly/daily charts haven’t been supportive of any firm near-term direction and thus, warrant some caution before placing any aggressive bets for the pair’s near-term trajectory.

A decisive breakthrough the 0.9800-0.9795 region – also nearing 50% Fibo. level – might prompt some technical selling and turn the pair vulnerable to accelerate the slide further towards

-637217795705356366-300x147.png)

-637211742211799359-300x147.png)

-637165949140085624-300x147.png)

-637094243479377368-300x147.png)

-637076048529841650-300x147.png)

-637068826263809659-300x132.png)

-637067377269597535-300x132.png)

-637066508442585331-300x132.png)

-637049959004970218-300x132.png)

-637031895419073883-300x132.png)

-637025933982178300-300x132.png)