USD/CHF edges higher for the fourth consecutive session on Thursday. The risk-on mood weighed on the safe-haven CHF and remained supportive. A pullback in the US bond yields kept a lid on the USD and capped gains. The USD/CHF pair now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading band near one-week tops, just below mid-0.9700s. The pair added to its positive momentum witnessed since the beginning of this week and edged higher for the fourth consecutive session on Thursday amid the prevailing risk-on mood, which tends to undermine the Swiss franc’s perceived safe-haven status. USD/CAD remains supported by risk-on mood More positive development surrounding the coronavirus saga, coupled with hopes the economic

Topics:

Haresh Menghani considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF edges higher for the fourth consecutive session on Thursday.

- The risk-on mood weighed on the safe-haven CHF and remained supportive.

- A pullback in the US bond yields kept a lid on the USD and capped gains.

The USD/CHF pair now seems to have entered a bullish consolidation phase and was seen oscillating in a narrow trading band near one-week tops, just below mid-0.9700s.

The pair added to its positive momentum witnessed since the beginning of this week and edged higher for the fourth consecutive session on Thursday amid the prevailing risk-on mood, which tends to undermine the Swiss franc’s perceived safe-haven status.

USD/CAD remains supported by risk-on moodMore positive development surrounding the coronavirus saga, coupled with hopes the economic impact from the outbreak of the virus could be limited continued boosting investors’ sentiment and weighed on traditional safe-haven assets. On the other hand, the US dollar stood tall near two-month tops but the upside seemed capped amid a modest intraday pullback in the US Treasury bond yields, which eventually turned out to be one of the key factors capping gains for the major. In absence of any major market-moving economic releases from the US, the broader market risk sentiment and the USD price dynamics might continue to act key determinants of the pair’s momentum ahead of Friday’s closely watched NFP report. |

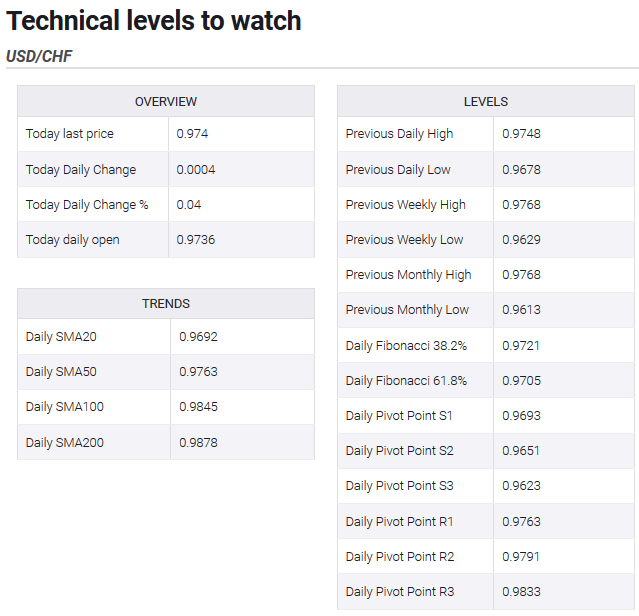

Technical levels to watch |

Tags: Featured,newsletter