Populism could remain a feature of politics in the western world, with the resultant volatility likely to have wide-ranging implications for investors.Populist parties have been on the rise in Western democracies in recent years. They have already achieved two landmark successes, with Brexit and Trump, and are threatening breakthroughs elsewhere. We see six main drivers of the populist surge: rising economic insecurity, globalisation, a technological innovation shock, cultural backlash, broader socio-economic change, and fragmentation of information sources.Populist parties have evolved to broaden their appeal. Broadly, they tend to espouse some mix of the following views: anti-immigration/nativist, protectionist, anti-austerity, anti-establishment, authoritarian and anti-EU. Beyond their economically insecure core constituency, their message can resonate more widely.The factors that have led to the rise of populism are unlikely to abate in the foreseeable future—and a renewed economic crisis could give populists a further boost. With populist parties now a permanent feature of the Western scene, political uncertainty for investors, although it may ebb and flow, will be higher than in the 1990s, when pro-market views dominated.

Topics:

Christophe Donay considers the following as important: Macroview, Populism, populism and economics, Populism and investment

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Populism could remain a feature of politics in the western world, with the resultant volatility likely to have wide-ranging implications for investors.

Populist parties have been on the rise in Western democracies in recent years. They have already achieved two landmark successes, with Brexit and Trump, and are threatening breakthroughs elsewhere. We see six main drivers of the populist surge: rising economic insecurity, globalisation, a technological innovation shock, cultural backlash, broader socio-economic change, and fragmentation of information sources.

Populist parties have evolved to broaden their appeal. Broadly, they tend to espouse some mix of the following views: anti-immigration/nativist, protectionist, anti-austerity, anti-establishment, authoritarian and anti-EU. Beyond their economically insecure core constituency, their message can resonate more widely.

The factors that have led to the rise of populism are unlikely to abate in the foreseeable future—and a renewed economic crisis could give populists a further boost. With populist parties now a permanent feature of the Western scene, political uncertainty for investors, although it may ebb and flow, will be higher than in the 1990s, when pro-market views dominated.

In terms of the macroeconomy, a greater role for populists in politics, either within governments or as a major influence on policy, would probably imply weaker real economic growth and higher inflation, in part as a result of increased protectionism and also because of less optimal economic policy-making in general.

Investment implications

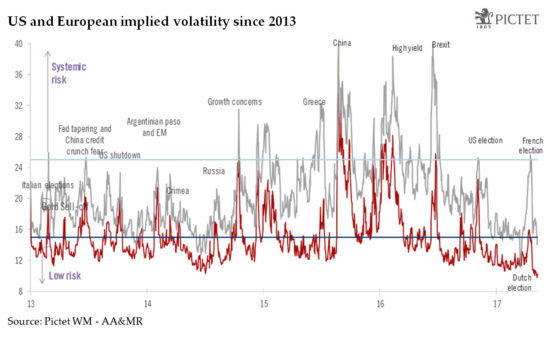

For investors, implications include increased volatility around the political cycle, and spikes in volatility if populists achieve or look potentially set to achieve breakthroughs. While volatility has broadly declined since late 2015, recent spikes have been down to political events. These periods will be marked by decorrelation between bonds and equities, with prices falling for equities and rising for bonds.

More broadly, political uncertainty is likely to add to the attraction of high-quality and defensive equities, and safe-haven government bonds. Gold’s appeal would also likely be boosted by a widespread populist surge: unlike currencies and bonds, gold is not tied to the political fortunes of any particular country, it is the purest safe-haven asset for political protection. Instability because of political concerns will remain a feature of markets for as long as populism continues its rise, which will be the case for as long as the key drivers of populism remain at work.