Summary Moody’s moved the outlook on Vietnam’s B1 rating from stable to positive. Nigeria’s central bank introduced a new FX window for portfolio investors. Moody’s moved the outlook on Romania’s Baa3 rating from positive to stable. Central Bank of Russia accelerated its easing cycle. Central Bank of Turkey delivered a hawkish surprise. Brazil’s lower house easily approved the labor reforms, but popular resistance is rising. Stock Markets In the EM equity space as measured by MSCI, Poland (+5.0%), Korea (+3.0%), and South Africa (+2.9%) have outperformed this week, while Colombia (-3.3%), Chile (-3.3%), and Egypt (-2.4%) have underperformed. To put this in better context, MSCI EM rose 1.6% this week while MSCI DM rose 2.1%. In the EM local currency bond space, Czech Republic (10-year yield -16 bp), Colombia (-13 bp), and Russia (-10 bp) have outperformed this week, while Brazil (10-year yield +26 bp), Argentina (+16 bp), and South Africa (+6 bp) have underperformed. To put this in better context, the 10-year UST yield rose 5 bp to 2.30%. In the EM FX space, TRY (+2.6% vs. USD), MYR (+1.3% vs. USD), and ILS (+1.3% vs. USD) have outperformed this week, while COP (-2.7% vs. USD), CLP (-2.0% vs. USD), and BRL (-1.8% vs. EUR) have underperformed.

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

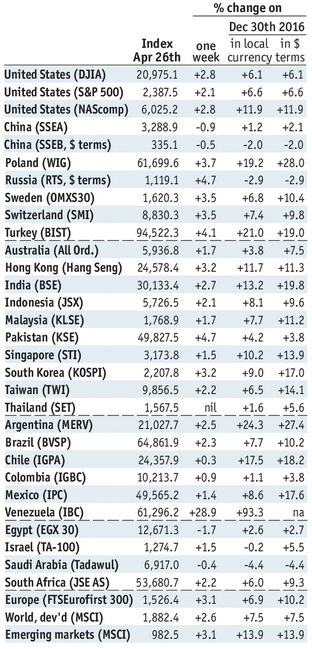

Stock MarketsIn the EM equity space as measured by MSCI, Poland (+5.0%), Korea (+3.0%), and South Africa (+2.9%) have outperformed this week, while Colombia (-3.3%), Chile (-3.3%), and Egypt (-2.4%) have underperformed. To put this in better context, MSCI EM rose 1.6% this week while MSCI DM rose 2.1%. In the EM local currency bond space, Czech Republic (10-year yield -16 bp), Colombia (-13 bp), and Russia (-10 bp) have outperformed this week, while Brazil (10-year yield +26 bp), Argentina (+16 bp), and South Africa (+6 bp) have underperformed. To put this in better context, the 10-year UST yield rose 5 bp to 2.30%. In the EM FX space, TRY (+2.6% vs. USD), MYR (+1.3% vs. USD), and ILS (+1.3% vs. USD) have outperformed this week, while COP (-2.7% vs. USD), CLP (-2.0% vs. USD), and BRL (-1.8% vs. EUR) have underperformed. |

Stock Markets Emerging Markets, April 26 Source: www.economist.com - Click to enlarge |

VietnamMoody’s moved the outlook on Vietnam’s B1 rating from stable to positive. The agency said the main factors for the move were strong FDI inflows coupled with ongoing economic reforms, which is seen leading to continue macroeconomic stability. An upgrade is long overdue, as both S&P and Fitch already have Vietnam at BB-. NigeriaNigeria’s central bank introduced a new FX window for portfolio investors. Some foreign purchases of NGN through this window have reportedly been executed at a rate above 400 per USD, which is well above both the official (315) and black market (385) rates. This is a good sign. Governor Emefiele said the bank will let the market determine the exchange rate, though we believe it will still be managed when needed. RomaniaMoody’s moved the outlook on Romania’s Baa3 rating from positive to stable. The agency cited expansionary fiscal policy as a major factor behind the negative move, as it will likely lead to an upward trajectory for the debt/GDP ratio. RussiaCentral Bank of Russia accelerated its easing cycle. After restarting the cycle with a 25 bp cut in March, the bank cut rates by a larger than expected 50 bp in April. We think the strong ruble was the deciding factor in the cut after Putin talked down the currency recently. TurkeyCentral Bank of Turkey delivered a hawkish surprise. It hiked the Late Liquidity Window (LLW) rate by 50 bp, while no change was expected. All other rates were left steady, but the bank has made banks utilize the LLW and so that rate has become more important with regards to policy. The bank has already snugged the weighted average COF for Turkish banks higher. BrazilBrazil’s lower house easily approved the labor reforms, but popular resistance is rising. The vote was 296-177 in favor, which was more than needed. Note that 308 votes will be necessary to pass pension reforms, which will face even greater resistance. Indeed, protests and strikes have erupted this week in opposition to the reforms even as unemployment rose to a record high 13.7% in March. |

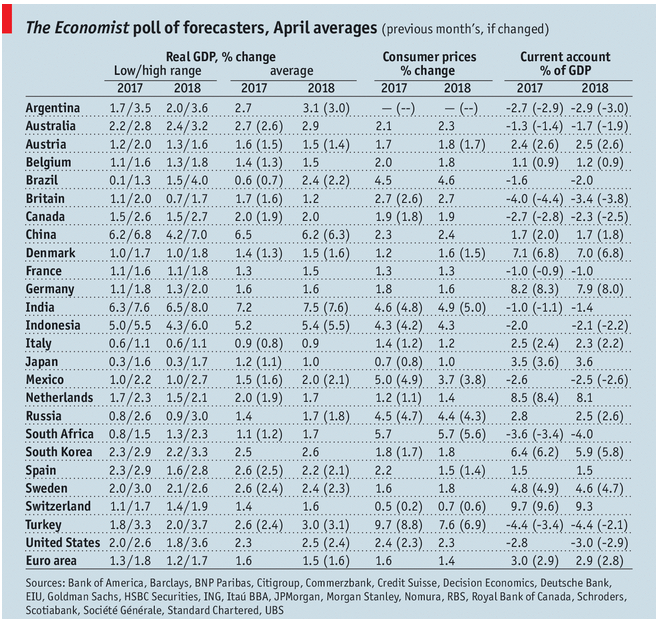

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, April 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin