The latest confidence surveys in the euro area have been remarkably strong, adding upside risks to our GDP forecasts, but meaning that the ECB will have to tread carefully.Recent composite purchasing manager surveys for the euro area are consistent with a growth rate of about 0.7% q-o-q in Q1, above our projection of 0.4%, and are pointing to similar levels of growth in Q2. More generally, ‘soft’ survey data and ‘hard’ activity data have been diverging significantly of late, with large differences across countries. The mixed signals from hard data in Q1 support our more cautious assessment of the pace of economic expansion. Although we expect hard data to catch up to some extent with the soft variety, PMI indices have already tended to overstate GDP growth in the present recovery. As a result, we are maintaining our GDP growth forecast for the euro area unchanged, although with upside risks. In essence, we expect both hard data to pick up and soft data to moderate in the next few months, leaving euro area real GDP growth at around 2% in annualised terms in H1, and around 1.5% in H2. If we are right, upside risks to our GDP forecast (1.5% in 2017 as a whole) will prove more limited than soft indicators are signalling.The global context and the hope of a more supportive fiscal policy, in particular, might help explain part of the discrepancy between hard and soft data.

Topics:

Frederik Ducrozet and Nadia Gharbi considers the following as important: euro area growth prospects, euro area soft hard data, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The latest confidence surveys in the euro area have been remarkably strong, adding upside risks to our GDP forecasts, but meaning that the ECB will have to tread carefully.

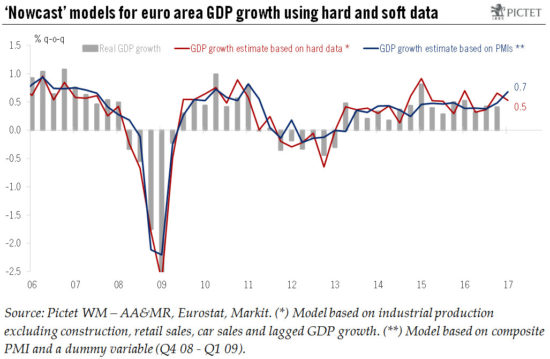

Recent composite purchasing manager surveys for the euro area are consistent with a growth rate of about 0.7% q-o-q in Q1, above our projection of 0.4%, and are pointing to similar levels of growth in Q2. More generally, ‘soft’ survey data and ‘hard’ activity data have been diverging significantly of late, with large differences across countries.

The mixed signals from hard data in Q1 support our more cautious assessment of the pace of economic expansion. Although we expect hard data to catch up to some extent with the soft variety, PMI indices have already tended to overstate GDP growth in the present recovery. As a result, we are maintaining our GDP growth forecast for the euro area unchanged, although with upside risks. In essence, we expect both hard data to pick up and soft data to moderate in the next few months, leaving euro area real GDP growth at around 2% in annualised terms in H1, and around 1.5% in H2. If we are right, upside risks to our GDP forecast (1.5% in 2017 as a whole) will prove more limited than soft indicators are signalling.

The global context and the hope of a more supportive fiscal policy, in particular, might help explain part of the discrepancy between hard and soft data. While the ‘animal spirit’ factor is likely more pronounced in the US, technical factors, including weather distortions or sample issues, have likely played a role in Europe. Still, the fact that business confidence has remained immune from political uncertainty may be a reflection that underlying economic conditions are stronger than generally assumed.

A more sustained and sustainable recovery should make the ECB more confident that the output gap will narrow steadily in the next couple of years. Policy hawks could even argue that if GDP growth accelerates further, inflation may return faster than expected and policy normalisation will have to start sooner rather than later. However, the outlook for price stability remains highly uncertain, with the March inflation figures likely to reinforce the doves’ case. We continue to expect a very gradual normalisation of the ECB’s policy stance as it waits until it sees the ‘whites of the eyes’ of core inflation.