Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both rising price prices and the resilient economy was limited. The Bank of Japan has already modified its aggressive balance sheet growth and reduced slightly the amount of funds deposited with it that are subject to negative interest rates. The Federal Reserve officials sounded considerably more confident about the US economy’s underlying strength and rising prices, but this seemed now to be mostly an attempt to ensure that last week’s hike was not a surprise. The FOMC statement and the forecasts simply confirmed the pace of normalization that had been previously signaled. Moreover, the Federal Reserve has been unable to rebuild its credibility in the sense that investors doubt that the central bank will deliver the rate hikes that it thinks will be appropriate.

Topics:

Marc Chandler considers the following as important: EUR, Featured, FX Trends, GBP, JPY, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Recent developments have given rise to doubts over the divergence theme, which we suggested have shaped the investment climate. There are some at the ECB who suggest rates can rise before the asset purchases end. The Bank of England left rates on hold, but it was a hawkish hold, as there was a dissent in favor of an immediate rate hike, and the rest of the Monetary Policy Committee showed that their patience with both rising price prices and the resilient economy was limited. The Bank of Japan has already modified its aggressive balance sheet growth and reduced slightly the amount of funds deposited with it that are subject to negative interest rates.

The Federal Reserve officials sounded considerably more confident about the US economy’s underlying strength and rising prices, but this seemed now to be mostly an attempt to ensure that last week’s hike was not a surprise. The FOMC statement and the forecasts simply confirmed the pace of normalization that had been previously signaled.

Moreover, the Federal Reserve has been unable to rebuild its credibility in the sense that investors doubt that the central bank will deliver the rate hikes that it thinks will be appropriate. If investors took seriously that the Federal Reserve would hike rates five more times by the end of next year, the two-year note would not be yielding around 1.30%.

Following the FOMC meeting, the market downgraded the chances of a follow-up hike in June. Judging by the Fed Funds futures strip, about one in nine think the Fed will not hike again. About a third think there may be one more hike, and one third accepts the dots that indicate two hikes maybe appropriate before the end of the year.

Five of the regional Fed presidents speak in the week ahead. Leaving aside Bullard, who seems to be still developing the new approach unveiled last year, and Evans, who leans to the dovish side, most of the other regional president will likely continue to press their case for quicker normalization. However, we again suggest putting more weight on the guidance from the Fed’s leadership, and in the week ahead it means Yellen and Dudley. They may offer a less dovish interpretation of the Fed’s recent decision than the market seems to believe.

United StatesInvestors may also be concerned that US fiscal policy may not be what they expected. The draft budget proposed by President Trump was expressed little of the populist sentiment seen on the campaign trail and subsequent rhetoric. In many ways, the budget was an expression of longstanding Republican aspirations. Rather than boost infrastructure spending, numerous domestic social programs and foreign aid were cut to make room for increased defense and security spending, including a down payment for the wall that is to be erected on the border with Mexico. Funds to the Department of Transportation, which would seem to play an important role in the revitalization of America’s infrastructure would see a 13% (nearly $2.5 bln) cut in the president’s plan. The Federal Aviation Administration (FAA) would be privatized. Amtrak funding would also be cut, and several new transit projects would have to be canceled. Meanwhile, the Republican health care plan as an alternative to the current Affordable Health Care Act (a.k.a. Obamacare) may be voted on before the end of the week ahead. At stake is not only health care, but it is a keystone to the Republican’s larger tax reform efforts. Specifically, the repealing of the taxes that financed the current scheme would free up around $1 trillion over the next decade. Of course, as most observers recognize, the Senate has other ideas and will likely pass a different bill. The differences will be hammered out in the reconciliation process, which requires a simple majority, which the Republicans possess. It is integral to the GOP strategy to use the reconciliation process to overcome the limitations posed by its slim majority in the Senate. The reassertion of US interests, as understood by President Trump is already being felt on the world stage. The G20 statement diluted the commitment to avoid trade protectionist measures. It is a warning side of the likelihood of future conflict. The Eurogroup meeting at the start of the week will also have to take seriously the possibility that the US prevents the IMF from participating in the aid package to Greece. Recall, that the German and Dutch parliaments require IMF participation in order to secure their approval. The ability to compromise may be limited by the German election that is six months away, and for which polls warn of a resurging SPD party that may make Merkel’s fourth contest here more difficult. |

Economic Events: United States, Week March 20 |

EurozoneThe eurozone’s PMIs have been running ahead of actual data. We expect the flash PMI, the main economic report for the week, to soften slightly. However, more attention may be paid to the price components and the official comments. If the macro divergence is being re-considered, the divergence in the euro area between creditor and debtor appears to becoming more pronounced again. Even though the ECB agreed at the end of last year to extend its asset purchases through the end of the year, albeit as modestly slower pace (60 bln euros vs. 80 bln euros) starting next month, the hawks (creditors) are emphasizing a move to the exit. In particular, they have been emphasizing that the sequence may differ than the Fed’s exit. Recall that the Fed tapered the asset purchases until ending them. Then, after several months, raised rates (December 2015). The ECB has a deposit rate of negative 40 bp. It seems clear that the ECB is talking about its exit strategy, but the creditors appear to have pushed the issue into the public space. Both German members on the ECB talk in the week ahead and the possibility that the deposit rate is increased before the asset purchase program are complete may be underscored. This may continue to spur upward pressure on yields in the eurozone. In turn, this may see the euro-sensitive two-year interest rate differential narrow, allowing the position is squaring the foreign exchange market to allow the euro to continue the correction from the sell-off since the US election. |

Economic Events: Eurozone, Week March 20 |

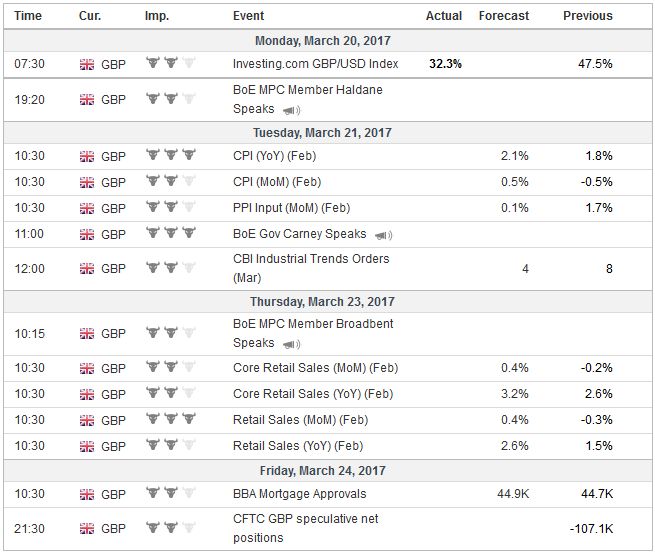

United KingdomSimilarly, the new found threat of a BOE rate hike Is unlikely to subside, and this may see sterling post additional corrective gains. The main economic report is the February CPI. Prices pressures have not peaked in the UK, and an uptick will keep investors cautious about the BOE taking back the rate cut delivered amid much uncertainty after last June’s referendum. Officials will draw attention to the measure of consumer inflation that also includes owner-occupied housing costs, like the United States, using a rental equivalence measure. The Office of National Statistics (ONS) says this will be it preferred measure going forward. Like other inflation measures, it is trending higher and is expected to breach the 2.0% threshold for the first time since late-2013. February retail sales also will be reported. A small rise is expected after declines in both December and January. The last time British retail sales fell in three consecutive months was late 2009 and early 2010 We suspect it is not coincidental that wage growth slowed in December and January. We suspect that the weakening wage pressure give the majority at the BOE time to see how the economy evolves before deciding if it needs to take back some of its accommodation. Within a few days of the EU’s celebration of the 60th anniversary of the Treaty of Rome (Match 25), which founded the European Economic Community, UK Prime Minister May is widely expected to formally trigger Article 50 to begin negotiations of its exit from the EU. Since the referendum, the initiative has been the UK’s. It did not have turn the non-binding resolution into law. It did not have to accept the small (52% to 48%) majority to be sufficient to pursue such a fundamental change. However, once Article 50 is triggered, the initiative shifts to the EU. Investors should be prepared for some jockeying for position and advantage in the coming weeks. UK Chancellor of the Exchequer Hammond quickly reversed himself on a tax increase on self-employed reflects the weakened state of May’s government. The reversal was in the face of a revolt, not of Labour, which is struggling to be more than obstructionist, but among the Tories themselves. It makes the government look weak. The power struggle within the Tory Party is one of the factors encouraging speculation, despite denials from 10 Downing Street that an early election will be called. There have been some rule changes that make the early election scenario more difficult, but not impossible. |

Economic Events: United Kingdom, Week March 20 |

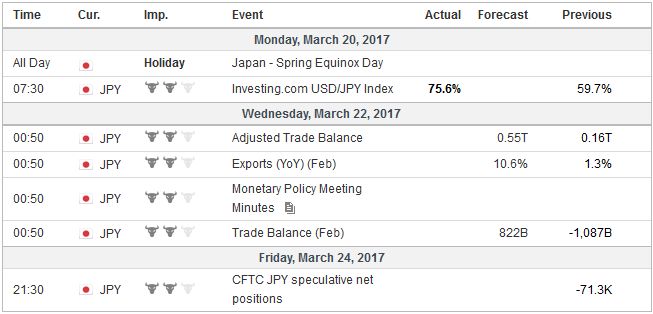

JapanThere is two highlights from the Asia-Pacific in the week ahead. The Reserve Bank of New Zealand meets. It is widely expected to keep rates on hold. The most recent data warned that the economy slowed more than expected, but it will take more than that to get the RBNZ to consider cutting rates. The other highlight is Japan’s trade balance. The February trade balance always (without fail for more than 30 years) improves over January. Although Japan exports around 15% of GDP (compared with over 40% for some European countries) the external sector plays an important role in capex plans and industrial output. Japan had generally run trade deficit from early 2011 through early 2016. However, Japan returned to surplus. Although Japan reported a large deficit in January (over JPY1 trillion), seasonal factors were the main culprits, and it is expected to return to surplus. There has been a strong improvement in Japan’s broader trade measures, its current account. Last year the average monthly surplus was JPY1.72 trillion, the highest since 2007. At the same time that Japan’s external account has improved, Japanese investors have turned sour on foreign bonds. In the last 18 weeks through March 10, Japan sold about JPY6.05 trillion (~$57 bln)of foreign bonds. Consider that in the previous 18 weeks, Japanese investors bought JPY7.76 trillion of foreign bonds. There had not been as much doubt about the outcome of the Dutch election as there is with the French election next month. Although the populists-nationalists did worse than the polls had suggested, they still picked up seats, and its anti-Islamic rhetoric may have influenced the government’s choices regarding the Turkish ministers recently. Unless something big happens, like Juppe jumping into the race, Le Pen’s support is sufficiently solid to put her into the second round. Barring a poll showing any candidate getting a majority, the key for medium-term investors is not the poll outcome of the first round, but the second round. There Le Pen loses handily. Of course, things can change, but this is the base case. Perhaps it will be Japanese investors who return to the French bond market. They had been substantial buyers (higher yielding bunds?) but in recent months were featured sellers. |

Economic Events: Japan, Week March 20 |

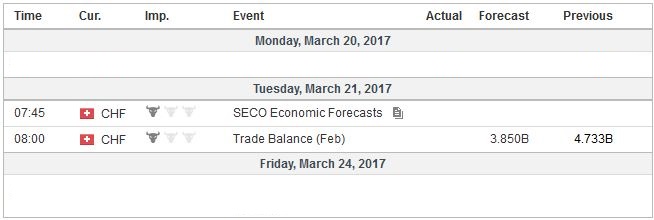

Switzerland |

Economic Events: Switzerland, Week March 20 |

Tags: #GBP,#USD,$EUR,$JPY,Featured,newsletter