Cartoon by Bob Rich No Surprises BALTIMORE – We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a big deal. Rate hike fantasies have been a recurring theme since 2009. Given that the market for federal funds is dead as a doornail (banks continue to hold huge excess reserves with the Fed and therefore have no need to borrow any in the interbank market), rate hikes are currently purely for show anyway. On Friday, Fed chief Janet Yellen appeared at a function organized by her alma mater, Radcliffe (which later merged with Harvard). Bloomberg was on the scene: “It is appropriate – and I have said this in the past – for the Fed to gradually and cautiously increase our overnight interest rate over time,” Yellen said Friday during remarks at Harvard University in Cambridge, Massachusetts. “Probably in the coming months such a move would be appropriate.” Yellen will host her colleagues on the Federal Open Market Committee in Washington June 14-15, when they will contemplate a second interest-rate increase following seven years of near-zero borrowing costs that ended when they hiked in December.

Topics:

Bill Bonner considers the following as important: alma mater, Debt and the Fallacies of Paper Money, Featured, Federal Funds Rate, Janet Yellen, newsletter, On Economy

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

No Surprises

BALTIMORE – We were not surprised by the big news last week. We saw it coming. Figures from the Conference Board research group revealed productivity sinking for the first time in three decades. We promised to explain why it was such a big deal.

Rate hike fantasies have been a recurring theme since 2009. Given that the market for federal funds is dead as a doornail (banks continue to hold huge excess reserves with the Fed and therefore have no need to borrow any in the interbank market), rate hikes are currently purely for show anyway.

On Friday, Fed chief Janet Yellen appeared at a function organized by her alma mater, Radcliffe (which later merged with Harvard). Bloomberg was on the scene:

“It is appropriate – and I have said this in the past – for the Fed to gradually and cautiously increase our overnight interest rate over time,” Yellen said Friday during remarks at Harvard University in Cambridge, Massachusetts. “Probably in the coming months such a move would be appropriate.”

Yellen will host her colleagues on the Federal Open Market Committee in Washington June 14-15, when they will contemplate a second interest-rate increase following seven years of near-zero borrowing costs that ended when they hiked in December. A series of speeches by Fed officials and the release of the minutes to their April policy meeting have heightened investor expectations for another tightening move either next month or in July. “The economy is continuing to improve,” she said…”

The economy has been “improving” for seven years. We’re beginning to wonder how much better it can get!

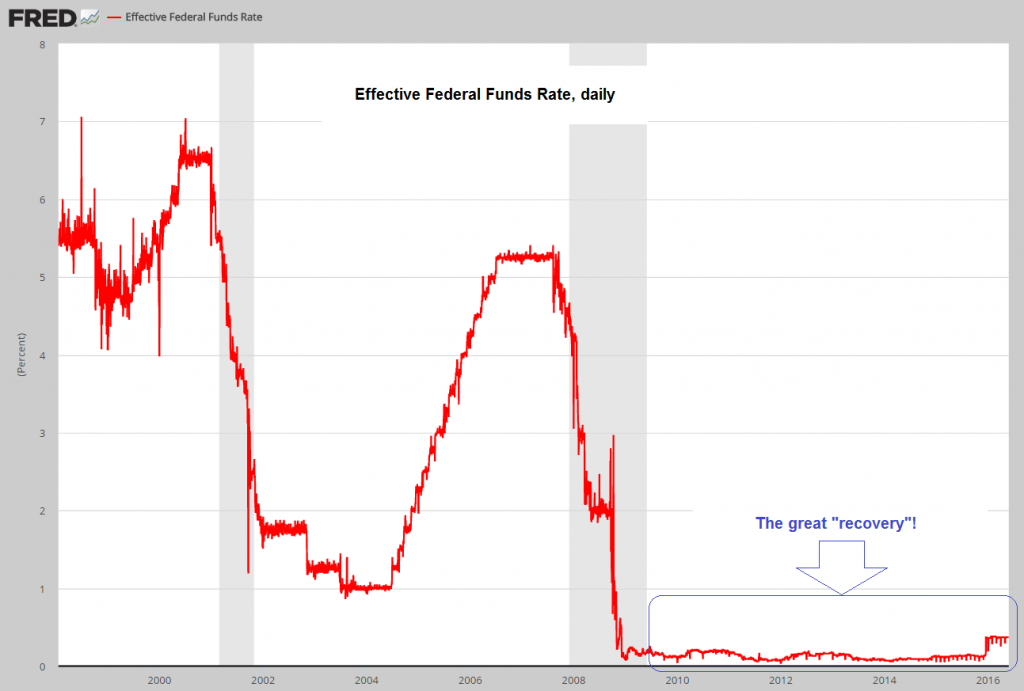

And yet, the federal funds rate – controlled by the Deep State through its intermediary, the Fed – is still at an emergency level. It sits at a mere half percentage point above zero.

Efferctive Federal Funds Rate, dailyThe massive ongoing recovery, as reflected by the federal funds rate… |

The Fed upped it by a quarter point in December. At this pace, assuming the economy continues to improve without a hiccup or arrière-pensée, we’ll get a quarter of a point every six months… until 2024… when the key rate will be at a more normal 4%.

If everything goes according to plan. And nothing goes wrong. And there is no crash or bear market on Wall Street. And no recession in the economy. And no blow-up or serious mishaps in China, or elsewhere. And no political surprises either.

No big hurricanes, volcanic explosions, particularly severe winters, or especially hot summers… no big increase in the price of oil and no big drop in oil either, and no teenager gets drunk and smashes up his dad’s car… and no one stubs his toe or catches a cold.

In other words, the geniuses at the Fed (we know they are geniuses, because they said so) will guide us back to a healthy, prosperous economy sometime after 2020…

… unless something comes up.

What a relief!

Free Money is Expensive

Meanwhile, there is that natty problem: a lack of productivity gains, which seems to have been caused by the same geniuses who have everything so perfectly under control. The thing that separates rich societies from poor societies is productivity. It measures how much output you can get from each unit of input – mainly labor and capital.

In the richer societies, a workman’s time is more valuable because he can produce more from each hour of labor. Since time is limited, the only hope of making material progress is to increase productivity.

Machine operator at a hydraulic tube bender: productivity is a function of the capital invested per worker. Economic progress and prosperity therefore depend on capital accumulation, which in turn depends on real savings and wise investment. Money printing encourages the opposite, namely capital consumption. It therefore interferes with productivity growth and there is a growing danger that it will reverse it.

So, it is no small matter when productivity growth comes to an end. Not to be alarmist about it, but if this trend persists, as we pointed out on Friday, it means the end of our civilization as we know it. And maybe even before the Fed completes its rate hikes!

Most economists (and politicians) have blamed world trade for stagnant U.S. wages. The median wage in China is only $8 a day. No wonder U.S. factory hands can’t catch a break; who can compete with that?

But Germans compete with the Chinese, too. And their wages have gone up! In real terms, after adjusting for inflation, wages in France and Germany have been going up at a 0.7% rate for the past 15-20 years.

Throughout most of the emerging market economies, wages went up… even though they all had to compete with the Chinese. What gives? We explained it in the recent issue of our monthly publication, The Bill Bonner Letter. In short, the U.S. is the center of the world money system. It has gained the most in some ways.

And lost the most in others. It was first in line when the new credit was handed out; it was like getting free money. But there’s no more expensive money than free money. You can quote us on that.

More to come…

Chart by: St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.