With the Federal Reserve's 50 bp rate cut, seven of the G10 central banks have begun an easing cycle that will extend, broaden, and may accelerate going forward. Australia and Norway will likely join the party next year, while some, like Canada and Sweden may increase the pace of its cuts in Q4. Beijing jumped into the mix, with rate cuts, reserve requirement reductions, and a flood of liquidity aimed at supporting the housing and property markets, and industry consolidation. Japan is the notable exception. It is in the process of normalizing monetary policy. It has begun "quantitative tightening" by not reinvesting the maturing proceeds from its balance sheet as it gradually raises rates. The Bank of Japan has been explicit about its intention to lift rates

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Featured, macro, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

With the Federal Reserve's 50 bp rate cut, seven of the G10 central banks have begun an easing cycle that will extend, broaden, and may accelerate going forward. Australia and Norway will likely join the party next year, while some, like Canada and Sweden may increase the pace of its cuts in Q4. Beijing jumped into the mix, with rate cuts, reserve requirement reductions, and a flood of liquidity aimed at supporting the housing and property markets, and industry consolidation.

Japan is the notable exception. It is in the process of normalizing monetary policy. It has begun "quantitative tightening" by not reinvesting the maturing proceeds from its balance sheet as it gradually raises rates. The Bank of Japan has been explicit about its intention to lift rates further, provided the economy and prices evolve as it expects, and the capital market are broadly stable.

The dramatic unwinding of carry-trade strategies that contributed to the volatility in July and early August was not an important driver in September. In the CME futures, non-commercial accounts (no underlying business need) covered more 80% of the gross short yen position that it had in early July. It has gone from a 17-year high to a three-year low. The non-commercial gross long yen position has jumped three-fold from early July. The net long position of more than 56k contracts (~$4.9 bln notional value) is the largest since 2016.

While these speculators in the futures market bought yen to cover shorts and went long, Japanese investors have taken advantage of the yen's recovery to buy more foreign bonds and stocks. Consider that in first half of the calendar year, Japanese investors bought JPY1.82 trillion (~$12 bln) of foreign bonds. Since the end of June, Japanese investors purchased JPY7.5 trillion (~$57 bln). At the same time, Japanese investors sold about JPY1.74 trillion of foreign shares in the first six months of the year, but since the end of June purchased JPY2.1 trillion.

The apparent success of the official then is not because Japanese investors mimicked the BOJ's operations of buying yen. Rather, Japanese investors accelerated their yen sales. The official intervention did spur a short squeezed among speculators. A critical difference between the two market segments, the speculators in the futures market and Japanese investors is that the former tend to be leveraged short-term market participant and the latter are of un-levered and typically have a longer time horizon. Ultimately, intervention proved successful, like the 2022 operation because Japanese officials timing coincided with a peak in US yields. The 30-day rolling correlation of changes in the exchange rate and US 10-year yields is at the upper end of its four-year range near 0.77. The rolling 100-day correlation is near a 14-month high slightly below 0.60.

Beijing's large package appears to have spurred unwinding of the yuan carry trade. The offshore yuan reached its best level since May 2023. Since the early July high, the dollar slumped by about 4.6% and has been pushed below CNH7.0. The dollar has held up slightly better against the onshore yuan, and the CNY7.0 has not been given. We will be watching the PBOC's daily dollar fix for signals that officials want to slow the yuan's advance. Chinese companies who held on to foreign currency earnings while the yuan was trending lower will likely repatriate. That will mean Chinese banks will be buying dollars from the corporations, and press reports will say state-owned banks are buying dollars, which will be confused for intervention.

The euro set the year's high in late August slightly above $1.12 as the market anticipated a Fed cut in September. The derivatives market had expected a 25 bp cut through the release of the August CPI in early September. At least two Fed officials (Chair Powell and Governor Waller, who some have speculator could be the next Chair in a Republican administration) suggest that CPI (and Powell added the Beige Book) that prompted a shift during the quiet period before an FOMC meeting. Apparently, this was signaled with a well-timed story on Dow Jones, and many observers suggest it was not the first time.

The euro's appreciation for the third consecutive month was not driven by positive news from the eurozone. Its economic impulses are faint. Year-over-year growth is running below 1%. The composite PMI has averaged about 50.4 through September, slightly lower than the pace seen in the first three quarters of 2023. Germany and France have weak political leadership, which seems to limit the scope for bold initiatives. Draghi's reform proposals may be dead on arrival given Germany's reluctance to support more joint borrowing. The Covid-related joint bonds (SURE and Next Generation) do not appear as precedents as much as emergency exceptions.

The euro's appreciation may be best understood as a reflection of the dollar's weakness. A key channel of transmission is the two-year interest rate differential between the US and Germany. The US premium peaked in mid-April (205 bp) within days of the euro's low for the year near $1.06. Since then, US and German rates have fallen, but US rates have fallen faster. The US two-year premium fell to around 135 bp in late September. This is the smallest US premium since May 2023, but snapped back to 150 bp as the market became more confident of an ECB cut in in October. This is not to suggest a one-to-one corresponds between the premium and the exchange rate. The direction and change seem to be critical. This warns that the wider US premium may be a factor stalling the euro near $1.12.

We argue here that the yen and euro exchange rates are sensitive to US rates, the 10-year for the former and the two-year differential for the latter. Sterling is a different story. While it has benefitted from the broadly weaker US dollar, sterling also appears to be drawing some support from the cautious stance of the Bank of England, which has only cut rates by 25 bp this year. It has the highest policy rate among the G7 and its two-year premium over the US near 40 bp, is the most in a year. The UK economy stagnated in June and July, and with an austere Autumn Budget expected by Chancellor of the Exchequer Reeves at the end of the month, the BOE will likely cut rates in early November. It is fully discounted. The swaps market has about a 60% chance of what would be the third cut discounted for December.

Sterling is the strongest G10 currency so far this year, gaining about 5.1% on the US dollar. The Australian dollar is in second place with a 1.5% gain. Ironically, Norway, where the central bank is the most hawkish--signaling no rate cut until 2025, has the weakest of the major currencies. The krone is off about 3.5% this year. The Bank of Canada is among the most dovish of the G10 central bank, and the Canadian dollar is the second worst performer, off about 2.0% this year.

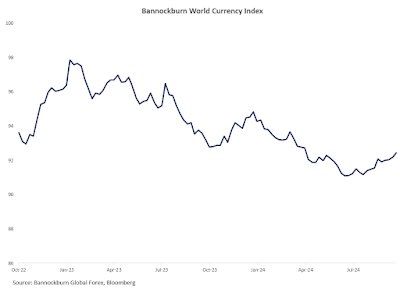

The Bannockburn World Currency Index, a GDP-weighted basket of the currencies of the 12 largest economies, which are divided equally between high-income and emerging market economies, rose by 0.75% in September, its best month of the year. It reached its best level in five months and is testing the 200-day moving average for the first time since January. It carved out a low in June and July, which helped boost our confidence the dollar's cycle was turning. That judgement remains valid, and even if there will be corrections along the way, we expect the dollar to continue to trend lower.

Even though the BWCI gain was modest, there were large moves among the components. Leaving aside he numeraire, the dollar, only three currencies moved less than 1% in September through the last full week of the month and moved by much less than 1%. The Canadian dollar fell 0.2% and was the only G10 currency to decline through the last full week of September. Ironically, one of the highest and one of least volatile emerging market currencies, the Mexican peso and the Indian rupee, respectively, both appreciated by 0.2%. The Brazilian real was the best performer, rising 3.2%, encouraged by the central bank signaling, delivering a rate hike, and suggesting more were likely. The yen's 2.8% gain put it in second place, though almost 2/3 of the gains came on the last day of the period, following the unexpected selection of the Ishida as the new LDP leader, and hence prime minister. The US 10-year yield also fell on September 27 by nearly five basis points, the most in two-and-a-half weeks. Two-thirds of the Australian dollar's 2.1% advance came after China's large stimulative measures were announced. The Russian ruble was the worst performer, in the BWCI, losing 3.1%.

U.S. Dollar: The Federal Reserve began its easing cycle with a 50 bp cut on September 18. The updated Summary of Economic Projections showed that the median "dot" was for another 50 bp reduction this year and 100 bp next year. The derivatives market has more another 75 bp of cuts this year. fully discounted. Federal Reserve Chair Powell has made it clear that the central bank's confidence that inflation is headed back to its target, allows it to focus more on the slowing of the labor market. Given the significant revision to nonfarm payroll growth, Powell acknowledged that officials were discounting the high-frequency data points. Downside surprises in the next two job reports will likely bolster expectations for an aggressive easing cycle, but the base case should be for two quarter-point cuts. The next month's national election is still seen as a tight contest, and its impact on the markets does not seem obvious. The policy mix is unlikely to change next year. Monetary policy is easing, and the federal deficit is projected to be about 6.5% of GDP for the third consecutive year. Last month, we thought the Dollar Index had potential toward 102.50 but it stalled slightly shy of 102.00. As the downtrend resumes, the next downside target is in the 99.00-99.55 area.

Euro: The euro rose for the third consecutive month in September, but it does not reflect a robust economy. To the contrary, the euro rose despite its economic malaise. The manufacturing sector continues to be hobbled by uncompetitively high energy prices. The euro's appreciation reflects the broad decline in the US dollar. At the risk of oversimplifying, as the US premium over Germany fell, the dollar depreciated. At the end of June, the premium was near 200 bp and by time the Fed delivered the 50 bp of cut that match what the ECB has done this year, the premium had fallen to almost 130 bp before recovering over the past couple of weeks. The ECB meets on October 17, and the bar had seemed high to cut back-to-back, but the Fed's move arguably gives it room to maneuver, and news stream has been poor, and inflation looks to have cooled further in September. The swaps market is discounting about an 80% chance of an October cut and has fully discount 50 bp of cuts in Q4. The key point is that the ECB has begun a monetary easing cycle that will bring down the deposit rate from a 4% peak to about 2.00% by the middle of next year, according to the pricing in the swaps market. The euro held support near $1.10, as we anticipated last month. It may have to spend more time in the $1.10-$1.12 trading range, but we favor an upside break, when it comes.

(As of September 27, indicative closing prices, previous in parentheses)

Spot: $1.1160 ($1.1050) Median Bloomberg One-month forecast: $1.1140 ($1.0900) One-month forward: $1.1175 ($1.1065) One-month implied vol: 5.9% (6.1%)

Japanese Yen: Japan is the third G5 country with a new government this year, following Labour's victory in the UK, and the new prime minister of France (though Macron remains President). However, it is not clear the extent of policy changes of Prime Minister Ishiba. Arguably, it was his strong defense posture that carried the day rather than his emphasis on helping the under-performing regions, which have been decimated by the declining population. The death of a young boy in China, and Beijing's encroachment and attempts at intimidation seemed to have been the salient backdrop for Ishiba's ascendancy after past failures. There are two elements are the business and economic climate that are more knowable. First, after contracting in the first two quarters of the year, the Japanese economy has found some traction and modest growth is expected for the remainder of the year before accelerating through the first half of next year. Second, the Bank of Japan has a tightening bias, which is to say that it has clearly signaled its intention to continue to raise interest rates barring a new shock. There are two BOJ meetings this year (October 31 and December 19) and the market has gradually pushed out the next hike into next year. The swaps market sees practically no chance of a hike at the October meeting and sees the overnight rate about 20 bp higher by the middle of next year.

Spot: JPY142.20 (JPY146.15) Median Bloomberg One-month forecast: JPY142.25 (JPY147.00) One-month forward: JPY142.10 (JPY145.55) One-month implied vol: 11.6% (11.8%)

British Pound: A patient Bank of England, which now has the highest policy rate in the G10 (alongside New Zealand) helped sterling outperform in September. At its best it rose by around 1.7% to $1.34, which it has not seen since March 2022. The key to the pace of rates cuts is inflation, and particularly the stickiness of service prices. The September CPI will be reported on October 16. Still, the market is confident of a November rate cut. What is an open question is whether there is a December cut as well. The swaps market has about a 60% chance discounted. The monthly GDP measure stagnated in June and July. A third consecutive month (August GDP on October 11) would point to a stalled recovery and provide additional encouragement for a lower rate. Fiscal policy in the form of the Chancellor Reeves Autumn Budget at the end of the month is important. There is much speculation of how the government will close a budget gap that they claim to have inherited. The focus is on capital gains and inheritance tax. Sterling may have potential in the coming weeks into the $1.3500-$1.3650 area, while support at $1.30 holds. Still, sterling has rallied more than four cents since the US CPI report on September 11 and short-term momentum indicators are stretched, warning of the risk of a correction.

Spot: $1.3375 ($1.3125) Median Bloomberg One-month forecast: $1.3355 ($1.2800) One-month forward: $1.3380 ($1.3130) One-month implied vol: 6.8% (6.9%)

Canadian Dollar: The Bank of Canada has been among the most aggressive G10 central banks in easing monetary policy and it looks poised to quicken its pace. It has delivered three quarter-point rate cuts beginning in June. At either the October 28 meeting, which is our bias, or the December 11 meeting, the Bank of Canada is likely to cut rates by 50 bp. The outright decline in August's CPI and weakness in the labor market, where the unemployment rate has risen from 5.8% at the end of last year to 6.6% in August paves the ground for the larger cut. The swaps market expects the pace of about 75 bp a quarter to continue through H1 25. There has been some drama in domestic politics, as the minority Liberal government lost support from the New Democratic Party, forcing Prime Minister Trudeau to negotiate issue by issue. The Liberals also lost to special elections in recent months, underscoring the lack of public support, and gives more the appearance of Trudeau being a lame-duck. Trudeau survived a vote of no-confidence in late September, but the respite may not be long. The Quebecois has given Trudeau until the end of October to improve pension benefits and exclude some agriculture sectors from international trade agreements. The Conservatives will likely lead the next government, and its platform is more business friendly. If the government does survive, national elections would be held in October 2025. Our correlation work shows that exchange rate most sensitive to the general movement of the US dollar (Dollar Index as the proxy) and general risk appetite (S&P 500 as the proxy) than oil or short-term interest rate differentials.

Spot: CAD1.3515 (CAD 1.3490) Median Bloomberg One-month forecast: CAD1.3515 (CAD1.3600) One-month forward: CAD1.3520 (CAD1.3480) One-month implied vol: 4.6% (5.3%)

Australian Dollar: The Australian dollar's 2% appreciation in September was enough to carry it to its highest level since February 2023. In part, it was rewarded for the restrictive monetary policy in the face of multiple rate cuts by many other G10 countries and the Fed's half-point move. The Reserve Bank of Australia, under Bullock's leadership continued to push back against market speculation of a rate cut. The market has been gradually giving up hopes of a rate cut this year. At the end of August, the futures market had about an 80% chance of a cut before the end of the year discounted and now it is less than 60%. It is expected to reduce rates by 100 bp next year. The two most important data points in October is the employment report on October 17 and the Q3 inflation report on October 30, ahead of the November 5 RBA meeting. Also, given the extensive trade ties between Australia and China, the Australian dollar is sometimes treated like a G10 proxy for China, and it (and the New Zealand dollar) seemed to draw some succor from China's large initiative. The technical indicators are getting over-extended, but the next important chart area is $0.7000-$0.7050.

Spot: $0.6905 ($0.6765) Median Bloomberg One-month forecast: $0.6870 ($0.6775) One-month forward: $0.6910 ($0.6770) One-month implied vol: 9.2% (9.0%)

Mexican Peso: The peso has fallen out of favor since June and the national election. It edged up by less than 0.5% through late September to be poised to snap a three-month slump. Still, the dollar held above MXN19.00 for the first month since December 2022. Constitutional reforms, including the election of the judiciary, have spooked investors. Sheinbaum is inaugurated on October 1 and investors remain wary. At the same time, price pressures continue to moderate, and the economy is slowing to less than 2% year-over-year. The central bank has delivered three quarter-point rate cuts over the past six months, and the market expects the pace to accelerate. The swaps market has almost 125 bp of cuts discounted over the next six months. Meanwhile, Brazil's central bank has begun hiking its policy rate. It is now 25 bp above Mexico's and the market anticipates another 75 bp increase in the next six months. The large net long speculative position in the futures market has been culled and stands near its smallest since March 2023, which was the last time this market segment was net short pesos. The September high was near MXN20.15, and this could be challenged in the month ahead.

Spot: MXN19.69 (MXN19.73) Median Bloomberg One-Month forecast: MXN19.55 (MXN19.48) One-month forward: MXN19.79 (MXN19.82) One-month implied vol: 14.7% (18.8%)

Chinese Yuan: After numerous pledges to take decisive action, Chinese officials moved in a big way in late September. The PBOC cut the 7-day repo rate by 20 bp to 1.50%, reduced the one-year Medium-Term Lending Facility rate by a record 30 bp to 2.0%, and cut reserve requirements by 0.5%. It announced a CNY800 bln (~$110 bln) support for the equity market and reduced existing mortgages and allowed buyers of second homes to put 15% down rather than 25%. The central bank increased the backstop for local governments buying unsold homes to 100% from 60%. Ahead of the Golden Week holiday that closes local markets from October 1 and reopens October 8, Beijing has promised to give cash handouts to extremely poor people and orphans. The specifics were not disclosed. Although it did not seem to draw the same attention as the rate cuts and support for real estate and stock market, but new measures were announced will promote mergers and acquisitions. Industry consolidation and concentration is an important way that the US, Europe, Japan, and others have rationalized production and limited excess capacity. The market gave Chinese officials the benefit of the doubt, though many critics are skeptical that the measures are sufficient. Fiscal efforts to support domestic demand are needed. Nevertheless, the measures are likely to prove sufficient to boost the chances that the 5% growth target is reached. The dollar broke CNH7.0 for the first time since May 2023. Our understanding of the opaque situation is that many Chinese companies were reluctant to repatriate foreign currency earnings when the yuan was depreciating. But market pressures are forcing them to do so now. Chinese banks will buy the dollars from them and some observers will confuse this for intervention. Beijing's moves also appear to be squeezing foreign investors out of the yuan carry trade.

Spot: CNY7.01 (CNY7.19) Median Bloomberg One-month forecast: CNY7.04 (CNY7.2000) One-month forward: CNY6.98 (CNY7.06) One-month implied vol: 6.0% (5.1%)

Tags: Featured,macro,newsletter