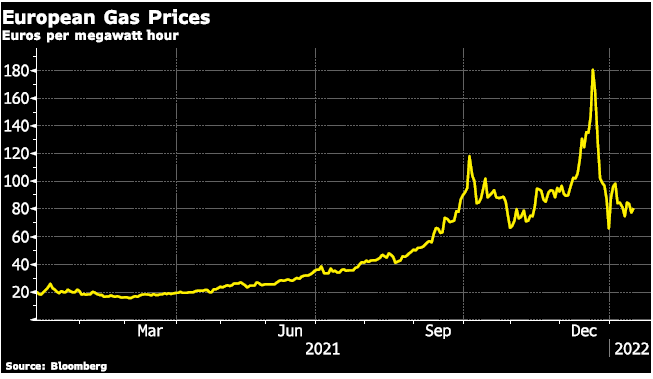

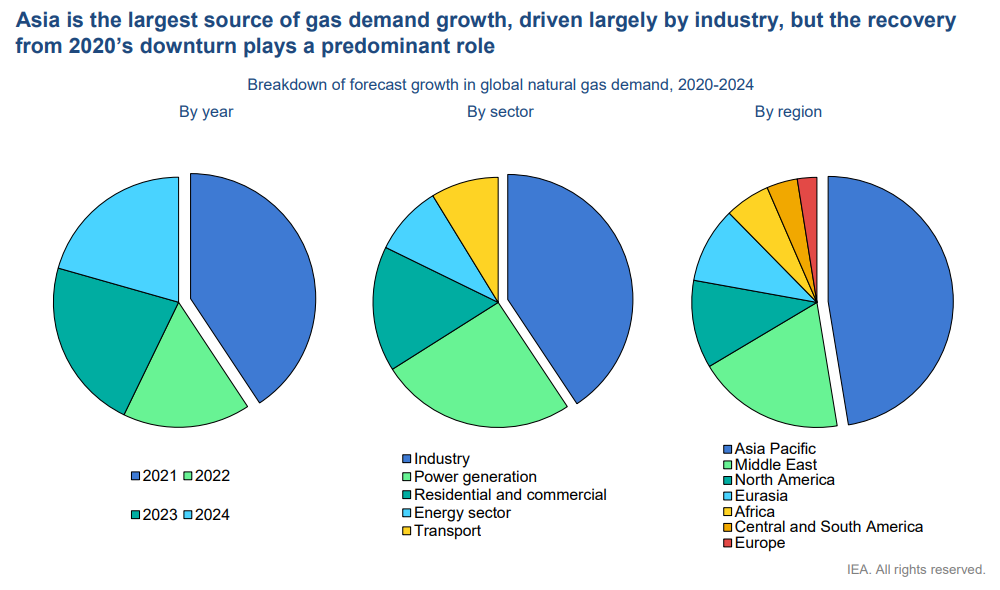

European Energy Crisis: 4 Reasons You MUST Know! European households are facing rising prices on many goods and services, but one particular standout is electricity and gas bills. According to Bank of America, European household gas bills are expected to rise to €1,850 in 2022 from €1,200 in 2020 (an ~55% increase). Natural gas prices have pulled back from the December peak. However, it remained high and it could get worse over the remainder of the winter months. Reasons for the energy crisis are not entirely straightforward as the global energy market is interconnected and quite complex. However, below we outline some of the key issues: European Gas Prices Chart A. Europe reliant on Gas Imports as Domestic Production Europe is increasingly reliant on gas

Topics:

Stephen Flood considers the following as important: 6a.) GoldCore, 6a) Gold & Monetary Metals, Bitcoin, Bond Markets, Economics, Energy crisis, energy prices, Featured, Gold, gold and silver, gold chart, gold price, inflation, natural gas, News, newsletter, Precious Metals, Renewable energy, silver, silver price

This could be interesting, too:

finews.ch writes Wo Pensionskassen und Unternehmen nach dem Wegfall der CS der Schuh drückt

finews.ch writes AEK Bank startet mit stabilem Gewinn ins Jubiläumsjahr

finews.ch writes Lombard Odier Luxembourg erhält neuen Hauptsitz

finews.ch writes Responsability meldet neues Mandat von deutscher Familienstiftung

C. Other Energy Sources not Producing Enough

Adding to the energy crunch was less electricity being produced across the European bloc due to lower wind speeds than usual.

The largest producing countries, Britain, Germany, and Denmark harnessed just 14% of total capacity in the third quarter of 2021. This was down from 20-25% in previous years (Source: Refinitiv).

This low production of wind sourced energy was compounded by France’s largest electricity supplier, EDF, taking additional nuclear reactors offline for maintenance issues.

Reuters reported French power giant EDF (EDF.PA) said it had found faults on pipes in a safety system at its Civaux nuclear power station, and it would shut down another plant because it used the same kind of reactors.

D. Russia provides ~40% of Europe’s Natural Gas

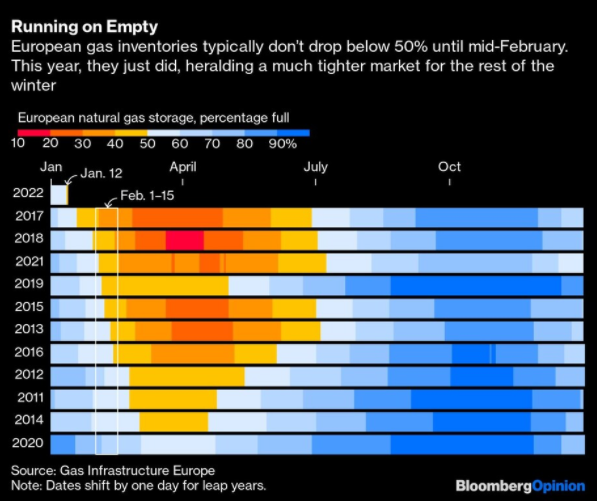

Greatly exacerbating lower storage levels and reduced energy from renewable sources, higher natural gas prices could all boil down to geopolitics.

Per a recent report from the EIA, European gas markets have strong elements of ‘artificial tightness’, which appears to be due to the behavior of Russia’s state-controlled gas supplier (Gazprom).

Unlike other pipeline suppliers – such as Algeria, Azerbaijan, and Norway –Russia has reduced its exports to Europe by 25% in the fourth quarter of 2021 compared with the same period in 2020 – and by 22% compared with its 2019 levels.

And this is despite the exceptionally high market prices for natural gas that we have seen in recent months.

The EIA further states, “Against today’s low baseline, we estimate that Russia could increase deliveries to Europe by at least one-third, or over 3 billion cubic meters per month.

This equates to almost 10% of the European Union’s average monthly gas consumption. This would be the equivalent of a new LNG tanker delivering a full cargo of natural gas to Europe every day.

Together with the current high level of LNG inflow, this would provide significant relief to European gas markets”.

And according to Brooking’s report, Russia denies restricting supplies to Europe.

But Putin taunts the EU for bringing supply volatility on itself. If only German regulators approved the Nord Stream 2 pipeline, Russian gas would again flow abundantly to Europe, Putin suggests.

Moreover, the worst part is that the Russia-Ukraine crisis could lead to even higher prices.

The growing tensions could keep prices high for an extended period and even lead to higher prices in the coming months.

The US is discussing harsh sanctions against Russia in an effort to deter an invasion of Russian troops into Ukraine.

Moreover, the hope is that the threat of these sanctions will be enough.

The sanctions on the table for discussion include targeting individuals and companies. Also sweeping sanctions such as cutting Russia off of the SWIFT system, which would remove Russia’s financial institutions from the global financial network.

And directly related to the natural gas crisis a proposed target for sanctions is the Nord Stream 2 gas pipeline.

Nord Stream 2 gas pipeline, when operational would double the amount of natural gas moved from Russia to Germany through the Baltic Sea. This is likely to reduce the need for other pipelines, such as the Urengoy–Pomary–Uzhhorod pipeline that runs through Ukraine (CNBC.com).

The US Senate voted down a proposal for automatic sanctions against Nord Stream 2 operators. However, there could still be sanctions imposed by the US and/or Germany.

Conclusion

Low wind speeds, limited on- and off-shore production, and geopolitics have driven European natural gas prices to record levels because energy demands must be met, especially during winter.

In December, European consumers were paying 15 times for natural gas compared to those in the U.S.

Much will also depend on how low temperatures drop in Europe over the coming weeks.

Tags: Bitcoin,Bond Markets,Economics,Energy crisis,energy prices,Featured,Gold,gold and silver,gold chart,gold price,inflation,Natural Gas,News,newsletter,Precious Metals,Renewable energy,silver,silver price