With the monthly Friday Payroll Ritual lurking tomorrow morning, and having been focused on PMI estimates before it, a quick look at the ISM’s Non-manufacturing PMI especially its employment index to bridge the latter to the former. The update today for the month of December put the headline estimate at 62.0, down from 69.1 the month prior. Omicron? While a rather sharp and unexpected 7-point drop, other than the size of the decline at 62.0 there’s little to suspect anything really off. This one’s been the outlier anyway; even among sentiment indicators for services if not US services sentiment. . Compared to IHS Markit’s, for instance, the ISM is in a place by itself, though that hasn’t been anything unusual. Ever since around the end of 2017, the index has

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, currencies, economy, Featured, Federal Reserve/Monetary Policy, ism non-manufacturing, Markets, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| With the monthly Friday Payroll Ritual lurking tomorrow morning, and having been focused on PMI estimates before it, a quick look at the ISM’s Non-manufacturing PMI especially its employment index to bridge the latter to the former. The update today for the month of December put the headline estimate at 62.0, down from 69.1 the month prior.

Omicron? While a rather sharp and unexpected 7-point drop, other than the size of the decline at 62.0 there’s little to suspect anything really off. This one’s been the outlier anyway; even among sentiment indicators for services if not US services sentiment. |

|

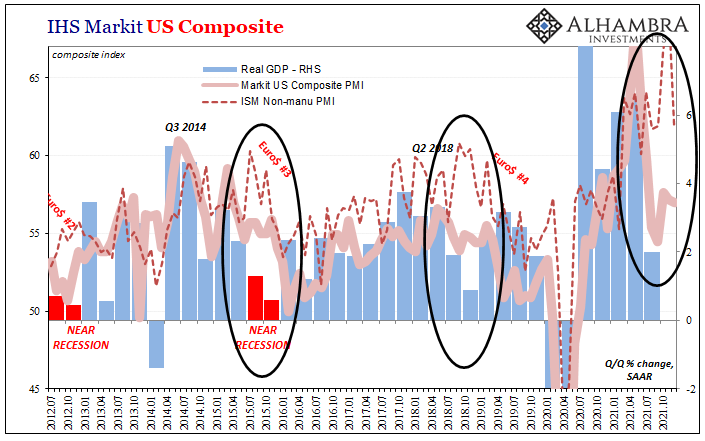

| Compared to IHS Markit’s, for instance, the ISM is in a place by itself, though that hasn’t been anything unusual.

Ever since around the end of 2017, the index has kept positioned perpetually elevated compared to its peers (below I’m showing it compared to Markit’s composite index, which includes that version of services sentiment along with manufacturing). The most glaring difference came in late in 2018 when other similar indications had already started lower for Euro$ #4’s globally synchronized downturn; the ISM NM among the tardiest to the synchronizing. It had actually performed similarly during the depths of Euro$ #3’s downturn, too. The index hit above 60 in July 2015 seemingly still on an upward trend even as the US part of the global economy was already mired in what would be a near recession; a downturn IHS Markit’s composite had already spotted coming the year before. |

|

| Since this soft economic measure tends to be last to have reached each prior inflection, it calls into question the same divergence in recent months; and that’s on top of any unsettled issues with corona effects (both positive, as in reopening places, and negative, as in shutting down places again).

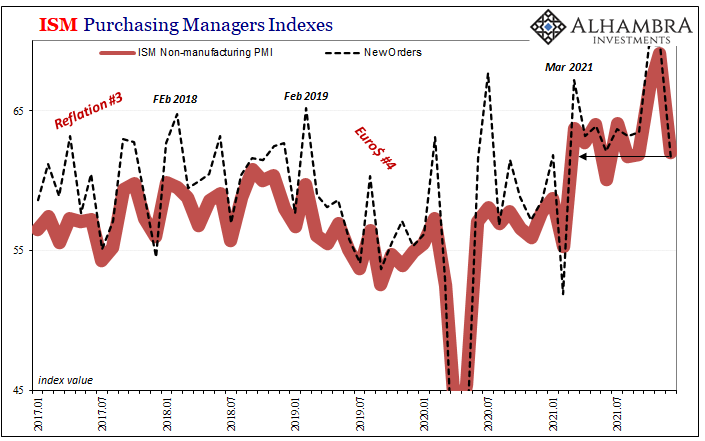

The New Orders segment was largely responsible for the headline miss, declining to 61.5 from 69.7 both October like November. Does it mean more that this index was still above 60 last month, or that at 61.5 this is the lowest since last February? |

|

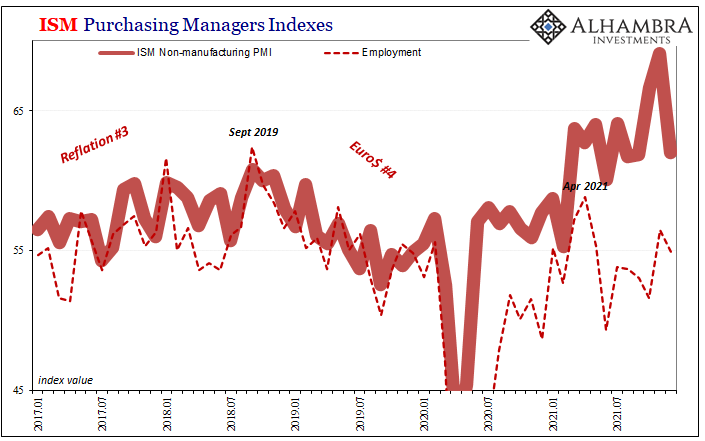

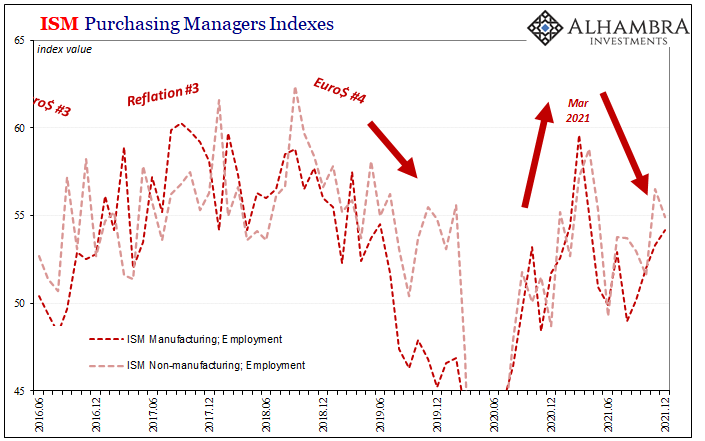

| Where I think it gets really interesting is the employment indicators; ISM’s for services as well as manufacturing. Neither have shown much improvement from earlier in the year, whether having dipped from the effects of delta COVID policies or other reasons. And for the non-manufacturing index, you can really see just how much the employment part of it has unusually lagged the overall headline during this post-2020 rebound.

It’s been in a different place altogether (above). Is this the alleged labor shortage? Perhaps, instead, businesses impacted by rising costs – one key reason why the headline index is so much higher – just aren’t able to pay the market-clearing wage for what is and would continue to be their largest input. In fact, even rebounding from mid-year, like a lot of these corona-impacted PMI numbers those in the latter half have been conspicuously less than what came up during 2021’s first few months up to around March and April. A brief peak before a possible if so far mild labor slowdown. |

In fact, ever since April, the employment index for non-manufacturing has been more like 2019 or late 2015 than any other reflationary period.

With payrolls looming, it’s an interesting pre-release take on the employment situation from another perspective. As is the ISM Non-manufacturing overall which seems to be sticking with its historical biases, whatever you make of these December declines.

Tags: currencies,economy,Featured,Federal Reserve/Monetary Policy,ism non-manufacturing,Markets,newsletter