Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed. In December 2020, millions of Americans still out of work were going to lose government benefits. The Department of Labor would later tally up the scale of this unemployment “cliff”: once funding dried up, 5.33 million eventually rolled off either of Pandemic Unemployment Assistance (PUA) or Pandemic Emergency Unemployment Claims (PUAC) in a bitter and painful twist to a fading recovery. . The impact on “inflation” very evident. . Quickly forgotten, however, washed

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, economy, Featured, Federal Reserve/Monetary Policy, income, inflation, Labor market, Markets, newsletter, taper, Unemployment Claims, unemployment insurance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Last year did not end on a sound note. The initial rebound after 2020’s recession was supposed to be a straight line, lifting upward for the other side of the infamous “V” shape. Such hopes had been dashed, though, and as the disappointing year wound toward its own end yet another big problem loomed. In December 2020, millions of Americans still out of work were going to lose government benefits.

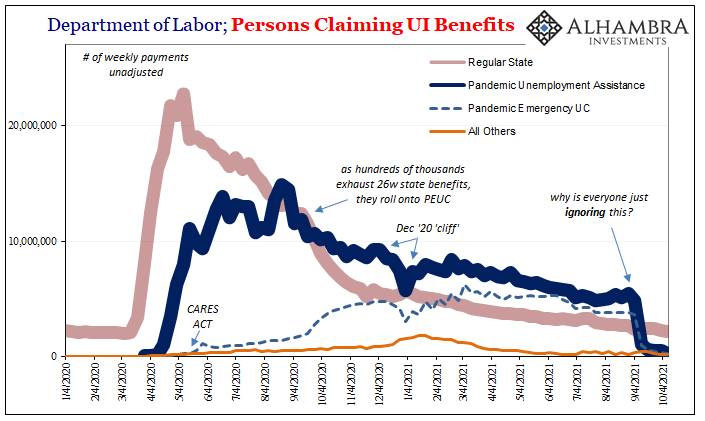

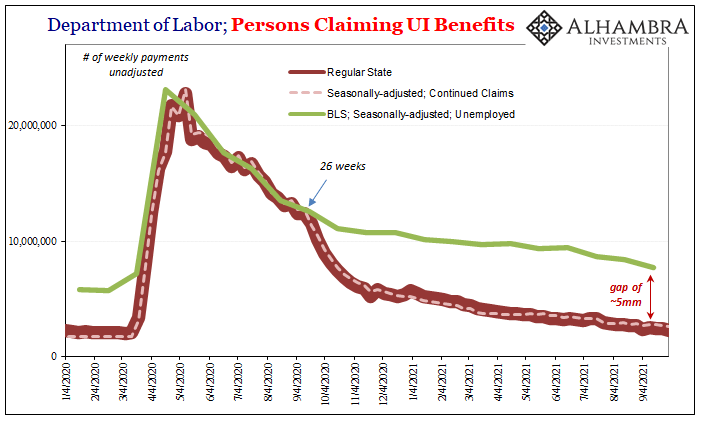

The Department of Labor would later tally up the scale of this unemployment “cliff”: once funding dried up, 5.33 million eventually rolled off either of Pandemic Unemployment Assistance (PUA) or Pandemic Emergency Unemployment Claims (PUAC) in a bitter and painful twist to a fading recovery. |

|

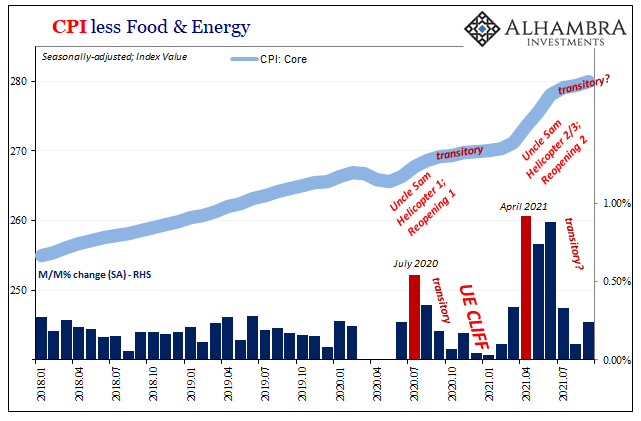

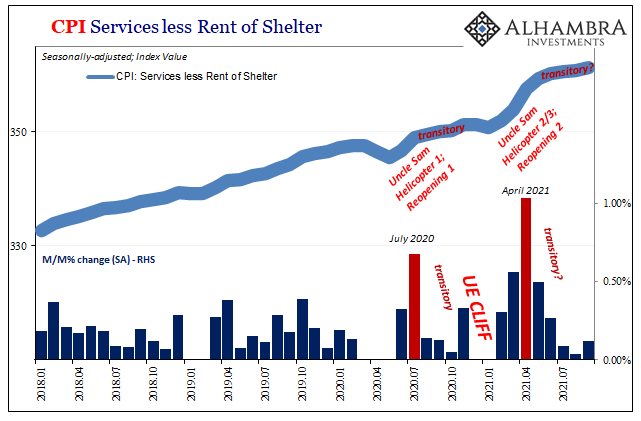

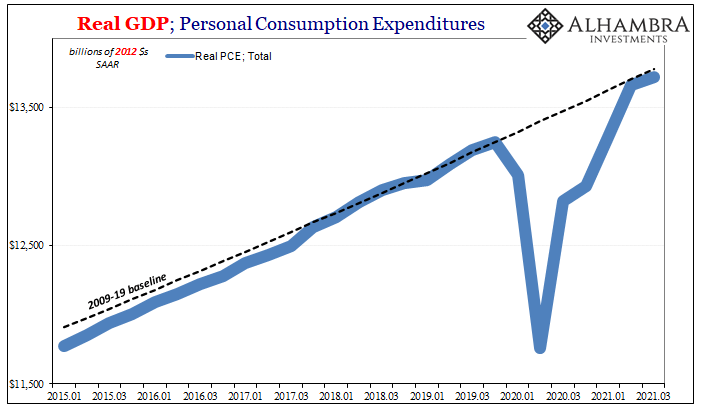

| The impact on “inflation” very evident. | |

| Quickly forgotten, however, washed away in the tidal wave of more government handouts. Not just restoration of those unemployment programs, even bigger the combined Treasury Helicopters #2 and #3 buoyed spirits as well as online consumer shopping. For a while, 2020’s very ragged, cliff-ed end and the material weakness it had indicated was overwhelmed as “stimulus” retook center stage.

Obviously, we will never know what might have happened had the government believed in last year’s hype and restrained itself. Elections and all that, as well as vaccines, too. Still, maybe more thought should have been given to why the first helicopter hadn’t created a recovery in the first place, leaving so many millions exposed to the negative whims of political employment policies. There is a chance, maybe a very good one, we find out this year. As 2021 draws closer to its final month, the good news is there won’t be any unemployment cliff this December. The bad news, this is only because there was an even bigger one in September. |

|

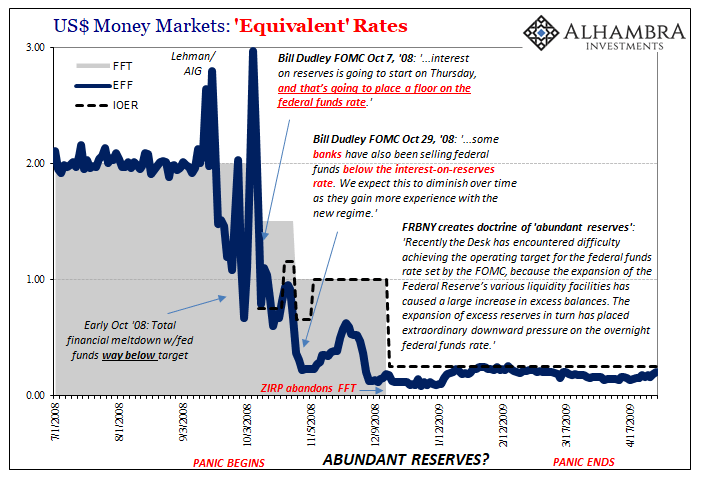

| In this rush toward taper, the inflation narrative pushing the Federal Reserve apparently leaves no room for reality. The economy is going to be even hotter, allegedly, so, apparently, we are all just going to pretend this massive precipice didn’t happen or that somehow it won’t matter even a little:

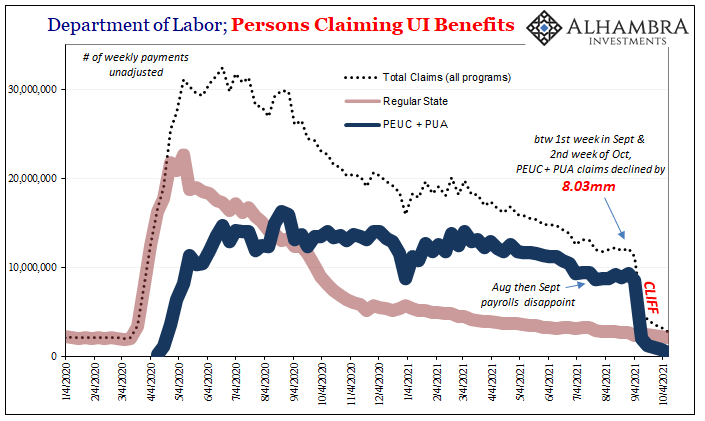

The prior one, December 2020, took down more than 5 million pandemic claims temporarily. The latest one, likely the last one, took down more than 8 million pandemic claims permanently. Eight million government payment streams vanish in a flash, or its economic equivalent of a condensed period spanning only 5 weeks. This really won’t be something to consider? No! Of course not. LABOR SHORTAGE!!!!! Setting aside the lack of market clearing emotions surrounding the topic, even if there was a tight labor market the numbers just don’t add up close to eight million more. |

|

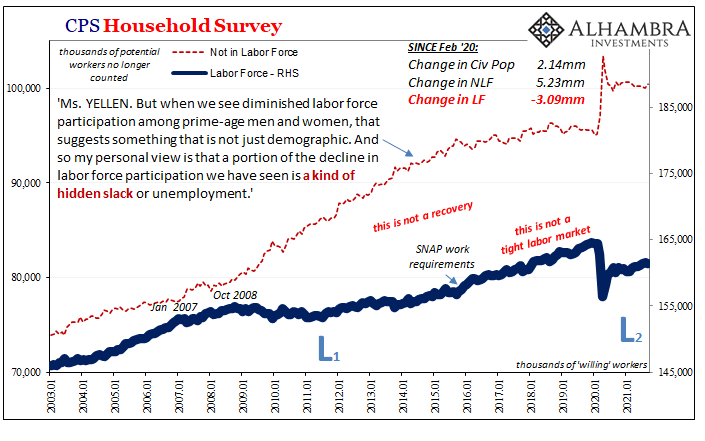

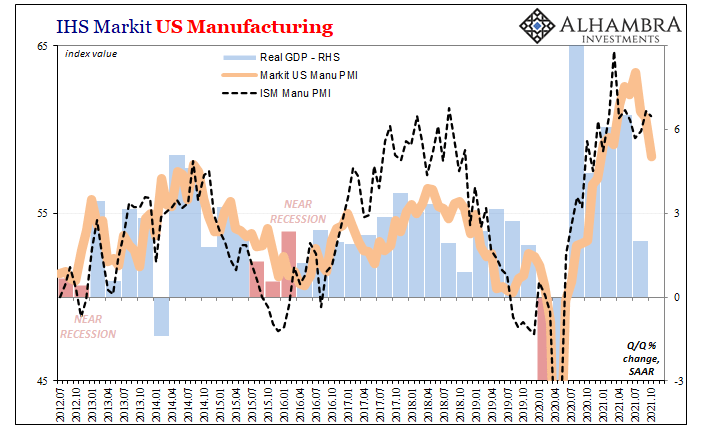

| From late February to August when the labor force reached the edge of the unemployment cliff, even during some of the best monthly jobs gains (due to reopening) in history, the Establishment Survey increased by only 4.1 million.

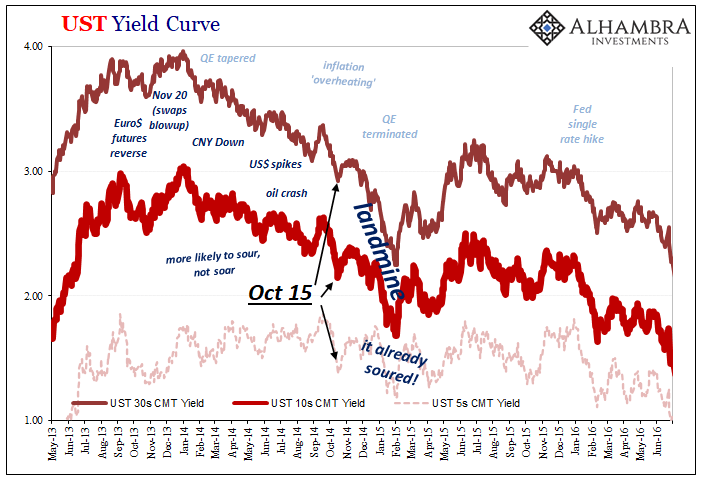

The Household Survey, the larger survey encompassing household workers, especially more informal gig workers, gained only 2.9 million. Remember what did not happen in September. As these eight million lost their government payments throughout that month, they did not flood the jobs market. On the contrary, the labor force itself lost several hundred thousand more (on top of the hundred thousand or so who didn’t enter it). And worse than August, employment growth during September was decidedly minimal. In fact, you could see the recent trouble coming…just by using unemployment claims data. The uptick in existing as well as new claims began around late July, just in time to sour the Fed’s tying taper to projected continuous payrolls. |

|

| Was this Q3 soft patch really only due to delta COVID?

If it was, then as the economy shakes off its impacts (see: today’s ISM Non-manufacturing record high) it is still faced with the unemployment cliff in 2021 which, unlike the one in 2020, is final. There’s no restored funding coming, no Helicopter #4 on the horizon. And if Q3’s slowdown isn’t only attributable to the pandemic, as the bond market clearly sees it, the huge loss of pandemic claims only subtracts that much more from the fading “stimulus” regime already having given up most of its effects months ago. |

. |

| You might see why no one wants to talk about the unemployment cliff, certainly not at the same time they’re all-in on red hot inflation. | |

Tags: Bonds,currencies,economy,Featured,Federal Reserve/Monetary Policy,income,inflation,Labor Market,Markets,newsletter,taper,Unemployment Claims,unemployment insurance