We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of direction, along with a clear commitment to extend the tightening cycle, should be enough to satisfy investors while also keeping bullets for later. In this scenario, we might get a knee-jerk lira sell-off that soon stabilizes. The real concern comes if they deliver a hike of 200-250 bp or less which

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, emerging markets, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of direction, along with a clear commitment to extend the tightening cycle, should be enough to satisfy investors while also keeping bullets for later. In this scenario, we might get a knee-jerk lira sell-off that soon stabilizes. The real concern comes if they deliver a hike of 200-250 bp or less which would lead to a dramatic move lower for the lira and undo the entire supportive narrative.

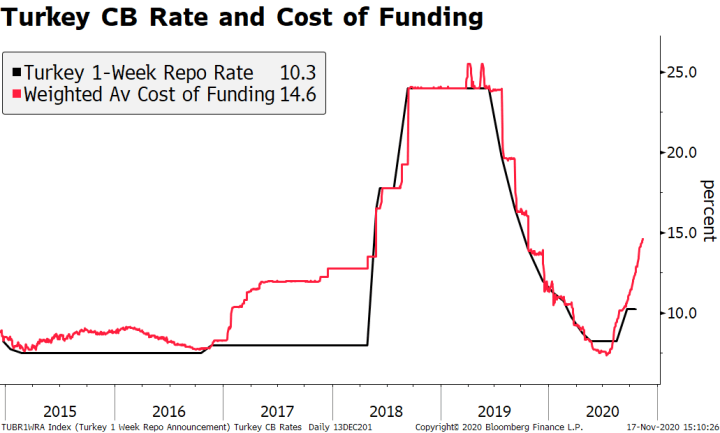

In practice, hiking the one-week repo rate is really a matter of consecrating the tightening that has been underway since November. We can see this by looking at local bank’s average cost of funding (now nearly 15%). In other words, official will switch from “backdoor tightening” back to the policy rate. But they also need to improve communication. We probably won’t get a “whatever it takes” moment, but we think the CBRT will sound convincingly hawkish. |

Turkey CB Rate and Cost of Funding, 2015-2020 |

| There is an additional upside risk of a broader policy reform. The new central bank chief Murat Uysal comes in with the full backing of President Erdogan, who said the country is ready to “swallow a bitter pill” to improve the economy. The new Finance Minister Lutfi Elvan, replacing Erdogan’s son-in-law, also brings an opportunity to reset the nation’s relationship with investors. This means that the CBRT may start moving towards reforming its baroque policy framework by refocusing our attention on the repo rate and away from liquidity windows and other rates.

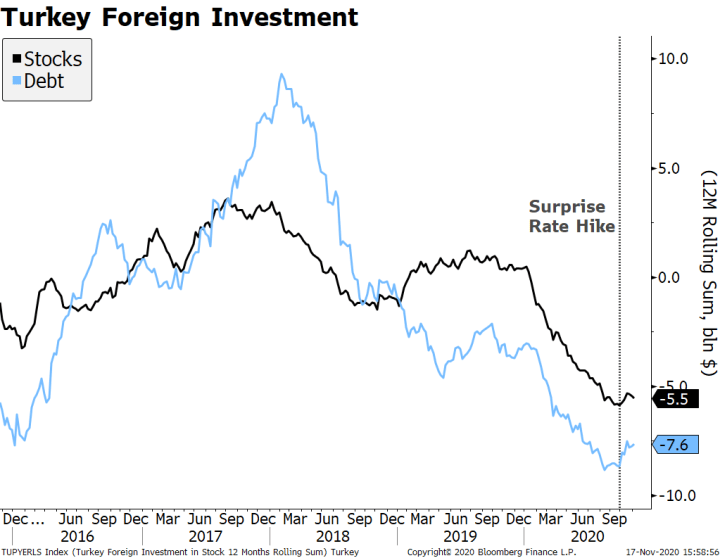

This time may be (a little bit) different. Everyone assumes we are just restarting the usual cycle of (1) credibility loss à (2) currency depreciation à (3) official overreaction à (4) currency rally à (5) back to credibility loss. We do too. However, this time around, we think the cycle of credibility rebuilding might be longer and deeper. There are many reasons for this, but the two main ones are: the well documented loss of Turkey’s FX reserves and a worsening of the external backdrop. On the latter, Turkey is engrossed in far too many international conflicts, including Syria, Libya, and South Caucuses, while picking fights with Greece and Saudi Arabia. If it wants to continue projecting power though the region, it needs to improve its domestic situation. While we still firmly believe the long-term trajectory for USD/TRY is upward, it’s not the time to express this view. |

Turkey Foreign Investment, 2016-2020 |

Tags: Emerging Markets,Featured,newsletter