Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25% UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic political outlook is getting (even more) turbulent; eurozone reported weak September IP Crude prices remain well supported by the dual engines of positive vaccine news and continued OPEC output restraint; Japan reported soft September core machine orders and October PPI; India reports October CPI and

Topics:

Win Thin considers the following as important: 5) Global Macro, 5.) Brown Brothers Harriman, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Marc Chandler writes Sterling and Gilts Pressed Lower by Firmer CPI

Ryan McMaken writes A Free-Market Guide to Trump’s Immigration Crackdown

Wanjiru Njoya writes Post-Election Prospects for Ending DEI

Swiss Customs writes Octobre 2024 : la chimie-pharma détermine le record à l’export

- Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today

- Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25%

- UK Q3 GDP rebounded strongly but September data show a loss of momentum; Brexit talks remain unresolved; the domestic political outlook is getting (even more) turbulent; eurozone reported weak September IP

- Crude prices remain well supported by the dual engines of positive vaccine news and continued OPEC output restraint; Japan reported soft September core machine orders and October PPI; India reports October CPI and September IP

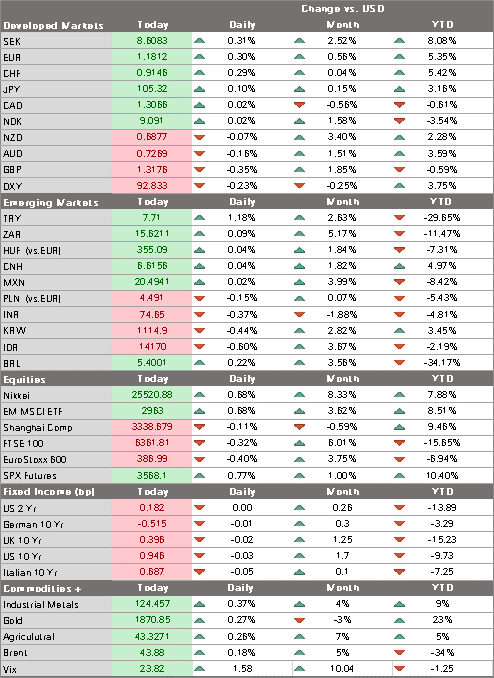

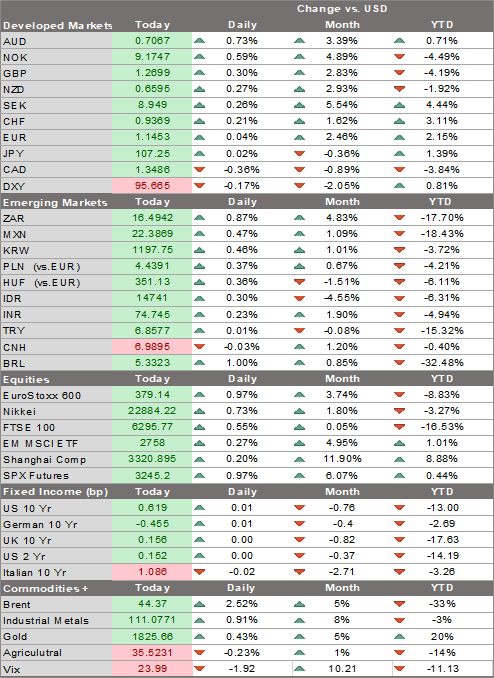

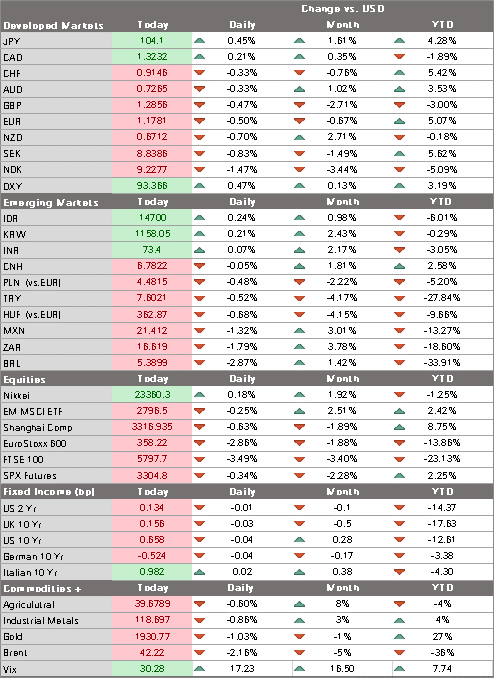

Pressure on the dollar has resumed. DXY is trading lower after being unable so far this week to break above the 93 area. The euro has broken back above $1.18 while sterling is breaking below $1.32. USD/JPY is trading heavy after the rally is ran out of steam near 105.70. We believe that dollar weakness will continue and so DXY should test this month’s low near 92.13 before eventually testing the September low near 91.746.

| AMERICAS

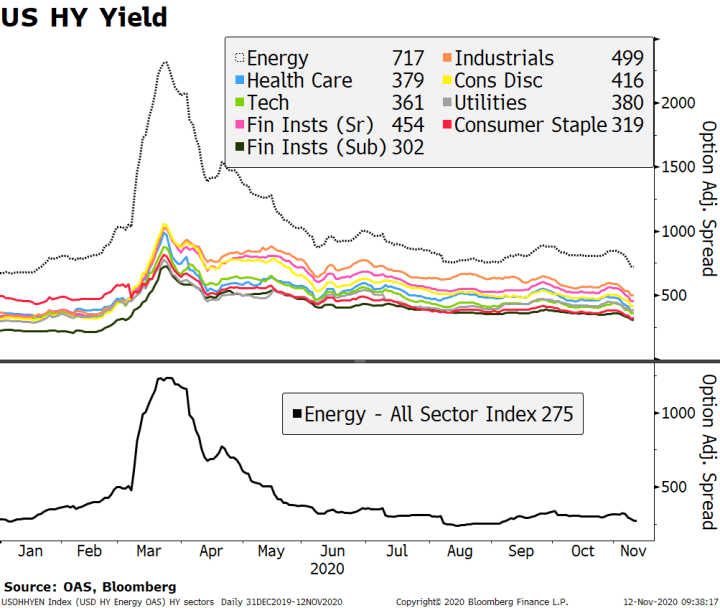

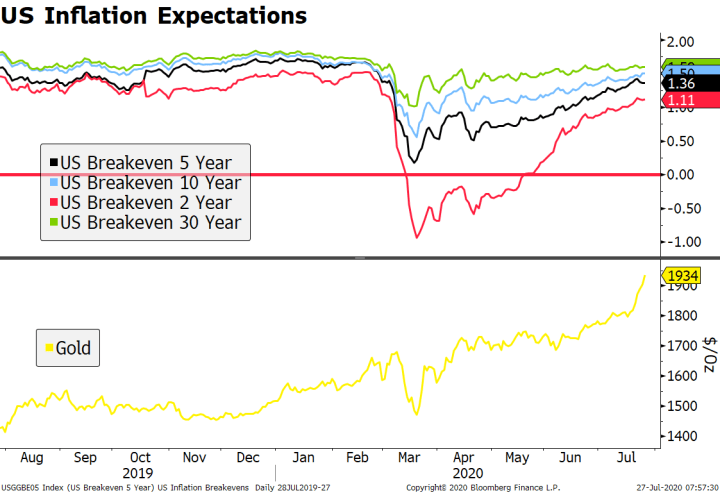

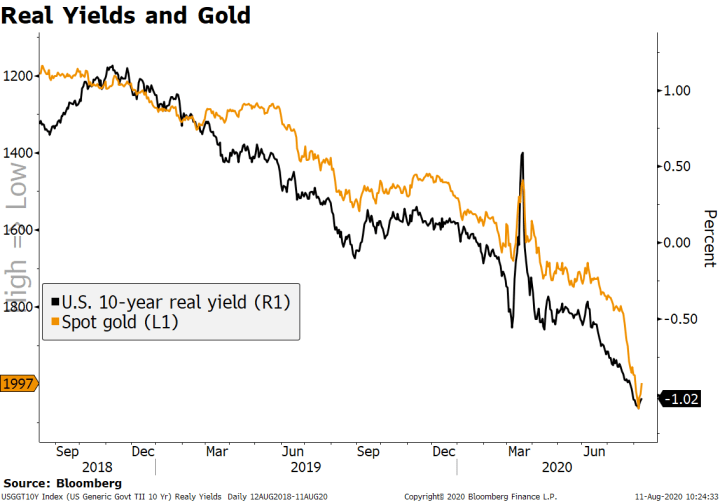

October CPI data will be the US highlight. Headline inflation expected to drop a tick to 1.3% y/y and core expected to remain steady at 1.7% y/y. PPI will be reported tomorrow, with headline inflation expected to remain steady at 0.4% y/y and core expected to remain steady at 1.2% y/y. At this point, no one is concerned about inflation in the US. The headline numbers may swing up and down due to food and energy prices, but underlying price pressures still hinge largely on wage pressures. With tens of millions still unemployed, we do not expect any sustainable price pressures to emerge for the foreseeable future. The US bond market was closed yesterday but yields have eased a bit today. It appears that the 1% level for the 10-year will be tough to crack, at least for now. As we have noted before, the Fed is likely to be unhappy with the recent bearish curve steepening in the US. Steepening tightens financial conditions and this is something the Fed wants to avoid for quite some time. Evans speaks today, while Powell will speak on a panel with ECB’s Lagarde and BOE’s Bailey. US high yield bonds have performed well during the last adjustment, despite the increase in US Treasury yields. All sectors benefited from the recent political and vaccine news, especially the energy sector. Since the elections, the difference (on an OAS basis) between the energy HY index and the broad HY index has narrowed around 50 bp. And of course, sectors that would most benefit from the re-opening have also outperformed. Weekly jobless claims data will be reported. Regular initial claims are expected at 731k vs. 751k the previous week. That was the lowest since the week ending March 14, but PUA initial claims rose slightly to 363k and so the two together still total around 1.1 mln, which remains elevated. Regular continuing claims are expected at 6.825 mln vs. 7.285 mln the previous week. Regular plus PUA continuing claims are around 17.2 mln, the lowest since the week ending April 11 but still elevated. Bottom line, the labor market appears to be improving modestly after stalling for much of Q3. The monthly budget statement for October will hold some interest. A deficit of -$275 bln is expected. If so, the 12-month total would rise to a record -$3.27 trln. Receipts are down and expenditures are up, and this trend is likely to remain in place for the foreseeable future. US Treasury yields were all over the place last week, first up on the notion of a Blue Wave, then down on the notion of a split government. Now, the Georgia Senate runoffs in January have reintroduced risks that a Blue Wave is still a possible outcome that will have significant implications for the US Treasury market. Banco de Mexico is expected to cut rates 25 bp to 4.0%. However, the market is split as nearly a third of the analysts polled by Bloomberg see steady rates of 4.25%. We favor a cut, especially as the peso is trading at the strongest levels since March. Markets are a little nervous after reports yesterday (later denied) that Finance Minister Herrera would step down. Peru central bank is expected to keep rates steady at 0.25%. CPI rose 1.99% y/y in October, right at the center of its 1-3% target range. For now, the bank is likely to remain on hold as fiscal policy likely carries the load for now. Political uncertainty has risen with the impeachment of President Vizcarra this week on allegations of corruption. He was replaced by Manuel Merino, the head of Congress, who becomes the third president in less than five years. Protests will continue with a nationwide one planned for tonight. Moody’s warned that the new government may be more inclined to adopt populist policies coming from Congress, which would risk undermining the nation’s creditworthiness. To be continued. |

US HY Yield, 2020 |

| EUROPE/MIDDLE EAST/AFRICA

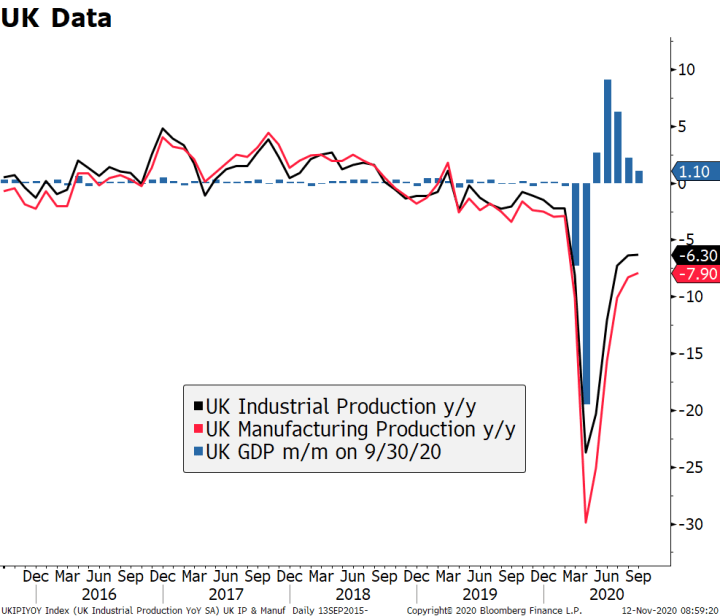

UK Q3 GDP rebounded strongly but September data show a loss of momentum. GDP grew 15.5% q/q vs. 15.5% expected and -19.8% in Q2. Despite the impressive number, there was little to get excited about. Stronger than expected private consumption and GFCF was offset by weaker than expected government spending and exports. Of note, September GDP growth was 1.1% m/m, half the August gain and already showing the looming slowdown. IP rose 0.5% m/m vs. 1.0% expected, while services rose 1.0% m/m vs. 1.3% expected and 2.4% in August. The only bright spot was construction output, rising 2.9% m/m vs. 2.1% expected. The expanded furlough scheme and BOE action will help mitigate the damage, but the outlook remains grim between the second lockdown and Brexit uncertainty. Brexit talks remain unresolved. The EU’s latest move has been to leverage the discussion about the UK’s access to the bloc’s energy markets to strengthen its positioning in the fishing rights issue. We believe the Brexit calculus for Johnson has shifted significantly with the loss of his ally Trump. Biden is rightly concerned about the impact of a hard Brexit on peach in Northern Ireland and would not look to bail out Johnson is it were to happen. Chancellor Sunak said there was a deal to be done and we are sure that he is pushing for one. Sunak is already struggling with the impact of the pandemic and the last thing he needs is further economic disruption from a hard Brexit. |

UK Data, 2016-2020 |

| Meanwhile, the domestic political outlook is getting (even more) turbulent. After several Tory rebellions and drop in popularity, Prime Minister Johnson is now facing another crisis after his Director of Communications Lee Cain resigned over an internal power struggle. Cain is a close ally of chief advisor Dominic Cummings and three worked together on the “Vote Leave” campaign ahead of the Brexit referendum. The drama comes at a difficult time and risks distracting from the important talks with Brussels.

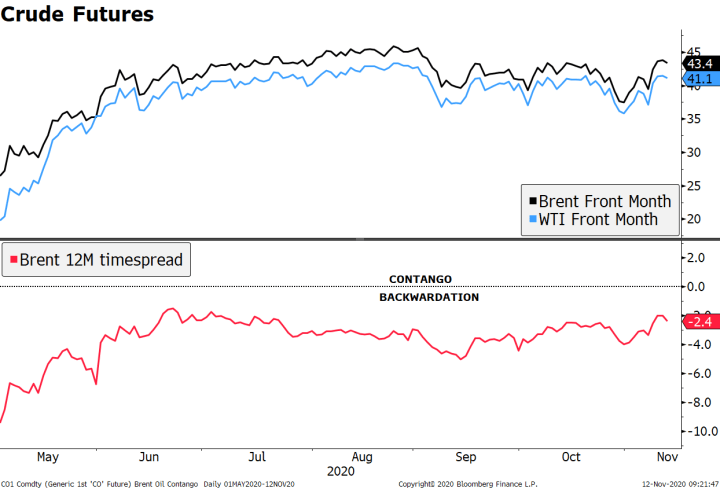

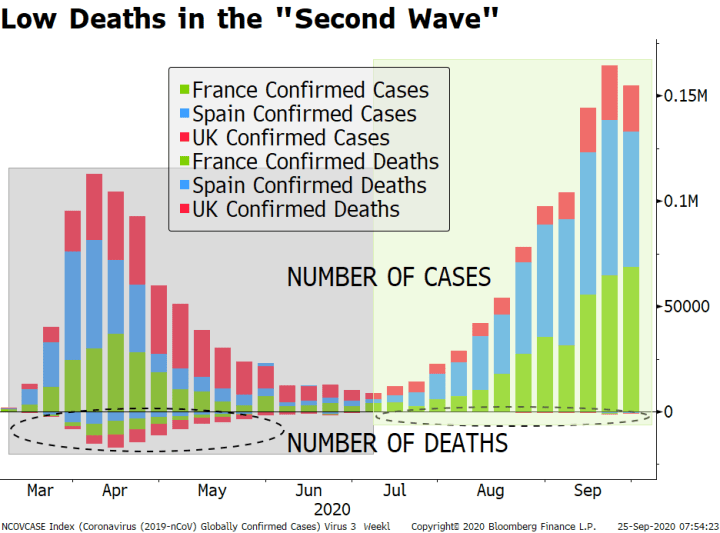

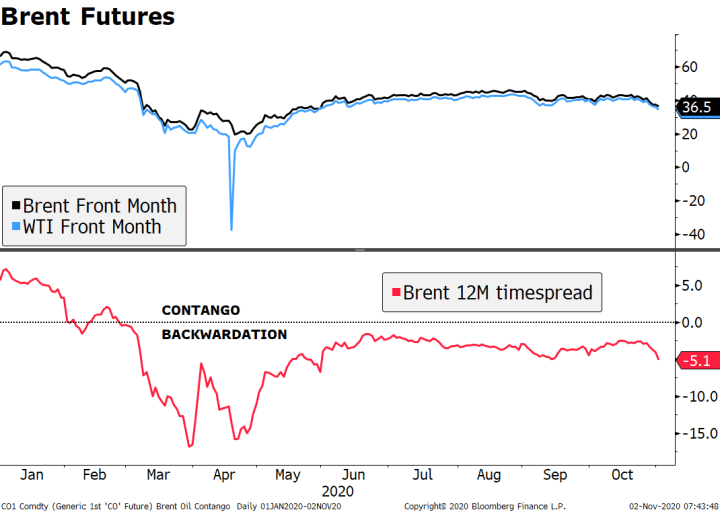

Eurozone reported weak September IP. It was expected to rise 0.6% m/m, but instead fell -0.4% m/m. August was revised down a tick to 0.6% m/m. Weak country readings this past week warned of downside risks but the outright drop is very disappointing. This just underscores why more fiscal and monetary stimulus measures are needed. Data show a loss of momentum already in Q3, and the Q4 outlook has worsened with the rise in virus numbers across Europe. Crude prices remain well supported by the dual engines of positive vaccine news and continued OPEC output restraint. On the latter, the group is considering extending its current oil production quotas by three to six months when they meet at the end of the month. Some reports even claim officials will consider deepening the cuts if necessary. Markets have been speculating about the delay in production hike for some time, but the latest headlines provide more substance to them. On the vaccine story, the IEA noted that “it is far too early to know how and when vaccines will allow normal life to resume. For now, our forecasts do not anticipate a significant impact in the first half of 2021.” Brent is up around 15% since the recent lows, but still within the range seen so far in the second half of the year.

|

Crude Futures, 2020 |

| ASIA

Japan reported soft September core machine orders and October PPI. Orders fell -4.4% m/m vs. -1.0% expected and +0.2% in August, while PPI fell -2.1% y/y vs. -2.0% expected and -0.8% in September. The soft readings are disappointing given the signs of recovery. To make matters worse, Japan hit a new daily record of virus infections. While the 1,634 cases are dwarfed by the numbers being seen in Europe and the US, the increase will certainly raise concerns that some sort of lockdowns will be instituted in the coming weeks. Indeed, the minister overseeing the coronavirus response Yasutoshi Nishimura said more stringent steps would be needed if infections continue to rise. Q3 GDP will be reported next Thursday and is expected to grow 18.9% SAAR vs. -28.1% in Q2. Risks to Q4 are rising along with the virus numbers. India reports October CPI and September IP. Headline inflation is expected at 7.30% vs. 7.34% in September, while IP is expected to contract -1.8% y/y vs. -8.0% in August. If so, inflation would remain above the 2-6% target range for seventh straight month. This has kept the RBI on hold since the last 40 bp cut back in May. Next RBI policy meeting is December 4 and steady rates are likely until inflation is under better control. Until then, it appears fiscal policy will be stepped up in its place. Finance Minister Sitharaman just announced another INR9 trln ($120 bln) of stimulus measures overnight, taking the total up to INR30 trln (15% of GDP). |

Tags: Articles,Daily News,Featured,newsletter