Tensions between the US and China continue to rise; the dollar is finding some traction Fed Beige Book contained no surprises; NY Fed President Williams said the Fed is “thinking very hard” about targeting yields; weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week Germany reports May CPI; ECB is likely to ease next week; BOE continues to show its dovish colors; Poland is expected to keep rates steady at 0.5% Japan’s Cabinet Office maintained its view that the economic outlook continues to deteriorate; Korea cut rates 25 bp to 0.5%, as expected The dollar is mostly firmer against the majors as US-China tensions continue to rise. Stockie and Kiwi are outperforming, while Nokkie and Aussie are underperforming. EM currencies are mostly softer.

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

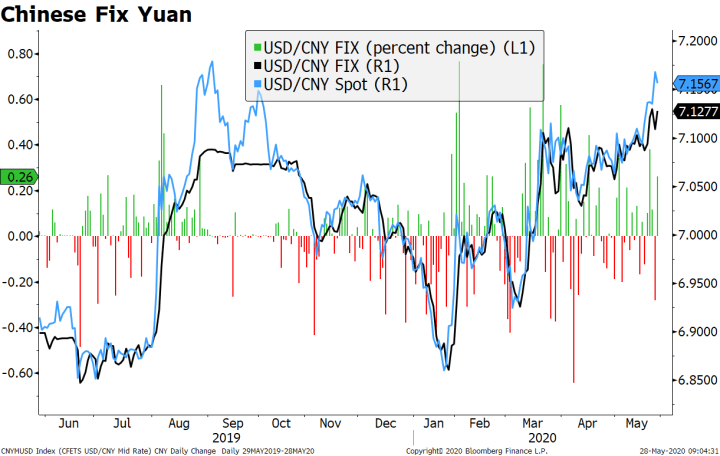

The dollar is mostly firmer against the majors as US-China tensions continue to rise. Stockie and Kiwi are outperforming, while Nokkie and Aussie are underperforming. EM currencies are mostly softer. The CEE currencies and CNY are outperforming, while TRY and ZAR are underperforming. MSCI Asia Pacific was up 0.8% on the day, with the Nikkei rising 2.3%. MSCI EM is flat so far today, with the Shanghai Composite rising 0.3%. Euro Stoxx 600 is up 0.9% near midday, while US futures are pointing to a higher open. 10-year UST yield is flat at 0.68%, while the 3-month to 10-year spread is flat at +54 bp. Commodity prices are mixed, with Brent oil down 1.1%, WTI oil down 1.4%, copper up 0.4%, and gold up 0.8%. Tensions between the US and China continue to rise. However, so far developments have been along the expected path. The PBOC fixed the yuan a bit stronger than what the models suggest, helping the yuan spot rate to trade slightly stronger on the day. Still, it has depreciated 1.3% on the month and nearly 3% on the year and yesterday USD/CNY traded at the highest level since last September. |

Chinese Fix Yuan, 2019-2020 |

| The dollar is finding some traction. DXY is trading higher off of yesterday’s low near 98.716. The euro remains heavy after failing again to break above the April 1 high near $1.1040. Sterling also remains heavy, down two straight days after making a new high Tuesday near $1.2365 area last week. Lastly, USD/JPY has edged higher though 108 still looks tough to crack.

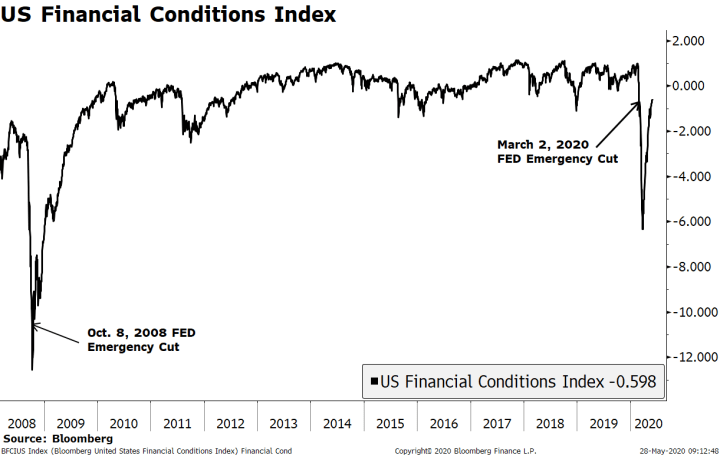

AMERICAS The US continues to ratchet up the pressure on China. Congress passed a sanctions bill against China in response to its alleged human rights abuses against Muslim minorities. Elsewhere, Secretary of State Pompeo said Hong Kong can no longer be considered politically autonomous from China. The move could trigger visa restrictions and asset freezes on top Chinese officials, and the US could also revoke special trading privileges for Hong Kong. President Trump said details would be revealed “very powerfully” later this week. Elsewhere, the US said it will expel any Chinese graduate students with ties to the People’s Liberation Army. The move could affect over 3000 students. While this is a small slice of the more than 350,000 Chinese students currently studying in the US, the move intensifies the conflict and invites retaliation. Indeed, there is simply no way China stays silent as the US continues its full court press. China vowed to take “necessary countermeasures in response.” As expected, China’s legislature approved the controversial national security legislation by a 2878-1 vote, even though details about what will happen in practice are still very scarce. These moves related to Hong Kong are seen by China as foreign meddling in its internal affairs. What can China do? Obviously, the easy response would be to expel US students from China. However, if it wants to make a stronger statement, China can say it will no longer honor its pledge to buy more US goods, particularly agriculture that comes mainly from the red states. Countervailing tariffs and sanctions on the US and US officials are also quite possible. Stay tuned. The Fed Beige Book report for the upcoming FOMC meeting June 10 contained no surprises. It noted “steep” job losses and business closures due to the pandemic, adding that “Although many contacts expressed hope that overall activity would pick up as businesses reopened, the outlook remained highly uncertain and most contacts were pessimistic about the potential pace of recovery.” The Fed also noted that the Paycheck Protection Program had “helped many businesses to limit or avoid layoffs, although employment continued to fall sharply in retail and in leisure and hospitality sectors.” Interestingly, New York Fed President Williams said the Fed is “thinking very hard” about targeting yields. He noted that so-called Yield Curve Control (YCC) is a way of ensuring borrowing costs stay at rock-bottom levels across the curve, not just at the short end. He added that “Yield-curve control, which has now been used in a few other countries, is I think a tool that can complement -– potentially complement –- forward guidance and our other policy actions.” We note that the US 10-year yield has been stuck between 55-85 bp for much of April, and further narrowing to 60-75 bp for much of May. We do not think YCC will be seen unless there is a real risk that the curve steepens substantially. Williams and Harker speak today. The vast decoupling between financial assets and the economic reality comes with a wholly different set of risks. These range from a change in tone by central banks to a turn of public perception about the implications of policy decisions. Take the US financial conditions index, for example, which summarizes credit conditions, stress in money markets, equities, and availability of funding. We are still in restrictive territory -0.6 using Bloomberg’s metric, but a far cry from the sub -6.0 level just a few weeks ago. This seems to be setting up markets for a “Taper Tantrum” type of event, because at some point the Fed will have to signal that it has successfully capped downside risks. We think that even a whiff of less easing (let along tightening) could sour the jubilant mood. And if this doesn’t happen, it’s only a question of time until public perception starts to reflect discontent about stock markets near new highs with unemployment still at double digits. |

US Financial Conditions Index, 2008-2020 |

| Weekly jobless claims are expected at 2.1 mln vs. 2.438 mln last week. If so, this would mean that around 41 mln will have become jobless over the last nine weeks, which is over 25% of the labor force. Consensus for the May jobs report is currently -8 mln vs. -20.537 mln in April, with the unemployment rate seen rising to 19.7% from 14.7% in April. First revision to Q1 GDP (seen steady at -4.8% SAAR) will also be reported today, along with April durable goods orders (-19.1% m/m expected) and pending home sales (-17.0% m/m expected).

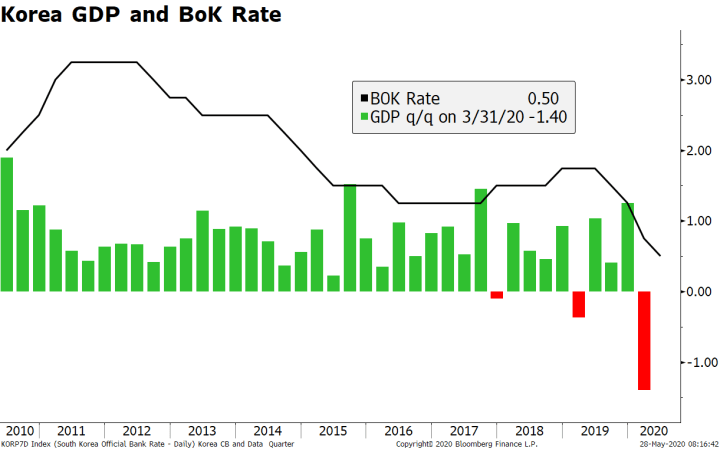

The regional Fed manufacturing surveys for May will continue to roll out. Kansas City Fed reports today and is expected at -22 vs. -30 in April. Yesterday, Richmond Fed came in at -27 vs. -40 expected and -53 in April. Previously, the Dallas Fed came in at -49.2 vs. -61.0 expected and -73.7 in April, the Philly Fed survey came in at -43.1 vs. -40.0 expected and -56.6 in April, and the Empire survey came in at -48.5 vs. -60.0 expected -78.2 in April. One can only say that the US manufacturing sector is getting “less bad.” Signs of true improvement or growth in the US remain elusive. EUROPE/MIDDLE EAST/AFRICA The euro popped yesterday on reports of the EC rescue package but ran out of steam around $1.1030. We think three things are likely to keep a lid on EUR gains: 1) the long, tortuous process ahead to get the fiscal plan done, 2) prospects of further ECB easing next week (see below), and 3) rising odds of a hard Brexit. Top UK negotiator Frost has admitted that a deal on fisheries was unlikely by the June 30 deadline. The next round of Brexit negotiations will be held next week by video. The last round ended with a lot of blame and finger-pointing by both sides, and so we do not hold out much hope of a breakthrough in this next round. Hard Brexit risks will impact sterling the most but the euro is likely to suffer collateral damage. Germany reports May CPI. Headline inflation is seen falling to 0.6% y/y from 0.9% in April, while the EU Harmonized rate is seen falling to 0.4% y/y from 0.8% in April. Some German states have already reported and suggest some downside risks to the national reading. The eurozone reading will come out tomorrow, with headline inflation seen falling to 0.1% y/y from 0.4% in April. Elsewhere, the EU’s economic confidence index for May today came in a bit lower than expected at 67.5, while April was revised down to 64.9 from 67.0 previously. The European Central Bank is likely to ease next week. ECB President Lagarde and Vice President De Guindos said GDP is set to shrink between 8-12%, calling its “mild” scenario out of date. Lagarde added that “We’ll have a better sense in a few days as we publish our numbers in early June, but it’s likely we will be in between the medium and severe scenarios.” An increase in the ECB’s asset purchases will likely be announced then. Looking further out, WIRP suggests nearly 65% odds that the ECB will go more negative by early 2021. BOE continues to show its dovish colors. Today, external MPC member Saunders said it’s better for the BOE to err on the side of too much easing rather than too little. He added that the UK is at risk of a relatively slow recovery from the crisis, which could see it stuck in a “lowflation trap.” Yesterday, Governor Bailey said the BOE is still studying the potential for negative rates. Parts of the UK curve remain negative. The 2- to 6-year section of the UK curve is currently under water. The 1- and 7-year yields are barely positive and likely to go negative too. Elsewhere, WIRP suggests the Bank of England will go negative on its policy rate by December. The dovish BOE, poor economic data, and rising Brexit risks are all likely to continue weighing on sterling. After its rally ran out of steam near $1.2365 this week, sterling remains heavy and a break below the $1.2185 area would set up deeper losses and a test of the May 18 low near $1.2075. National Bank of Poland is expected to keep rates steady at 0.5%. At the last meeting April 8, the bank surprised markets with a 50 bp cut, the second one in three weeks. QE is under way but we think it is too early to increase the size, as the curve has been pushed down significantly already. Over the past month, the short end is down nearly 100 bp and the long end nearly 65 bp. May CPI will be reported Friday, with inflation expected to ease to 3.0% y/y from 3.4% in April. ASIA Japan’s Cabinet Office maintained its view that the economic outlook continues to deteriorate. It noted that with the nationwide state of emergency was lifted this week, economic activity will resume gradually but warned “an extremely severe situation is expected to continue.” This view was contained in its monthly assessment, which describe the economy for a second month as worsening rapidly. The assessment said weakness in the jobs market is increasing and added that business investment, which had been flat, is now showing signs of weakness. Lastly, the Cabinet cut its view of exports, saying they are worsening rapidly. No wonder another slug of fiscal stimulus was announced this week. For now, markets see low odds of BOJ cutting rates further but this view could change if the economy shows few signs of turnaround. The Bank of Korea cut rates by 25 bp to a new historic low of 0.50%, as expected. The communication suggest that further easing will be done through unconventional tools, such as bond purchases, rather than more rate cuts. Indeed, the groundwork for outright QE has been laid after the BOK last week unveiled a plan to buy corporate debt indirectly via a special purpose vehicle. The bank cut its 2020 GDP forecast from +2.1% to -0.2%, and cut its CPI forecast from 1.0% to 0.3%. The government has enacted a substantial fiscal effort and another package worth KRW40 trln ($32 bln) is reportedly in pipeline, which might be the reason for the BOK’s optimistic 3.1% GDP forecast for 2021. In any case, the bank won’t hesitate to help the government by keeping funding costs low. |

Korea GDP and BoK Rate, 2010-2020 |

Tags: Articles,Daily News,Featured,newsletter