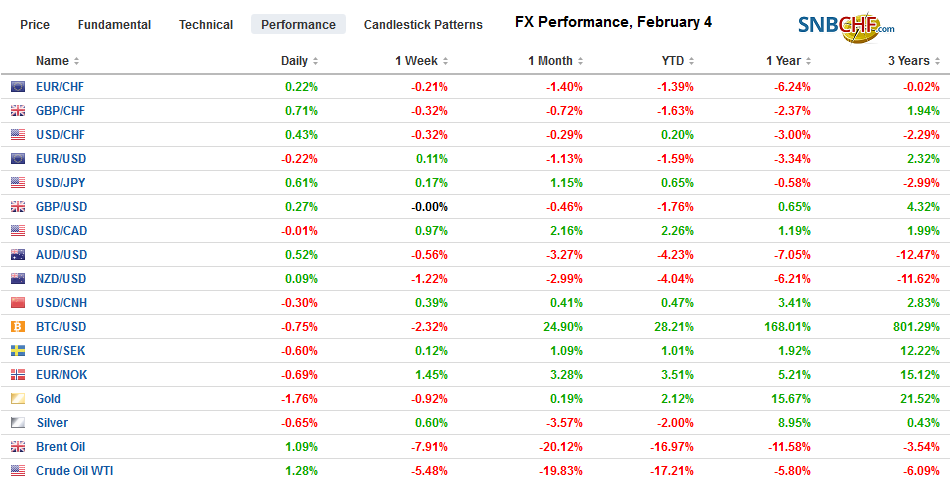

Swiss Franc The Euro has risen by 0.21% to 1.0701 EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe’s Dow Jones Stoxx 600 is posting broad gains and is up over 1% in late morning turnover. The S&P 500 is poised to gap higher and test last week’s highs a little above 3290. Bonds are surrendering the safe-haven bid, and yields are mostly 2-5 bp higher in Europe and the US. Italian and Greek bonds are holding in better,

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, China Brexit, Currency Movement, Featured, Ireland, newsletter, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has risen by 0.21% to 1.0701 |

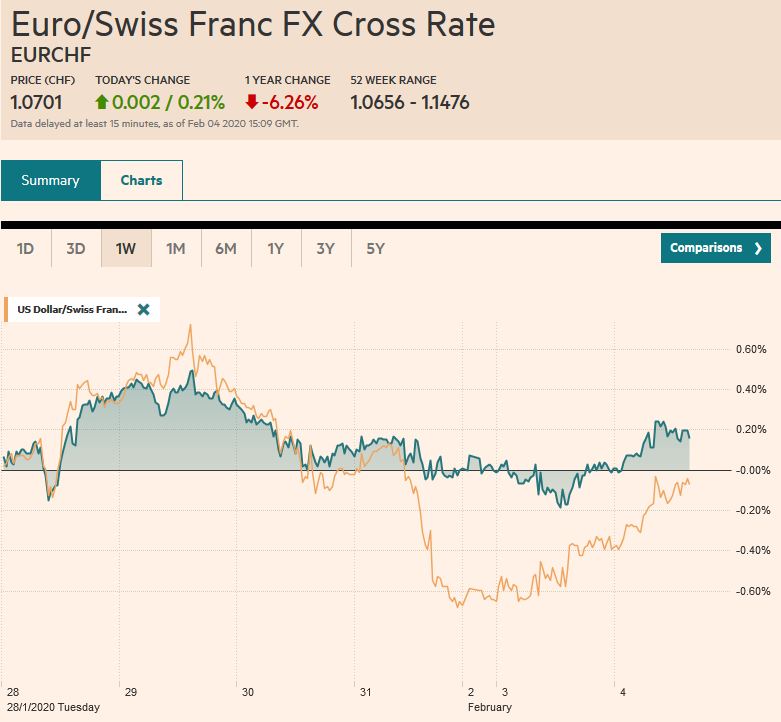

EUR/CHF and USD/CHF, February 4(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The combination of the rally in US shares yesterday and the continued efforts of China to inject liquidity helped lift sentiment today. The MSCI Asia Pacific Index snapped an eight-day slide, and many markets jumped more than 1%. Led by energy and materials, Europe’s Dow Jones Stoxx 600 is posting broad gains and is up over 1% in late morning turnover. The S&P 500 is poised to gap higher and test last week’s highs a little above 3290. Bonds are surrendering the safe-haven bid, and yields are mostly 2-5 bp higher in Europe and the US. Italian and Greek bonds are holding in better, as they trade more like risk assets. In the currency markets, the Japanese yen and Swiss franc are nursing losses, while the Scandis, Australian and Canadian dollars, and sterling are bid. Emerging market currencies are mostly firmer, and the JP Morgan Emerging Market Currency Index is rising for the second consecutive session. With today’s loss, gold is off a little more $20 over the past two sessions after finishing last week near $1590. March WTI initially extended its losses below $50 (finding a bid near $49.65) before rebounding to nearly $51.30 in Europe before apparently running out of steam. |

FX Performance, February 4 |

Asia Pacific

The market performance does not mean that the new coronavirus has peaked or that a vaccination is at hand. Investors seem to responding to financial efforts and the official confidence game. The PBOC injected another CNY400 bln (~$57 bln) into the banking system via reverse repos (whose rate was cut yesterday), and there seemed to be a coordinated effort by policy arms, such as insurance companies, to buy shares today. The PBOC also set the reference rate for the dollar a little lower than expected, a CNY6.9779. This helped push the dollar back below CNY7.0 after it had approached CNY7.02.

As it turns out, by the time that the US and China signed the trade deal in mid-January, the new coronavirus was already spreading. There is an equivalent to a force majeure clause in the agreement that allows for consultations. The agreement called for China to buy almost $77 bln more of US goods than it did in 2017, which is around $106 bln more than last year’s purchases.

As widely anticipated, the Reserve Bank of Australia kept the cash rate target unchanged at 0.75%. The strength of the labor and property market bought the central bank more time to consider the impact of the coronavirus. To be sure, the market has not given up on speculation of an RBA rate. It sees a move as more likely near mid-year.

South Korea reported stronger than expected price pressures in January. The 0.6% rise on the month was twice what economists projected and lifted the year-over-year rate to 1.5% to double the December pace (0.7%). The core rate edged to 0.9%, the highest in six months. The takeaway is that the last year’s deflationary threat has ended. Still, ultimately, the slowing of its biggest trading partner, for an export-led economy (exports ~45% of GDP) poses new challenges in the coming period. That said, both Hyundai and Kia have indicated a shortage of parts from China is limiting their output. Pressure may increase on other central banks, though Thailand and the Philippines are widely expected to remain on the sidelines. India’s underwhelming budget unveiled over the weekend is not enough to get the Reserve Bank of India, which also meets Thursday, to move in the face of the recent surge in inflation to 7.35% in December year-over-year.

After finding a base in recent days near JPY108.30, the dollar has rallied back above JPY109 in late Asia/early European activity. Buying interest appears to be drying up, and there are options for $1.1 bln struck at JPY109 that expire today. If the dollar does pullback as the intraday technicals suggest likely, initial support is seen around JPY108.70-JPY108.80. The Australian dollar initially made a new low for the move just below $0.6680 and rallied back to around $0.6730 before stalling in early Europe. Congestion in the $0.6690-$0.6700 may offer initial support. Sentiment remains fragile.

EuropeIreland goes to the polls this weekend, and the latest polls show a tight race Taoiseach (~Prime Minister) Varadkar’s party Fine Gael slipped into third place behind the Fianna Fail and the Senn Fein. Fine Gael and Fianna Fail have pledged not to form an alliance with Senn Fein, the former political arm of the IRA, though there may be some individual defects. Varadkar has been emphasizing Brexit while voters’ interest has rivetted back to domestic issues of health care and housing. The realization that a disruptive Brexit is still a likely scenario was driven home yesterday by the conflicting stances offered by the UK, and the EU. Sterling gave back the gains scored in the wake of the Bank of England’s decision to keep rates on hold on the same 7-2 vote as the previous two meetings. Sterling rallied from around $1.2980 to $1.3215 yesterday before reversing entirely by the NY close yesterday. Ironically both sides say they want a close relationship, with the UK wanting something akin to the deal struck with Canada. It took almost a decade of talks, but 98% of the tariffs were removed. Tariff-free quotas were raised. The intellectual property had greater protections and government procurement was opened up to foreign business. At the opposite extreme is what the UK now wants to call the Australian option, but is really the old wine (hard Brexit) in new skin. Australia does not have an agreement with the EU and instead relies on the WTO’s standards, though there have been some regulatory cooperation. |

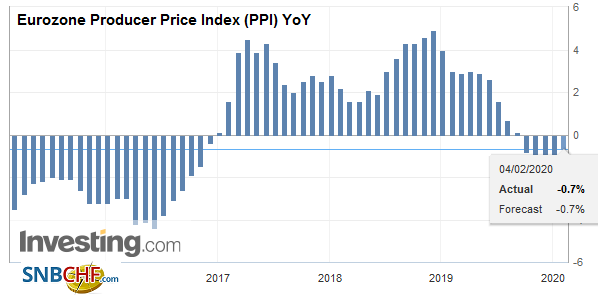

Eurozone Producer Price Index (PPI) YoY, December 2019(see more posts on Eurozone Producer Price Index, ) Source: investing.com - Click to enlarge |

The euro is about a 15-tick range above $1.1050, comfortably inside yesterday’s range, which was itself within the pre-weekend range. The consolidative tone may persist provided the $1.1030 area holds, which is a (61.8%) retracement of the recent advance and holds about a 660 mln euro option that is set to expire today. The daily technical studies still look broadly supportive. Sterling was sold to new lows for the year near $1.2945 before finding support after recording a big outside down day yesterday. Perhaps helped by a better than expected (though still below the 50 boom/bust level) construction PMI, sterling has turned better bid and resurfaced above $1.30 in the European morning where a nearly GBP250 mln option is struck that expires later today. The $1.3050 area may provide sufficient resistance to cap a stronger recovery. Separately, note that there is an option for 1.1 bln euros at GBP0.8500 that will be cut today as well and is right where the cross is as this is being posted.

America

The weaponization of the foreign exchange market may be escalating. The US Commerce Department is pushing, over the objections of some Treasury officials, to give the US authority to regard “under-valued exchange rates” as an illegal subsidy for which the US could impose countervailing tariffs. While companies can file complaints, the US government could also initiate charges, seemingly short-cutting a semblance of due process. It would allow the US to strike at countries that do not meet the threshold of currency manipulation, which after the charge against China for the first time since 1994, and then relatively quick reversal, may have weakened stigma.

The US reports December factory goods orders today, but a recovery from the 0.7% decline in November has already been signaled by the durable goods orders report (2.4%). However, the details were not as good as the headline as aircraft and defense orders drove the recovery. Boeing’s decision on cutting production of the 737 Max was not made until the middle of January. The jobs data at the end of the week remains the more important economic report. Mexico’s central bank meets next week (Feb 13) and weakness in today’s reports (Markit PMI and IMEF surveys) may boost expectations for a cut.

The US dollar traded above CAD1.33 yesterday for the first time in two months. As the greenback approaches the upper end of the six-month range, the risk-reward shifts against the establishment of new longs. The intraday technicals, though, warn that a high may not be in place. Support for the US dollar is seen near CAD1.3250-CAD1.3260. As we envisioned, the Mexican peso is among the biggest beneficiaries of the modest relaxation of investor anxiety. The high rates offered it a cushion during the risk-off pressure. The dollar has retreated to around MXN18.66 after reaching a high near MXN18.94 ahead of last weekend. Still, the risk that the impact of the coronavirus is still growing warns that the peso may be vulnerable to another setback when anxiety returns.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,China Brexit,Currency Movement,Featured,Ireland,newsletter