Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October in our central scenario (55% probability). As such, we remain underweight core euro sovereign bonds.Our central scenario is for the 10-year Bund yield to move back into positive territory toward the end of 2019 for a number of reasons. First, in contrast with market expectations for further monetary policy easing, we foresee neither rate cuts nor

Topics:

Laureline Chatelain and Nadia Gharbi considers the following as important: Bund forecast, ECB policy forecast, German Bund yields, German yields, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside.

Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative territory until at least October in our central scenario (55% probability). As such, we remain underweight core euro sovereign bonds.

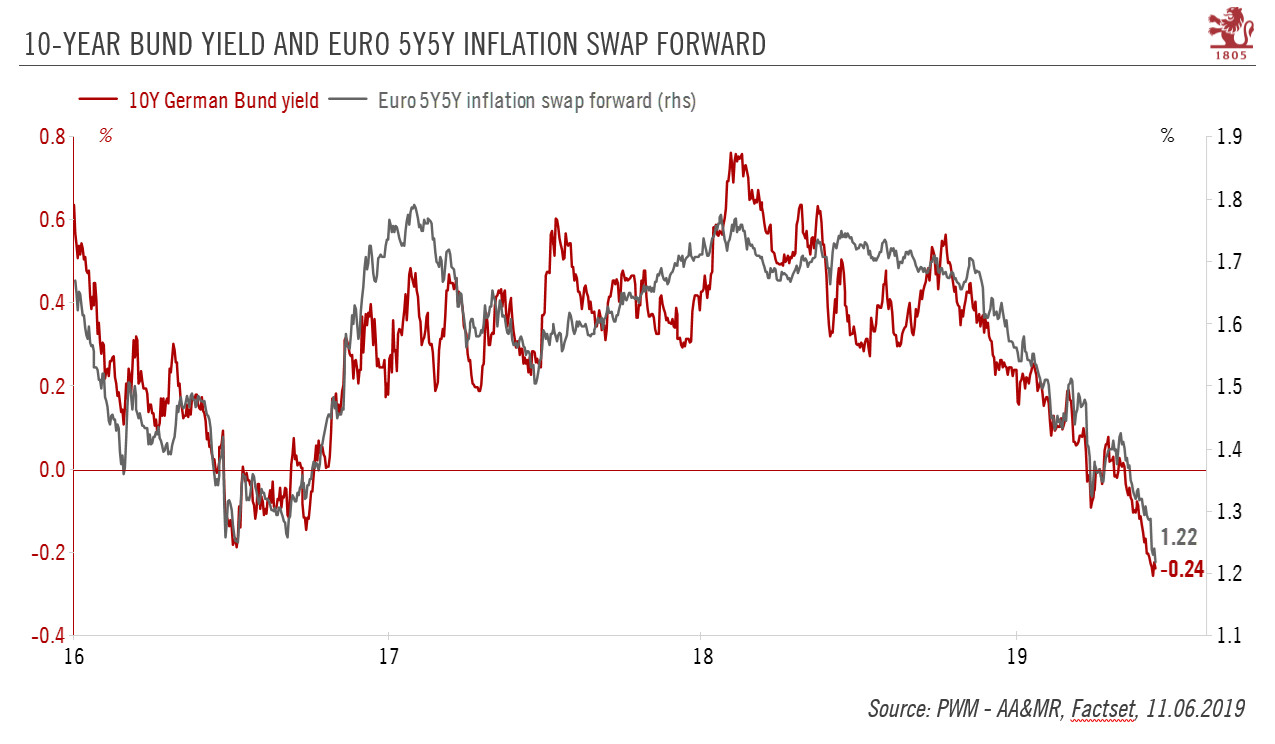

Our central scenario is for the 10-year Bund yield to move back into positive territory toward the end of 2019 for a number of reasons. First, in contrast with market expectations for further monetary policy easing, we foresee neither rate cuts nor renewed quantitative easing (QE) from the European Central Bank (ECB) this year or next. Second, the global slowdown in manufacturing has fuelled market expectations of a broader economic slowdown contributing to the fall in the 10-year yield. But as we expect recession fears to dissipate as the year progresses, bond yields should rise again. Third, rising and persistent political uncertainties have been pushing investors into safe-haven assets like the Bund. These uncertainties remain significant, making it difficult for the Bund yield to move above zero in the short-term, but could well dissipate as the year progresses. Finally, falling market-based inflation expectations have also contributed to push down the 10-year Bund yield, with the inflation breakeven yield following suit (see chart). Should core inflation rebound as we expect in H2, we could see a rise in inflation expectations that pushes the 10-year Bund yield higher.

However, we acknowledge that risks are becoming tilted to the downside, and in an alternative scenario (40% probability) we could see the Bund yield falling deeper into negative territory.