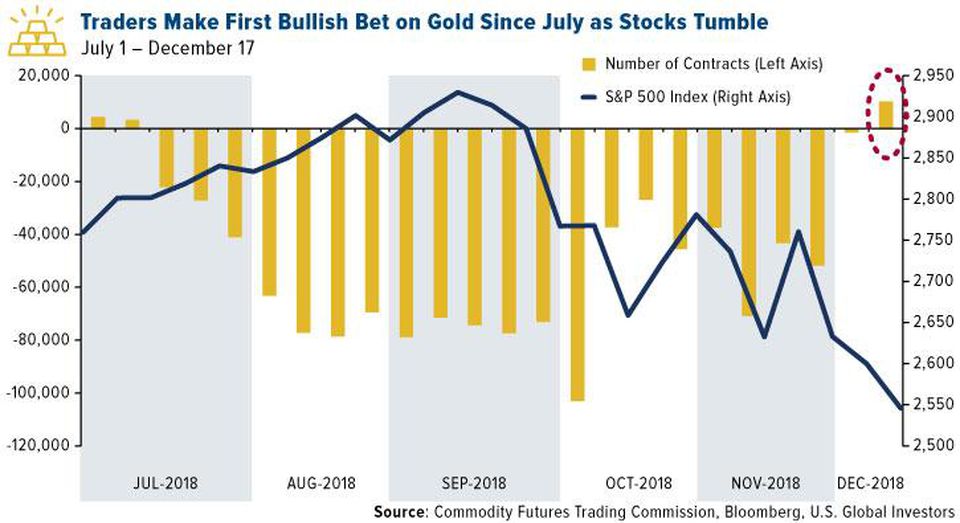

Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931. Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data. As many of you know, December has historically been a strong month for stocks. But fears of a slowdown in global growth, rising interest rates and the U.S.-China trade war have prompted many investors to pare down their stocks in favor of gold, often perceived as a safe haven in times of economic and financial instability. Now, as we head into 2019, gold “is

Topics:

Frank Holmes considers the following as important: 6) Gold and Austrian Economics, 6a) Gold & Bitcoin, Daily Market Update, Featured, GoldCore, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Gold traders appear excited about gold again as stocks are on pace for their worst year since 2008, and their worst December since 1931.

Bullish bets on the yellow metal outnumbered bearish ones for the week ended December 11, resulting in the first instance of net positive contracts since July, according to Commodity Futures Trading Commission (CFTC) data. As many of you know, December has historically been a strong month for stocks. But fears of a slowdown in global growth, rising interest rates and the U.S.-China trade war have prompted many investors to pare down their stocks in favor of gold, often perceived as a safe haven in times of economic and financial instability. Now, as we head into 2019, gold “is poised to take the bull-market baton from the dollar and stocks,” writes Bloomberg Commodity Strategist Mike McGlone. Although the U.S. dollar has been strengthening since September, which would ordinarily dent the price of gold, the yellow metal has shown “divergent strength on the back of increasing equity-market volatility,” McGlone adds. |

Traders Make First Bullish Bet on Gold Since July as Stocks Tumble |

Gold and Metal Miners Have Crushed the Market

So far this quarter, gold has crushed the market, returning more than 5 percent as of December 18, compared to negative 11.9 percent for the S&P 500 Index. Gold miners, though, as measured by the NYSE Arca Gold Miners Index, have been the top performer, climbing nearly 12 percent.

We could see even higher gold and gold equity prices next year and beyond, but the dollar will likely need to come down. For that to happen, the Federal Reserve will need to call time out on its quarterly rate hikes. Many industry leaders now support this idea, including Jeffrey Gundlach and Stanley Druckenmiller, not to mention President Donald Trump.

“I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make another mistake,” Trump warned in a tweet Tuesday morning. “Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!”

The WSJ editorial Trump refers to makes the case that “economic and financial signals suggest [Fed Chairman Jerome Powell] should pause,” a line the president has been repeating for months now.

Investment Case For Gold In Next 5 Years Is AttractiveLooking ahead five years, the investment case for gold and gold miners gets even more attractive. London-based precious metals consultancy firm Metals Focus projects a gradual increase in gold consumption between now and 2023, supported by strong jewelry demand and physical investment. “From late 2019 onwards,” Metals Focus analysts write, “we expect a bull market in gold to emerge, which in our view will remain in place for the next two to three years.” |

Gold Consumption Forecast Through 2023 |

Greenspan Urges Investors to “Run for Cover”

In an interview this week with CNN, former Federal Reserve Chairman (and gold fan) Alan Greenspan urged investors to “run for cover,” as he doesn’t see the market moving much higher than they are now.

“It would be very surprising to see it sort of stabilize here, and then take off,” Greenspan said.

I believe the best way to “run for cover” is with gold and short-term, tax-free municipal bonds. As for gold, I always recommend a 10 percent weighting, with 5 percent in bullion, coins and jewelry, the other 5 percent in high-quality gold stocks, mutual funds and ETFs.

Tags: Daily Market Update,Featured,newsletter