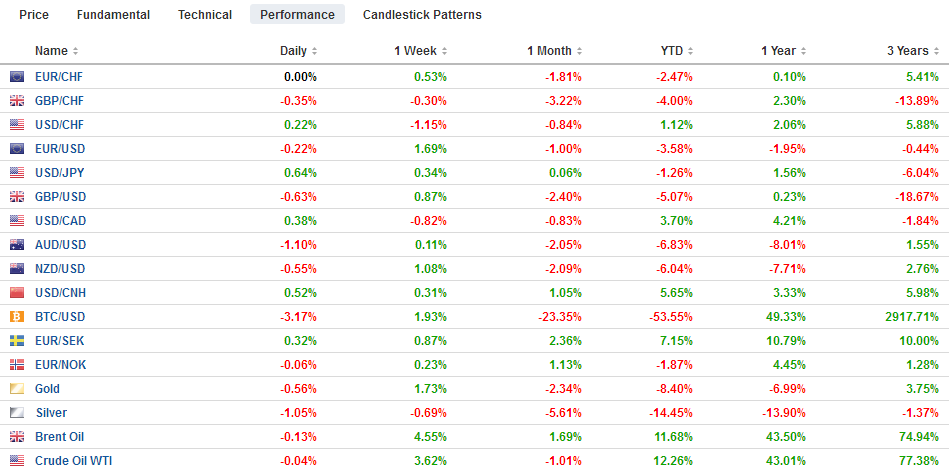

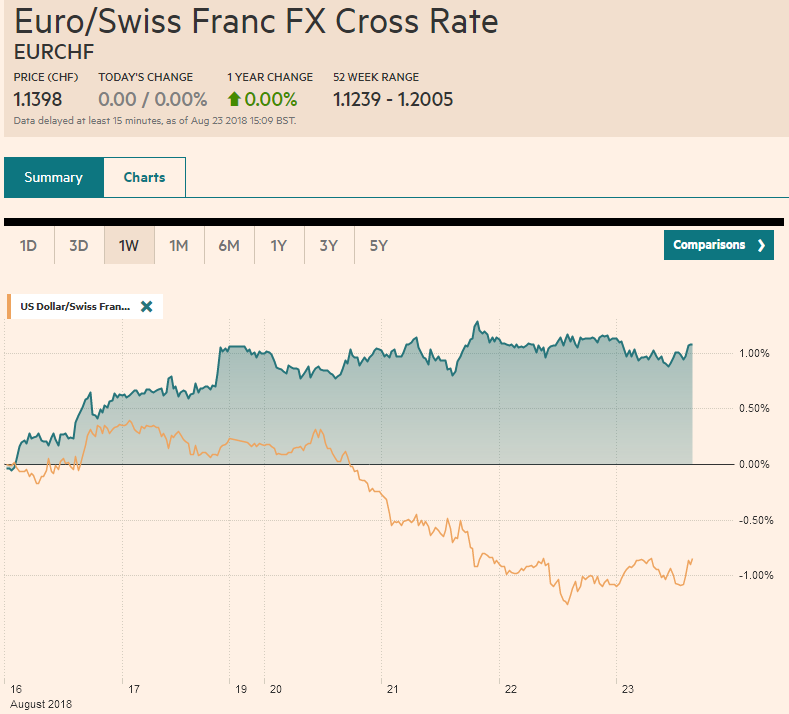

Swiss Franc The Euro has stayed at 1.1398. EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After correcting lower since the middle of last week, and pushed faster if not further by President Trump’s comments, the US dollar is rebounding against most of the major and emerging market currencies today. After an initial wobble on the back of the FOMC minutes, the greenback’s recovery began in earnest. The minutes confirmed the high probability of a hike next month, and there was little to cast doubt on the likelihood of a December hike as well. The minutes revealed a more confident Fed due to the strong labor market, robust growth, and an

Topics:

Marc Chandler considers the following as important: 4) FX Trends, AUD, EUR, Featured, GBP, JPY, newsletter, USD, ZAR

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has stayed at 1.1398. |

EUR/CHF and USD/CHF, August 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesAfter correcting lower since the middle of last week, and pushed faster if not further by President Trump’s comments, the US dollar is rebounding against most of the major and emerging market currencies today. After an initial wobble on the back of the FOMC minutes, the greenback’s recovery began in earnest. The minutes confirmed the high probability of a hike next month, and there was little to cast doubt on the likelihood of a December hike as well. The minutes revealed a more confident Fed due to the strong labor market, robust growth, and an inflation rate at the target. Fed officials are concerned that tariffs and trade tensions risk slowing the economy and boosting prices. However, there appears to be little tangible impact yet, but the Fed is mindful. While others, such as ourselves, have expressed concern, it may be the first time that at least some Fed officials acknowledged that faster-than-expected fading of fiscal stimulus or a greater than anticipated fiscal tightening also posed a downside economic risk. The US and China have gone forward with the levying of 25% tariffs on $16 bln of each other’s goods even though trade talks are set to continue today. Part of the low probability of anything meaningful coming out of the negotiations is that Trump rejected the deal worked out by the Treasury Department earlier in the year when China was prepared to step up its purchases of US goods. No one else’s commitments seem to matter but the President’s which is why a resolution is only possible by a Trump-Xi meeting that could tentatively take place in November. However, by that time, the next round of tariffs (possibly 25% tariff on Chinese goods) could be implemented. |

FX Performance, August 23 |

Meanwhile, reports suggest that Trump’s intent to levy a 25% tariff on imported cars that do not meet the new domestic content rules that are being negotiated under NAFTA may be forestalling even the “handshake agreement” with Mexico (whose meaning is not exactly clear). Several issues remain outstanding, even if Canada can agree with the bilateral progress between the US and Mexico. These include red-line items like the sunset clause, conflict resolution mechanism, and rules on government procurement.

Moreover, given the US procedural requirements, formal notification to Congress that the President intends to sign a new agreement needs to be made in the next several weeks, if the current sitting Congress will be able to vote on the measure. Otherwise, the Congress elected in November. On the other hand, Mexico’s new congressional session begins September 1 even though AMLO does not take office until December 1. The Mexican peso is a bit softer after yesterday’s push lifted it to its best level in nearly two weeks.

However, among emerging market currencies, the South African rand is under the most pressure. The rand had appreciated by nearly 4% over the past four sessions as the dollar pulled back broadly. The macroeconomic fundamentals are poor, and the rand was vulnerable to a dollar recovery. Yet today’s driver is also news that Trump has asked the US Secretary of State to look into South Africa’s land and farm seizures. The rand is off about 1.5% with the dollar near ZAR14.36. It finished last week near ZAR14.64.

It is not just currencies with poor news that are weakening in the face of the rebounding dollar. Consider the plight of the euro. After poking through $1.16 yesterday, the single currency rally has faltered. It fell to nearly $1.1540 in Asia. Even the firm flash PMIs for France and Germany failed to rekindle the lost momentum.

The French flash manufacturing PMI recovered to 53.7 from 53.3 and the flash service PMI rose to 55.7 from 54.9. Both were stronger than expected and led to a 55.1 composite, the strongest since April. German manufacturing slipped to 56.1 from 56.9 as trade tensions may have hit a bit more than for France. However, German services rebounded to 55.2 from 54.1, which largely offset the disappointing manufacturing report. The composite rose for the third consecutive month, and the 55.7 reading is the highest since February.

While the ECB may take comfort in the results for the two largest members, their contribution seemed blunted at the aggregate level by apparently more pessimistic assessment from other countries, especially the periphery. The composite, for example, eked out the smallest of gains, rising to 54.4 from 54.3, and missing the median (Bloomberg survey) forecast of 54.5. Consider that it averaged 54.7 in Q2 and 57.0 in Q1.

Expiring options may also help cap the euro. There are 1.1 bln euros struck at $1.16, and 2.9 bln euros struck at $1.1625 that will roll-off today. The $1.1580 area may offer initial resistance. Support is seen in $1.1500-$1.1520 area, note that there is a 637 mln euro option expiring at the lower end of that range today as well.

There is a report in the German press that we had anticipated. The issue is the next ECB President after Draghi’s term ends in about 14 months. Many see it as Germany’s turn and BBK President Weidmann is the obvious choice. We have demurred. Not only do we suspect that Weidmann has not done enough to show himself as a consensus builder, but also we have argued the Merkel’s interest may be elsewhere. Specifically, with the ECB’s unorthodox policies coming to an end, there is no compelling reason for a German to lead what will be a thankless task of removing the proverbial punchbowl. Instead, we suggested that Merkel would likely use her chits to help shape the future of Europe post-Brexit and post-crisis, and this would be the European Commission, which will also turnover next year. The press report today plays up this scenario for what appears to be the first time.

Although US President Trump’s political problems are not taking a toll on the dollar, politics in Australia are keeping the Aussie on the defensive. News that another Turnbull faces another leadership challenge tomorrow (after surviving yesterday’s challenge) is proving too much for the Aussie, which is off about 0.7%, a little below $0.7300. The $0.7270 area corresponds to a 61.8% retracement of the rally since August 15.

The dollar dipped below JPY110 on Tuesday and now is absorbing offers near JPY111, where the 20-day moving average is found. There is a little more than $1 bln in options struck at JPY111.00-JPY111.20 that expire today. Separately, Japans’s flash manufacturing PMI firmed to 52.5 from 52.3. The average for July and August is 52.4, which is the lowest two-month average in a year and compares with a 53.2 average in Q2 and 54.0 average in Q1. Also, we note that Japanese investors sold JPY1.93 trillion of foreign bonds last week. It was the most this year and the second largest liquidation in the past three years. Some are linking it to the change in the BOJ policy to allow more volatility in the 10-year JGB yield and the resulting steeper curve.

The MSCI Asia Pacific Index ended a four-day run higher with a 0.3% loss today. Japan stocks were narrowly mixed and the Shanghai Composite traded on both sides of Wednesday’s range and finished about 0.3% higher. European equities are faring better than Asia, and the Dow Jones Stoxx 600 is up about 0.3% in late morning turnover. The information and energy sectors are leading the advance. Benchmark bond yields are little changed, though European peripheral bonds are firm. The US 10-year yield remains pinned near its recent lows above 2.80%. Recall that the yield tested the 3-handle at the start of the month. The September note futures is near a three-month high.

The Jackson Hole Fed conference kicks off today, and Powell speaks tomorrow. There will be headline risk over the next two days from the meeting. The US reports weekly initial jobless claims, and Markit issues its flash PMIs. New home sales may also draw attention after the weaker than expected existing home sales report (fourth consecutive monthly decline). New home sales fell by an average of 2% in Q2 after rising nearly as much (1.9%) on average in Q1. New homes sales appear to have peaked last November near 712k annual pace. In June it had fallen to 631k, the least since last October.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$EUR,$JPY,Featured,newsletter,ZAR