We see US dollar’s strength against the euro as likely to peak around the middle of the year.Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.2150-1.2550 trading range, which had been in place since 18 January.Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted underlying inflationary pressures) have weighed on the single currency recently. In the meantime, soft data remains buoyant in the US and the Fed has become increasingly hawkish. Significant long euro positioning among short-term investors has not helped either.Regarding the growth

Topics:

Luc Luyet considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

We see US dollar’s strength against the euro as likely to peak around the middle of the year.

Over the past 10 days, the euro has declined significantly against the US dollar. On 26 April, the EUR/USD rate moved below the low of its 1.2150-1.2550 trading range, which had been in place since 18 January.

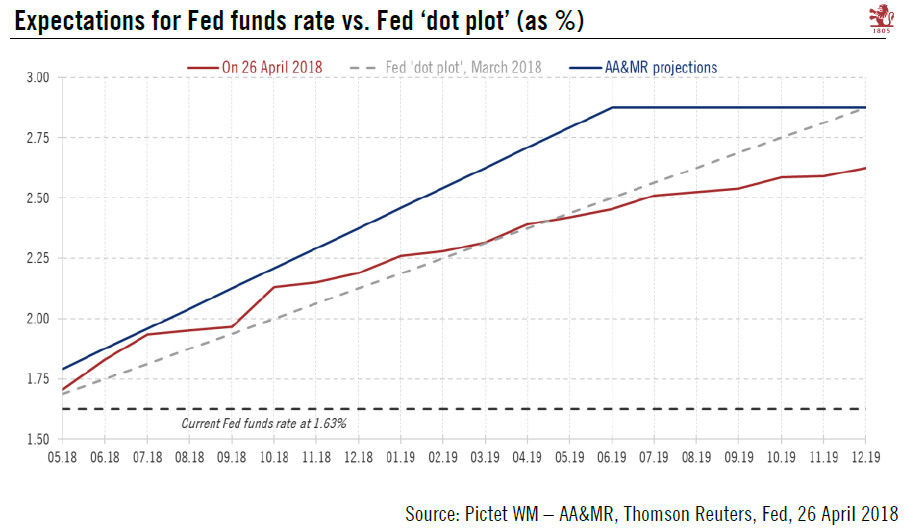

Reasons for this decline can be found in the growth differential and monetary policy divergence. Indeed, moderation in leading indicators (from elevated levels) in the euro area and a cautious ECB (given muted underlying inflationary pressures) have weighed on the single currency recently. In the meantime, soft data remains buoyant in the US and the Fed has become increasingly hawkish. Significant long euro positioning among short-term investors has not helped either.

Regarding the growth differential, we remain confident about the cyclical recovery in the euro area. Indicators are still consistent with robust, broad-based economic expansion this year, if at a slightly slower pace than in 2017. We expect euro area GDP growth of 2.3% in 2018 compared with 2.5% in 2017. In the US, Q2 GDP growth is likely to be strong after a softish Q1 reading, and there is no sign of an imminent slowdown in the growth outlook.

Overall, while the growth differential should prove positive for the US in the short term, the low probability of a sharp slowdown in the euro area (contrary to what is implied by recent hard data) and some moderation in the US after a likely sharp rebound in Q2 GDP should mean this factor is neutral for the EUR/USD rate in the next 12 months.