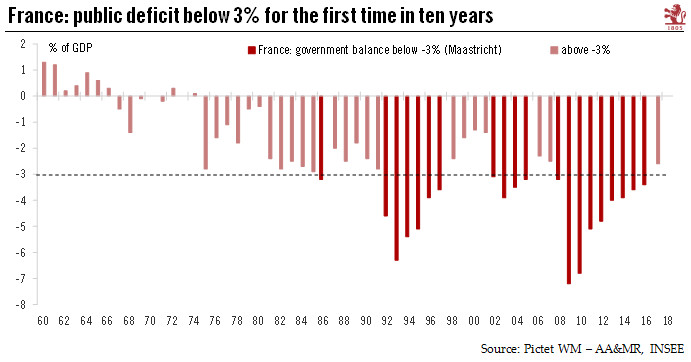

The deficit declined below 3% for the first time in a decade, which should boost France’s credibility with its neighbours.France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.France’s budget balance ended up about EUR10bn above the level initially projected by the government, which helped offset a slippage in expenditures as well as a EUR10bn increase in one-off transfers due to the partial refund of the 3% tax on dividends that was ruled unconstitutional, and a EUR2.3bn capital injection

Topics:

Frederik Ducrozet considers the following as important: France public deficit, French deficit, French public debt, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

The deficit declined below 3% for the first time in a decade, which should boost France’s credibility with its neighbours.

France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.

France’s budget balance ended up about EUR10bn above the level initially projected by the government, which helped offset a slippage in expenditures as well as a EUR10bn increase in one-off transfers due to the partial refund of the 3% tax on dividends that was ruled unconstitutional, and a EUR2.3bn capital injection into Areva. On the revenue side, stronger economic growth (+2.0% in 2017 versus 1.7% expected) translated into a 4% increase in fiscal receipts, including a one-off contribution from corporate income tax. Of note, social security funds recorded a net lending for the first time since 2008.

Despite this strong performance, France will likely remain under European Commission pressure to do more. In structural terms, the planned reduction in the 2018 deficit has been deemed insufficient by Brussels, and additional corrective measures could be required eventually. Meanwhile France’s compulsory fiscal levies ratio rose to a record high of 45.4% of GDP. The public debt ratio increased to 97% of GDP in 2017, another all-time high.

Fiscal consolidation is a marathon, not a sprint, and should be seen in the light of broader structural reforms aimed at boosting growth potential. For France, it is a matter of rebuilding credibility with its European partners at this particular juncture. The structural reforms implemented in the past year have been welcomed by Brussels and Berlin. Pourvu que ça dure.