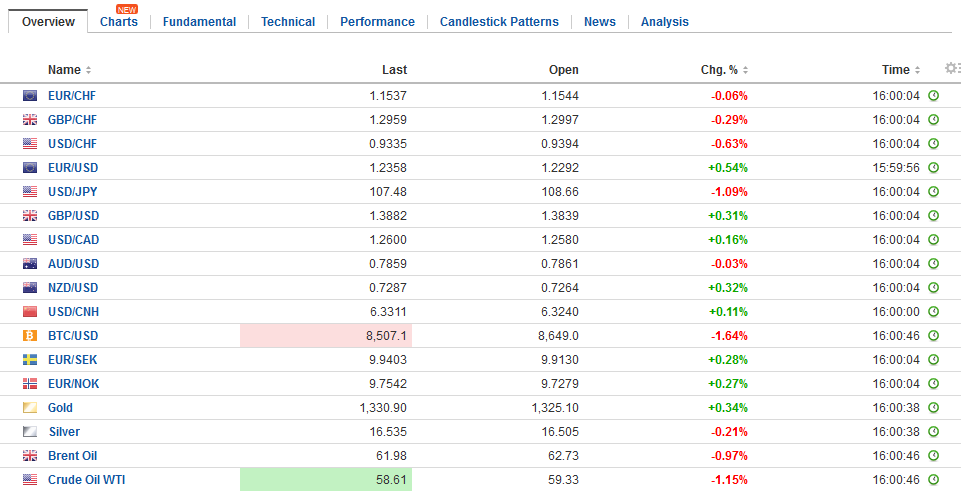

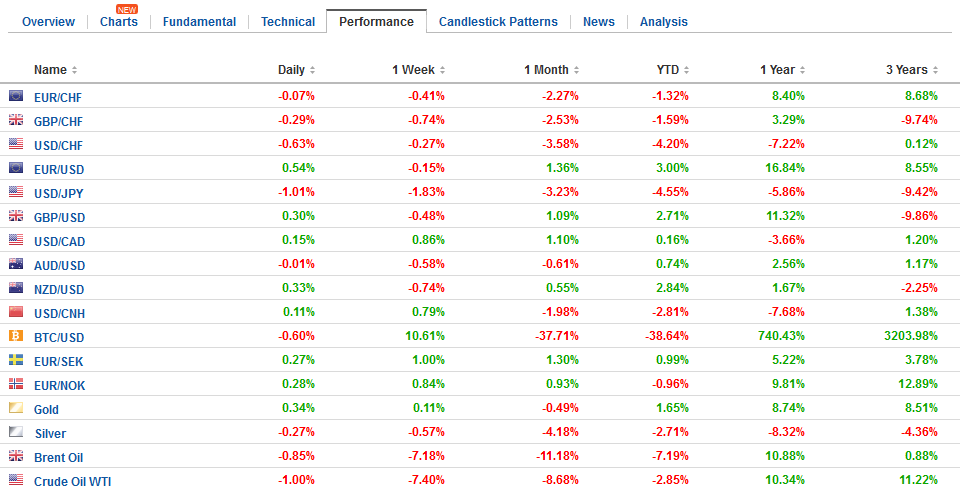

Swiss Franc The Euro has fallen by 0.09% to 1.1531 CHF. EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates There are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September’s low. The MSCI Asia Pacific Index extended Monday’s recovery with another 0.5% gain. However, looking closer, the momentum faltered. The benchmark finished in the middle of the range, Japan’s Topix, which had been up a little more than 1% finished down nearly as much. FX Daily Rates, February 13 -

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Featured, FX Trends, GBP, Japan Producer Price Index, JPY, newslettersent, SPY, U.K. Consumer Price Index, U.K. Core Consumer Price Index, U.K. House Price Index, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

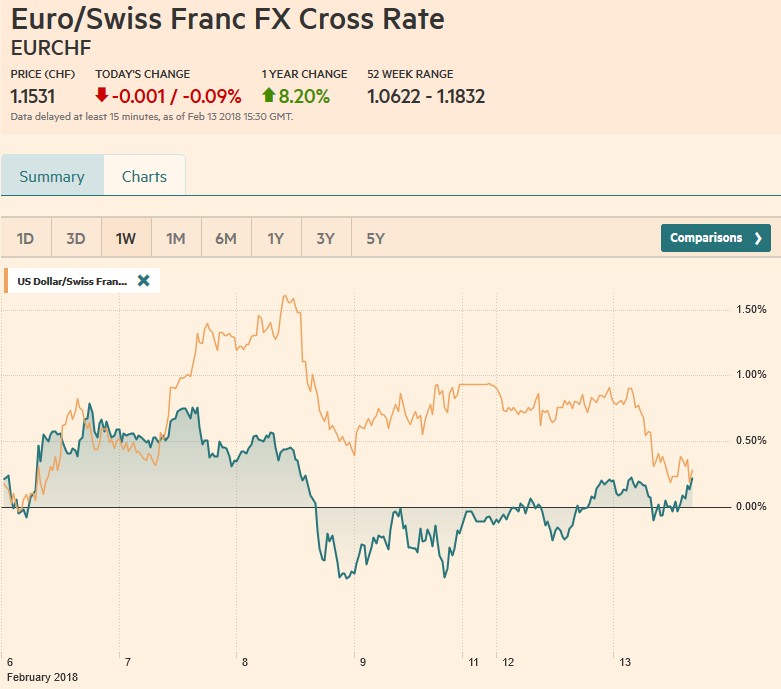

Swiss FrancThe Euro has fallen by 0.09% to 1.1531 CHF. |

EUR/CHF and USD/CHF, February 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThere are two important developments today. First, the recovery in the global equity markets is being challenged. Second, the yen has strengthened across the board, and is now at its best levels against the dollar since last September’s low. The MSCI Asia Pacific Index extended Monday’s recovery with another 0.5% gain. However, looking closer, the momentum faltered. The benchmark finished in the middle of the range, Japan’s Topix, which had been up a little more than 1% finished down nearly as much. |

FX Daily Rates, February 13 |

| European markets are nursing modest losses. Italian and Spanish bourses are underperforming, but the Dow Jones Stoxx 600 is off about 0.2% in late morning turnover. The S&P 500 is trading lower. It has rallied 5.6% off the pre-weekend low. The Dow Jones Industrials have rallied 1400 points during the same time. Opinion seems divided about the near-term outlook. The initial recovery has stalled, and the shape and extent of the pullback today may go a long way toward shaping the debate.

Japan’s markets were closed on Monday, and although it initially played catch-up with the world, as the gains were reversed the yen strengthened. Stops appeared to have been triggered on a break of JPY108.40 and then JPY108.00. The dollar fell to nearly JPY107.50 in early Europe before tentative stabilizing. The dollar reached a low near JPY107.30 last September, and carved out a low in the second half of 2016 around JPY100. Intermittent support is seen near JPY105. |

FX Performance, February 13 |

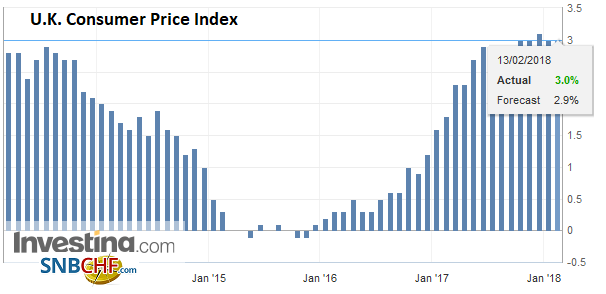

United KingdomThe main economic news today is limited to the UK inflation readings. Headline CPI eased by 0.5%, the same as January 2017. This kept the year-over-year rate steady at 3.0%. Economists had seen a chance for a 2.9% pace. |

U.K. Consumer Price Index (CPI) YoY, Jan 2018(see more posts on U.K. Consumer Price Index, ) Source: Investing.com - Click to enlarge |

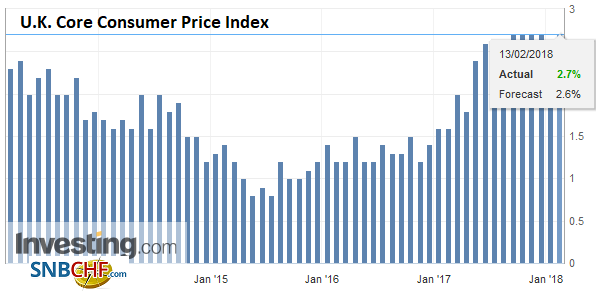

| CPIH was also unchanged at 2.7%. The core rate provides fodder to those who now think that inflation will decline more gradually than previously thought and that the BOE is likely to raise rates at the May meeting (March 22 meeting to lay more groundwork). |

U.K. Core Consumer Price Index (CPI) YoY, Jan 2018(see more posts on U.K. Core CPI, ) Source: Investing.com - Click to enlarge |

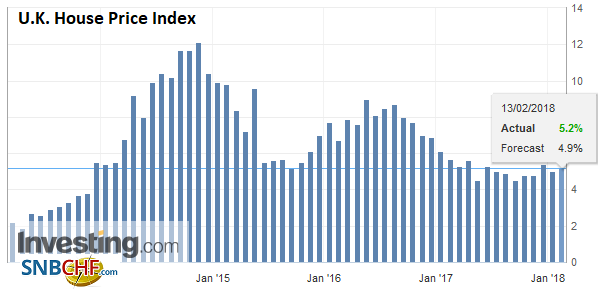

| There is a little more than half the hike already discounted. Producers prices moderated, though the government’s house price index finished the year on a firm note, rising 5.2% year-over-year, the same as 2016. |

U.K. House Price Index YoY, Jan 2018(see more posts on U.K. House Price Index, ) Source: Investing.com - Click to enlarge |

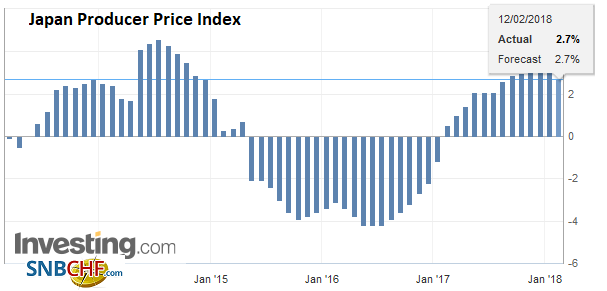

Japan |

Japan Producer Price Index (PPI) YoY, Jan 2018(see more posts on Japan Producer Price Index, ) Source: Investing.com - Click to enlarge |

The euro spiked down to JPY132 at the end of last week. It traded inside the pre-weekend range yesterday and has an outside day in the works today. A break targets the JPY131 area, but suggests potential toward JPY128-JPY130. Sterling held last week’s low a little below JPY149.00. A convincing break may target JPY147. 00. The Australian dollar is reversing lower against the yen after making a three-day high earlier. It peaked near JPY85.60 and is now near JPY84.60. Last week’s low (~JPY84.00) had not been seen since last June. The Canadian dollar did not find such support at it is now at eight-month lows.

Sterling was firm before the data and extended its gains afterward. Recall that sterling hit a high near $1.4065 after the BOE’s somewhat hawkish assessment last week. It fell to $1.3765 ahead of the weekend. Today’s high completes a 50% retracement of the decline. The next retracement objective is seen near $1.3950, but the $1.40 area may be more formidable.

For its part, the euro is posting gains for a third consecutive session. It is above $1.23 for the first time in four sessions. It has retraced 38.2% of the losses seen since the high a little above $1.2520 was seen at the start of the month. That retracement was near $1.2325. The next area of resistance is likely to be encountered near $1.2365.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Featured,Japan Producer Price Index,newslettersent,SPY,U.K. Consumer Price Index,U.K. Core Consumer Price Index,U.K. House Price Index,USD/CHF