Stock Markets EM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM. Stock Markets Emerging Markets, February 07 Source: economist.com - Click to enlarge China China is expected to report January money and loan data this week, but no date has been set. Consensus sees an increase in aggregate financing of CNY3.15 trln with new loans making up CNY2.05 trln. For now, we see CNY trading with the rest of EM. We do not see a deliberate

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Stock MarketsEM FX ended Friday on a mixed note, as risk assets recovered a bit from broad-based selling pressures. Best EM performers on the week were ZAR, PHP, and CNY while the worst were COP, RUB, and ARS. Besides the risk-off impulses still reverberating through global markets, we think lower commodity prices are another headwind on EM. |

Stock Markets Emerging Markets, February 07 Source: economist.com - Click to enlarge |

ChinaChina is expected to report January money and loan data this week, but no date has been set. Consensus sees an increase in aggregate financing of CNY3.15 trln with new loans making up CNY2.05 trln. For now, we see CNY trading with the rest of EM. We do not see a deliberate campaign to weaken the yuan. SingaporeSingapore reports December retail sales Monday, which are expected to rise 4.5% y/y vs. 5.3% in November. January trade data will be reported Thursday, with NODX expected to rise 7.1% y/y vs. 3.1% in December. Inflation remains low while the real sector data has been spotty. A lot can happen between now and the April MAS meeting but we lean towards steady policy then. IndiaIndia reports January CPI and December IP Monday. The former is expected to rise 5.1% y/y and the latter by 6.1% y/y. January WPI will be reported Wednesday, which is expected to rise 3.2% y/y vs. 3.6% in December. The RBI delivered a hawkish hold last week and we think there are rising odds of a hike at the next policy meeting April 5. January trade data will be reported Thursday. ColombiaColombia central bank releases its quarterly inflation report Monday. It cut rates 25 bp to 4.5% at the January meeting, as expected. Next policy meeting is March 20, and another 25 bp cut then seems likely. December trade, retail sales, and IP will be reported Wednesday. Q4 GDP will be reported Thursday, and growth is expected to remain steady at 2.0% y/y. PeruPeru reports December trade Monday. It then reports Q4 GDP Thursday. The economy remains weak, and the latest leg down in copper prices is a concern. CPI rose 1.3% y/y in January, which is in the bottom half of the 1-3% target range. The next central bank policy meeting isMarch 8 and another 25 bp cut to 2.75% is likely. HungaryHungary reports January CPI Tuesday, which is expected to rise 2.0% y/y vs. 2.1% in December. If so, it would be right at the bottom of the 2-4% target range. Q4 GDP will be reported Wednesday, which is expected to grow 4.3% y/y vs. 3.9% in Q3. Despite the robust economy, we cannot rule out further easing via unconventional measures. Next policy meeting is February 27. PolandPoland reports December trade and current account data Tuesday. Q4 GDP will be reported Wednesday, which is expected to grow 5.2% y/y vs. 4.9% in Q3. January CPI will be reported Thursday, which is expected to rise 1.8% y/y vs. 2.1% in December. If so, it would remain in the bottom half of the 1.5-3.5% target range. MalaysiaMalaysia reports Q4 GDP Wednesday, which is expected to grow 5.7% y/y vs. 6.2% in Q3. Q4 current account data will be reported that same day. Bank Negara started the tightening cycle last month, but we think the pace will be very cautious. Next policy meeting is March 7and rates are likely to be kept at 3.25% then. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. Inflation was 0.7% y/y in January, below the 1-4% target range. The economy is fairly robust but we do not think the central bank is in any hurry to hike rates. Czech RepublicCzech Republic reports January CPI Wednesday, which is expected to rise 2.2% y/y vs. 2.4% in December. If so, it would remain in the top half of the 1-3% target range. The central bank has been hiking rates once every quarter. After hiking February 1, no change is expected at the next policy meeting March 29. Q4 GDP will be reported Friday, which is expected to grow 5.2% y/y vs. 5.0% in Q3. South AfricaSouth Africa reports December retail sales Wednesday, which are expected to rise 4.3% y/y vs. 8.2% in November. The economy is sluggish, but all eyes are on politics now. Press reports suggest President Zuma will announce his resignation this week. If the rand remains firm, we think SARB will cut rates at the next policy meeting March 28. BrazilBrazil COPOM minutes will be released Thursday. At last week’s meeting, COPOM cut rates 25 bp to 6.75% but signaled an end to the easing cycle. Next policy meeting is March 21, no change expected then. Markets are pricing in the first rate hike in Q4. December GDP proxy will be reported Saturday. IsraelIsrael reports January CPI Thursday, which is expected to rise 0.2% y/y vs. 0.4% in December. If so, it would remain below the 1-3% target range. While inflation remains low, we think the bar to further stimulus is very high. The next central bank policy meeting is February 26, no change is expected then. IndonesiaBank Indonesia meets Thursday and is expected to keep rates steady at 4.25%. CPI rose 3.3% y/y in January, which is near the bottom of the 3-5% target range. We see little reason for the central bank to hike anytime soon. Indonesia also reports January trade data that same day. Exports are expected to rise 6.0% y/y and imports by 16.2% y/y. |

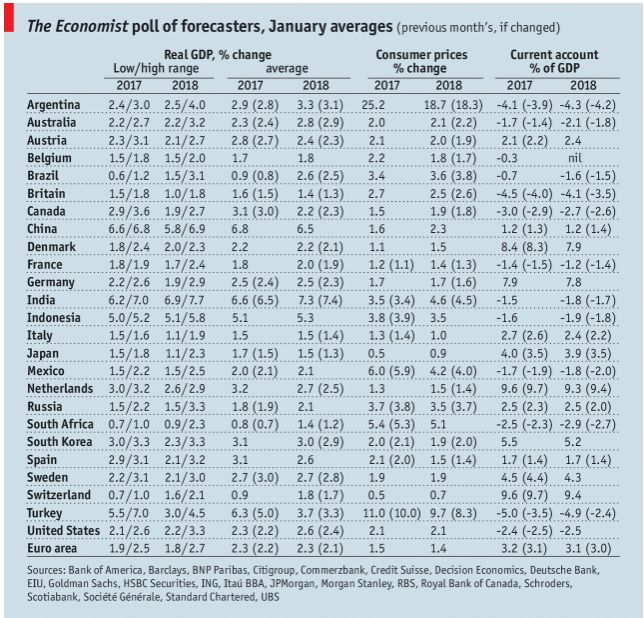

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin