Summary India plans to increase spending and widen its budget deficit targets ahead of key elections. India appears to be cracking down on cryptocurrencies. South Africa’s parliament has scheduled a no- confidence vote for Zuma on February 22. Turkish central bank raised its end-2018 inflation forecast in its quarterly inflation report. Peru’s Popular Force party expelled Kenji Fujimori and several of his allies. Stock Markets In the EM equity space as measured by MSCI, Czech Republic (+1.0%), Malaysia (+0.4%), and Egypt (+0.4%) have outperformed this week, while South Africa (-6.8%), Peru (-5.0%), and Brazil (-3.7%) have underperformed. To put this in better context, MSCI EM fell -3.4% this week while MSCI DM fell

Topics:

Win Thin considers the following as important: emerging markets, Featured, newsletter, win-thin

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary

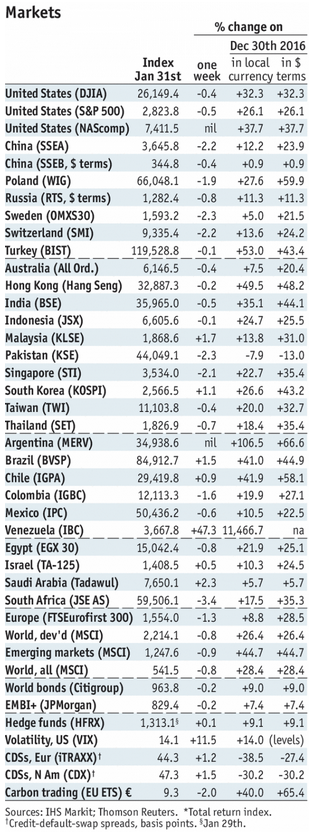

Stock MarketsIn the EM equity space as measured by MSCI, Czech Republic (+1.0%), Malaysia (+0.4%), and Egypt (+0.4%) have outperformed this week, while South Africa (-6.8%), Peru (-5.0%), and Brazil (-3.7%) have underperformed. To put this in better context, MSCI EM fell -3.4% this week while MSCI DM fell -2.7%. In the EM local currency bond space, Turkey (10-year yield -25 bp), Russia (-21 bp), and Czech Republic (-8 bp) have outperformed this week, while Hungary (10-year yield +30 bp), India (+16 bp), and Romania (+6 bp) have underperformed. To put this in better context, the 10-year UST yield rose 18 bp to 2.84%. In the EM FX space, CZK (+0.4% vs. EUR), CNY (+0.4% vs. USD), and ARS (+0.4% vs. USD) have outperformed this week, while BRL (-2.1% vs. USD), ILS (-1.6% vs. USD), and KRW (-1.5% vs. USD) have underperformed. |

Stock Markets Emerging Markets, January 31 Source: economist.com - Click to enlarge |

IndiaIndia plans to increase spending and widen its budget deficit targets ahead of key elections. The government will target a budget deficit equal to -3.3% of GDP for the fiscal year starting April 1. This is up from its previous goal of -3%. The deficit was estimated at -3.5% of GDP for the fiscal year ending March 31, up from -3.2% previously forecast. The revisions come as Prime Minister Modi’s ruling BJP tries to woo voters and create jobs before potentially eight state elections this year and national elections next year. India appears to be cracking down on cryptocurrencies. Finance Minister Jaitley told lawmakers that policymakers don’t consider cryptocurrencies to be legal tender “and will take all measures to eliminate the use of these crypto-assets in financing illegitimate activities or as part of the payment system.” However, he added that India will explore the use of blockchain technology. India is just the latest country in the region to push back against the use of cryptocurrencies, following China and Korea. South AfricaSouth Africa’s parliament has scheduled a no-confidence vote for Zuma on February 22. The motion was brought by the opposition Economic Freedom Fighters. He’s survived many no-confidence motions, but this one will likely be very close because the ANC is split. Before, the ANC voted as a bloc to protect Zuma but we think some reformists will break ranks and vote with the opposition in an effort to oust him before his term ends in 2019. TurkeyTurkish central bank raised its end-2018 inflation forecast in its quarterly inflation report. The rate was raised to 7.9% from 7.0% previously. The end-2019 inflation forecast was also raised to 6.5% from 6.0% previously. The central bank said it will continue its tight policy stance “independent of base impact” on inflation. PeruPeru’s Popular Force party expelled Kenji Fujimori and two of his allies. Seven more resigned, and these lawmakers were all part of the Popular Force faction that abstained from the impeachment vote against President Kuczynski last month. Kenji’s sister Keiko leads the Popular Force, which no longer has a majority in parliament after the expulsions and resignations. Note that the New Peru and Broad Front parties are seeking support to launch a new impeachment motion due to new evidence. |

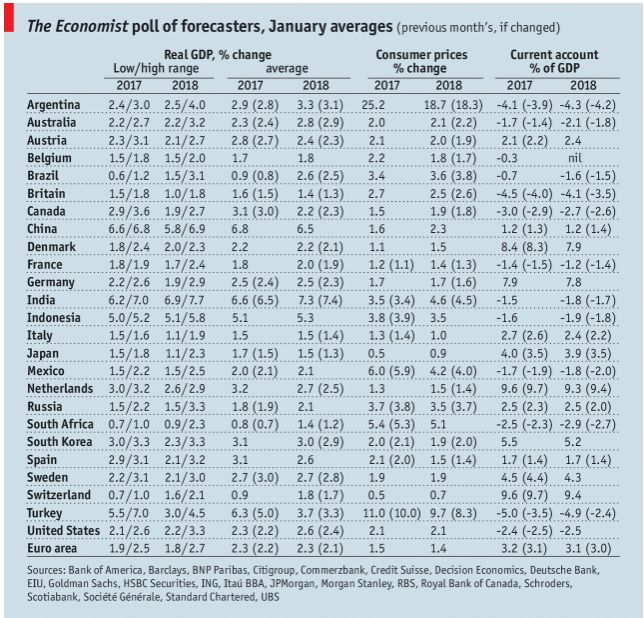

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,Featured,newsletter,win-thin