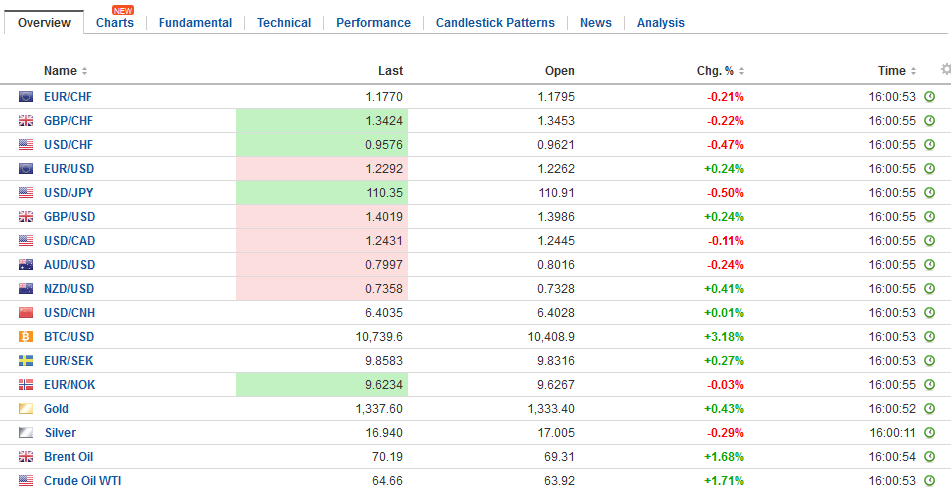

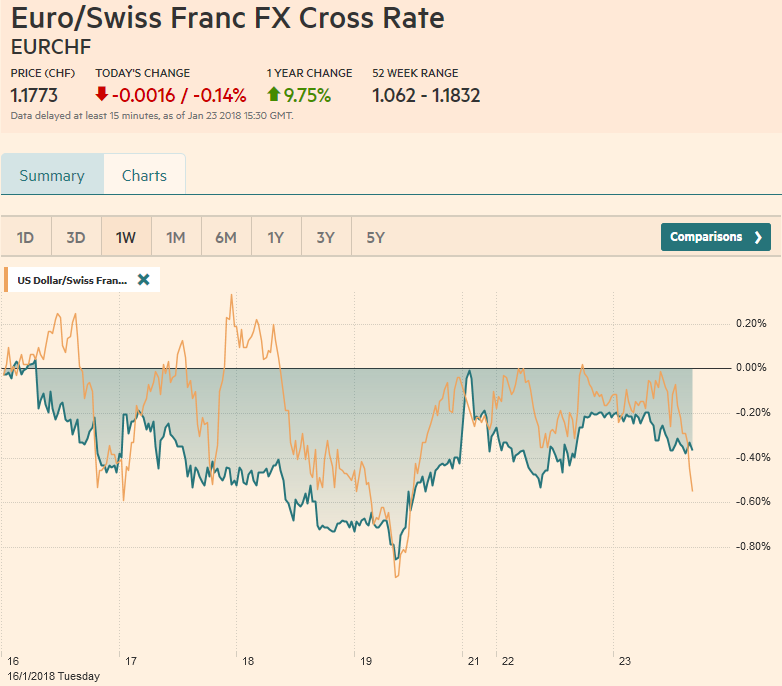

Swiss Franc The Euro has fallen by 0.14% to 1.1773 CHF. EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the downside, and said there was no change in inflation expectations. Last time it has said expectations were weakening. It also reiterated that there was no policy implication to the bond operations. The dollar bounce was capped in front of yesterday’s high near JPY111.20. There is around a 0 mln option

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, EUR/CHF, Eurozone Consumer Confidence, Eurozone ZEW Economic Sentiment, Featured, FX Trends, GBP, Germany ZEW Economic Sentiment, JPY, NAFTA, newslettersent, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss FrancThe Euro has fallen by 0.14% to 1.1773 CHF. |

EUR/CHF and USD/CHF, January 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe US dollar has come back better bid in late Asian activity. The session highlight was the BOJ meeting. BOJ maintained forecasts and policy. There was a small tweak to the inflation assessment, noting that prices were skewed to the downside, and said there was no change in inflation expectations. Last time it has said expectations were weakening. It also reiterated that there was no policy implication to the bond operations. The dollar bounce was capped in front of yesterday’s high near JPY111.20. There is around a $400 mln option that expires today struck at JPY111.50. Tomorrow, there are $2+ yards struck at JPY110.00-JPY110.05 that roll off. |

FX Daily Rates, January 23 |

| There were two developments in the US to note. First, the spending authorization issue was kicked down the road until Feb 6. This allows the US government to re-open. Remember half the time the government has shut since 1977, the closure lasted 3 days. This one is par, and the economic impact is inconsequential. Second, President Trump put tariffs on solar panels (30% to begin and after 4 years to fall to 15%) and washing machines (quota and tariff, 20% tariff on the first 1.2 mln washing machines and 50% any more washing machines).

Companies in these sectors in Asia weakened but Asian shares largely followed the US to new record highs. South Korea quickly announced a WTO challenge. MSCI Asia Pacific Index is up nearly 0.9%, and note that after underperforming on the pre-weekend MSCI warning, Korean shares bounced back smartly today with the KOSDAQ leading the region with a 2.4% gain. Also, of note, the H-shares in Hong Kong, the HK Enterprise Index rose nearly 2% to extend its streak to 18 sessions. |

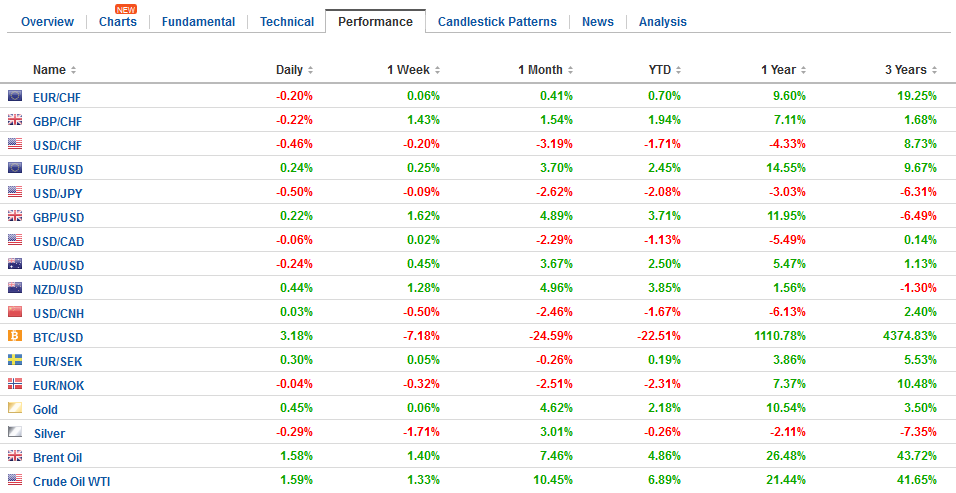

FX Performance, January 23 |

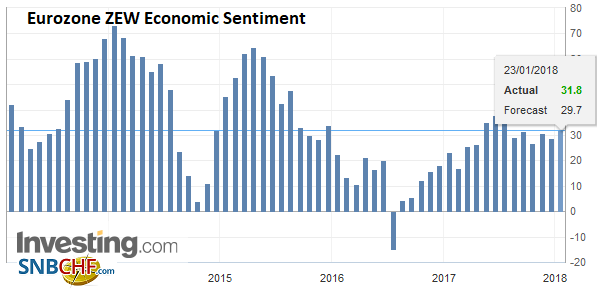

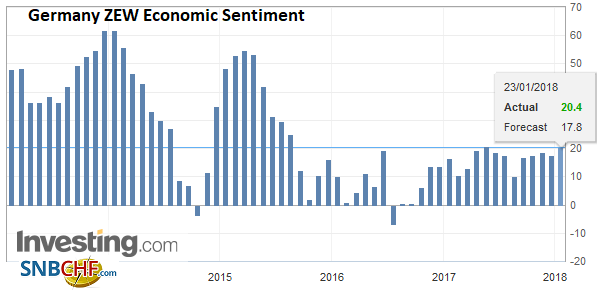

EurozoneIt is a light European calendar. Germany’s ZEW is featured. In the UK it is the monthly budget position and CBI trends survey. The week’s highlights lie ahead. Tomorrow the UK reports employment (earnings growth is expected to be unchanged at 2.5% including bonus and 2.3% without) and the first look at Q4 GDP ahead of the weekend (0.4% q/q for a 1.4% y/y pace down from 1.7%). Thursday is the ECB meeting. Since it met last, December inflation was reported softer than expected and the euro has appreciated. On the other hand, oil prices have also risen. Draghi is likely to reiterate the ECB’s stance that despite the impressive and broadening expansion, prices are not yet on a sustainable and durable path to the target. Continued monetary support is necessary. |

Eurozone ZEW Economic Sentiment, Jan 2018(see more posts on Eurozone ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

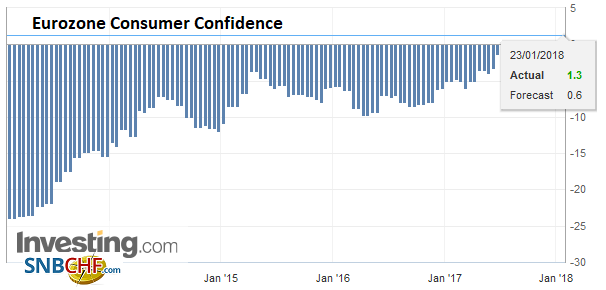

Eurozone Consumer Confidence, Jan 2018(see more posts on Eurozone Consumer Confidence, ) Source: Investing.com - Click to enlarge |

|

Germany |

Germany ZEW Economic Sentiment, Jan 2018(see more posts on Germany ZEW Economic Sentiment, ) Source: Investing.com - Click to enlarge |

Canada reports no data, and the slate is empty in the US except for the Richmond Fed survey. Note that Trump’s second nominee to the Federal Reserve governors, Goodfriend, has confirmation hearings in the Senate today.

Sterling poked briefly and marginally through $1.40 in Asia, the highest since the UK referendum. Rather than being seen as a breakout, it appears to have been greeted with profit-taking. Initial support is seen near $1.3950. For its part, the euro remains confined to the pre-weekend range roughly $1.2215 and $1.2295. There is a 660 mln euro option struck at $1.22 that expires today. Europe may probe the upside first.

The Aussie is the weakest of the majors, off by around 0.6% and pushing back below $0.8000. The 4% drop in iron ore may be providing the incentive for some profit-taking. With today’s pullback, the Aussie is still up 2% year-to-date.

NAFTA negotiations resume today in Montreal. It is the 6th round of what is intended to be 7 rounds. Although the first five rounds did not appear to resolve the thorny issues, that seems to be typical of these kinds of negotiations. The low hanging fruit is picked first, leaving the toughest issues for last. Although news wire survey found 41 of 45 economists expect a successful conclusion, the risks seem skewed to the downside. Mexico’s presidential campaign kicks off in March (July election) and it is difficult to expect any progress during it. Whether it can be concluded in time is a challenge. If the US were to leave, as Trump has threatened, it would seem to be only after the 7th round of negotiations.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,$JPY,EUR/CHF,Eurozone Consumer Confidence,Eurozone ZEW Economic Sentiment,Featured,Germany ZEW Economic Sentiment,NAFTA,newslettersent,USD/CHF