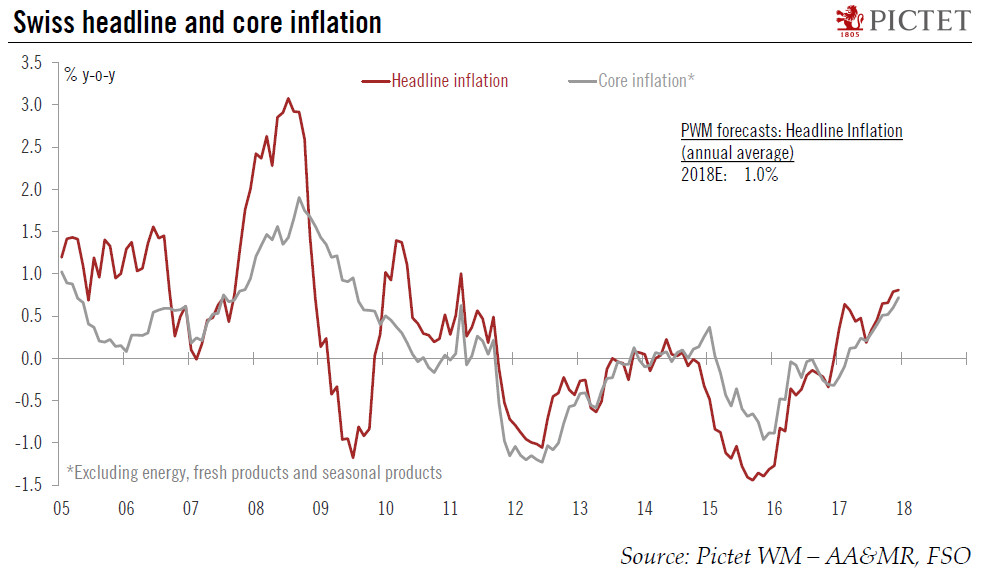

According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to 0.7% y-o-y in December. This was the highest rate since August 2009. The breakdown showed that there was no sign of growing domes tic inflationary pressures. In particular, services inflation fell for a second successive month by 0.1pp to 0.5% y-o-y. Average annual inflation reached 0.5% in 2017, in

Topics:

Nadia Gharbi considers the following as important: Featured, Macroview, newsletter, Pictet Macro Analysis, SNB rate hike, Swiss and European Macro, Swiss core inflation, Swiss headline inflation, Swiss inflation outlook

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Krypto-Ausblick 2025: Stehen Bitcoin, Ethereum & Co. vor einem Boom oder Einbruch?

Connor O'Keeffe writes The Establishment’s “Principles” Are Fake

Per Bylund writes Bitcoiners’ Guide to Austrian Economics

Ron Paul writes What Are We Doing in Syria?

| According to the Swiss Federal Statistical Office (FSO), consumer prices in Switzerland remained broadly stable at 0.8% y-o-y in December, in line with consensus expectations, meaning that Swiss inflation stayed at its highest rate in almost seven years at the end of 2017. Core inflation (headline CPI excluding food, beverages, tobacco, seasonal products, energy and fuels) rose slightly from 0.6% y-o-y in November to 0.7% y-o-y in December. This was the highest rate since August 2009. The breakdown showed that there was no sign of growing domes tic inflationary pressures. In particular, services inflation fell for a second successive month by 0.1pp to 0.5% y-o-y.

Average annual inflation reached 0.5% in 2017, in line with our forecast. It comes after-0.4% in 2016 and – 1.1% in 2015. This was the first year of positive average inflation since 2011. The rise was mainly due to housing and oil prices. Domestic inflation rose on average by 0.3% and imported prices by 1.2%. |

Swiss Headline and Core Inflation, 2005 - 2018 |

Swiss inflation outlook

Over the past few years, Swiss corporates have sought to offset the strength of the franc by adjusting their prices and costs. Inflation returned to positive territory in 2017. The base effects of energy price fluctuations are likely to drive Swiss headline inflation lower in the near term, but price inflation should firm up as 2018 progresses. Several other developments will also dampen inflation. First, as a result of the rejection of the “2020 pension reforms” in a referendum in autumn 2017, Swiss VAT rates were reduced to 7.7% (normal rate) and 3.7% (special rate for accommodation) on 1 January. The reduced rate of 2.5% will remain unchanged. The reduction of VAT rates could put some downward pressure on inflation. Second, rents, which are under pressure due to the fall in the base rate, will also impact inflation. In contrast, prices of imported goods are expected to rise due to the weaker franc. All in all, we expect average headline inflation of 1.0% in 2018 after 0.5% in 2017, but with risks tilted to the downside.

At its December meeting, the Swiss National Bank (SNB) upgraded its 2018 inflation forecast from 0.4% to 0.7%. While the SNB was rather optimistic on the economic outlook, it remained rather cautious in its currency assessment, mentioning that the Swiss franc was “highly valued” and that the situation on foreign exchange markets was still fragile.

Given the outlook for inflation is still contained, the SNB is likely to remain cautious and true to its current ‘two-pillar’ strategy (negative interest rates and commitment to intervene in the FX market if needed). We expect a window of opportunity for a first SNB rate hike in Q4 2018.

Tags: Featured,Macroview,newsletter,SNB rate hike,Swiss core inflation,Swiss headline inflation,Swiss inflation outlook