We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on

Topics:

George Dorgan considers the following as important: Featured, newsletter, Swiss and European Macro, Switzerland Exports, Switzerland Exports by Sector, Switzerland Imports, Switzerland Imports by Sector, Switzerland Trade Balance

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true.

Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans.

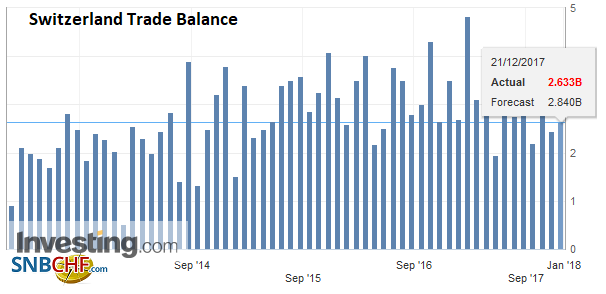

But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

Exports and Imports YoY DevelopmentSwiss foreign trade proved dynamic in November 2017. After correction of working days, exports grew by 9.5% and imports even 16.4% year on year, both boosted by rising prices. In real terms, they increased by 4.4 and 6.8%, respectively. The balance commercial loop with a surplus of 2.7 billion francs. ▲Trade with Europe: exports + 11%, imports + 14% |

Swiss exports and imports, seasonally adjusted (in bn CHF), November 2017(see more posts on Switzerland Exports, Switzerland Imports, ) Source: Swiss Customs - Click to enlarge |

Overall EvolutionThe exports corrected for working days were increased by 9.5% over one year (actual: + 4.4%). Compared with October (seasonally adjusted), they gained 1.5%. They and thus their record level last May. The imports have shown growth impressive 16.4% in one year (real: + 6.8%). After seasonal adjustment (compared with the previous month), they swelled by 2.1%. Over the last twelve months, they thus draw a clearly bullish trend. |

Switzerland Trade Balance, November 2017(see more posts on Switzerland Trade Balance, ) |

ExportsExports: 10 out of 11 merchandise groups upWith the exception of vehicles, all sectors have had the wind in their sails. Five of them even grew between 13 and 21%. The chemicals and pharmaceutical made the largest contribution (+582 million francs). Exports of metals (+ 20%) and precision instruments (+ 16%) have cardboard. Those of the group machinery and electronics (+256 million francs) were reinforced by 10%, galvanized by sales of machine tools for metalworking. The watchmaking saw its turnover grow by 6%. In chemistry-pharma, drugs have inflated by a tenth (+299 million francs) against 7% for immunological products (+151 million). Demand has grown on all continents. Exports jumped 15% to the Latin America (Brazil: + 37%) against 11% towards Europe, the main market. Here, Austria, Belgium and Italy grew by 20 to 37%. Also note the vigor of the France (+ 10%) and Germany (+ 7%). The demand Asian has increased by 10%. The Thailand (+115 million francs, machinery), Singapore (+133 million, pharma) and the Japan (+171 million, pharma) took the elevator. Conversely, China has weakened by 5%. The sales to the third outlet, the North America, grew by 2% (USA: + 3%). |

Swiss Exports per Sector November 2017 vs. 2016(see more posts on Switzerland Export, Switzerland Exports by Sector, ) Exports by commodity roup: Nominal variations corrected for days working compared to November 2016 Source: Swiss Customs - Click to enlarge |

ImportsImport growth supportedIn November, imports of the twelve commodity groups strengthened, with different rhythms however. Those of the jewelery and jewelery were the most dynamic (+ 83%, +541 million francs; mainly returns of goods). With +545 million francs, the chemistry pharma has not been left behind. The metals have increased by a quarter (real: + 12%). The area textiles, clothing and shoes took off from a fifth against 17% for the machinery and electronics group (+445 million francs). In the chemicals and pharmaceuticals (+ 15%; real: -0%), all segments gained ground, including active ingredients (+ 27%). With the exception of Latin America (-3%), imports from all regions have intensified. With an increase of 32%, the Asia won the palm. The entrees from the United Arab Emirates tripled (merchandise returns from jewelery and while those of Japan and China accelerated by +29 respectively + 19%. Arrivals of North America jumped by a quarter (Canada: +167 million francs; airliners). In Europe (+ 14%), Ireland (+403 million, pharma), Germany, France and Italy each rose in hundreds of millions of francs. |

Swiss Imports per Sector November 2017 vs. 2016(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) Imports by commodity group: Nominal variations corrected for days working compared to November 2016 Source: Swiss Customs - Click to enlarge |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance