Swiss Franc The Euro has risen by 0.03% to 1.1352 CHF. EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around 0 bln of European equities in 2016 and bought around a third back this year. The Dow Jones Stoxx 600 is off around 0.25% today. It could be the second three-day drop this month. This benchmark of European shares peaked three

Topics:

Marc Chandler considers the following as important: EUR, EUR/CHF, Featured, FX Trends, GBP, JPY, Korea, newslettersent, SPY, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

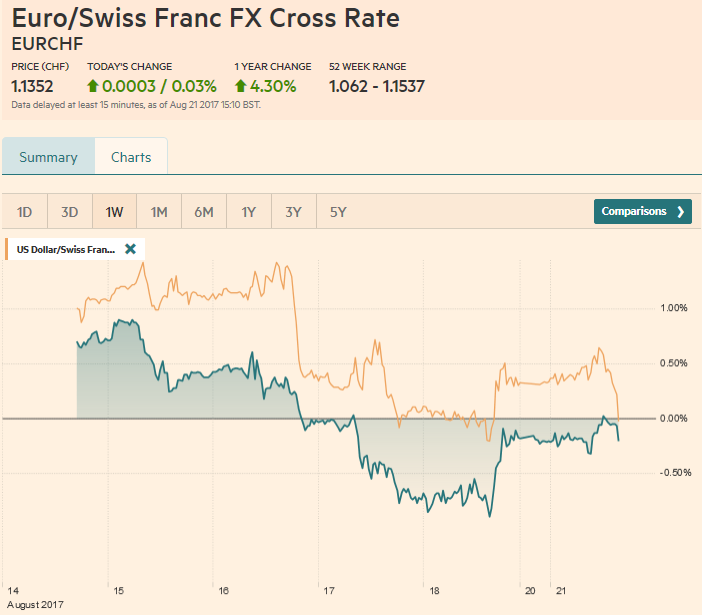

Swiss FrancThe Euro has risen by 0.03% to 1.1352 CHF. |

EUR/CHF and USD/CHF, August 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

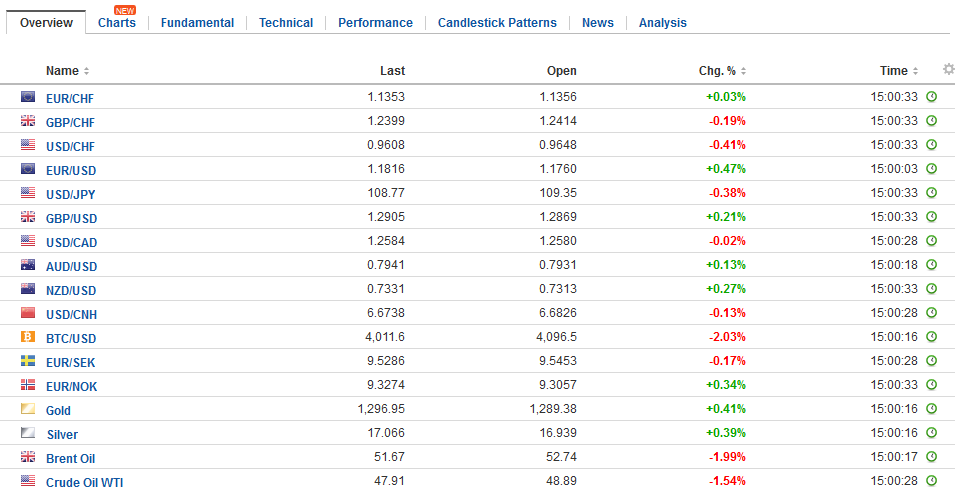

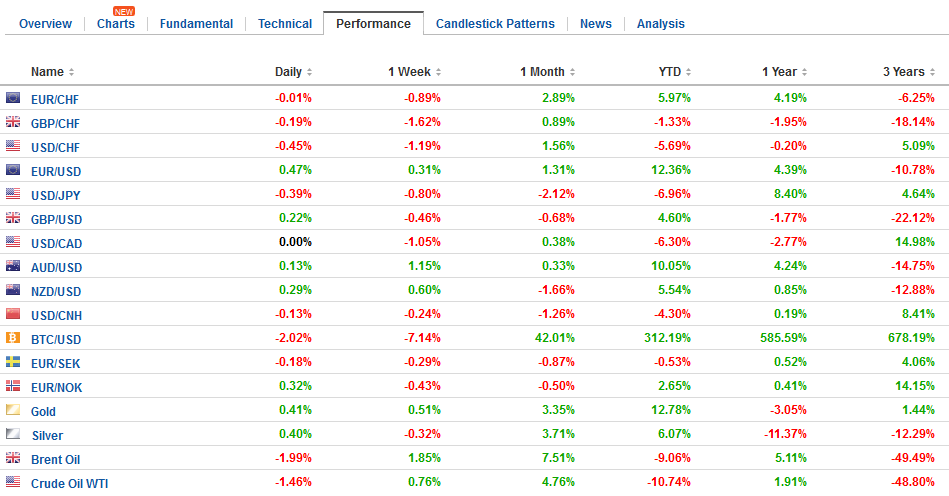

FX RatesThe US dollar is mostly firmer against most of the major and emerging market currencies. The main impetus appears to be some position adjustment emanating from equities. The equity markets turned south in the second half of last week and are moving lower today. Foreign investors appeared to have sold around $100 bln of European equities in 2016 and bought around a third back this year. The Dow Jones Stoxx 600 is off around 0.25% today. It could be the second three-day drop this month. This benchmark of European shares peaked three months ago and fell 6.3% through August 11. It bounced in the first part of last week, but, after gapping lower before the weekend is back near the recent lows. The euro peaked August 2 a little above $1.1900. Last Thursday marked the low a little ahead of $1.1660. The euro has been confined to about a third of a cent range in Asia and the European morning. With a light events schedule and the focus on Jackson Hole, participants seem content to tread water. The 20-day moving average that served as support now is acting as resistance. It is found near $1.1770. |

FX Daily Rates, August 21 |

| The MSCI Asia Pacific Index fell for the second day. This two-day decline (~0.5%) broke a four-day advance. This regional benchmark gapped lower before the weekend and spent today’s session inside the previous day. While most markets in Asia were lower, the Greater China markets (Shanghai, Shenzhen, Hong Kong, and Taiwan) all advance. Nearly every other market fell, with Thailand ((~0.2%) an exception, perhaps aided by the better than expected Q@ GDP (1.3% vs. 1.0% median forecast). While there is a strong correlation (~0.76, 60-days, percentage change basis) between the MSCI Asia Pacific Index and the MSCI Emerging Market Index, the latter is posting a small (~0.2%) gain so far today.

That said, EPFR reported that emerging market equity funds saw the first net liquidation in several months and the largest of the year. This fund tracker says that $1.6 bln left emerging market equity funds in the week ending August 16. It also said that investors liquidated $79 mln in emerging market fixed income funds, the first time since January. The main focus this week is on the central bank gather at the end of the week in Jackson Hole. We do not expect much light to be shed on current policy debates either in the US or Europe. The topic at hand “Fostering a Dynamic Global Economy,” lends itself to a broader discussion of structural forces. Draghi champions structural reforms in the EMU, while Yellen has argued in favor of increasing participation, especially women, in the labor market. |

FX Performance, August 21 |

Meanwhile, US-South Korean military exercises start to and run a couple of weeks. Although they have long been scheduled, and is a bit of an annual event, in the current content, they may be provocative. Last year, North Korea launched a ballistic missile from a submarine, demonstrating the difficulty in denying it a second strike capability. Korean shares fell 0.15% for the second day, though the Korean won’s 0.2% advance leads the regional currencies higher today. It has been alternating between gains and losses daily for the past week.

Lower bonds yields and heavier shares may be helping underpin the yen today. The dollar is in half a yen range, after closing last week near JPY109.20. It leaves the greenback pinned near the lower end of the five-month range. While the yen is the strongest of the majors, the Swiss franc is the weakest (~-0.25%). The euro peaked near CHF1.1550 on August 4 and has built a little shelf now near CHF1.1260. Given the volatility, rates, and our subjective assessment of the likely actions by the central banks, we have suggested that the Swiss franc may be a preferable funding vehicle compared with the Japanese yen.

Sterling is holding its own today. Some profit-taking on the euro-sterling cross seems to be the main impetus behind cable’s mostly steady tone. The UK is to submit several new position papers on Brexit this week. However, it is still at loggerheads with the EU, and in our assessment, the EU holds the most important cards now. Reports suggest the UK is still trying to drive the process and hopes that the EU’s negotiating position changes after the German election if the FDP rather than the SPD is part of the governing coalition. This does not strike as as particularly realistic and time continues to tick down.

The economic calendar in North America is light today. There are euro options struck at $1.17 and $1.18 that expire today, but are not relevant it seems. There are $410 mln struck at JPY109 and $600 mln struck at JPY109.50 that could be in play. There are GBP550 mln options struck at $1.28 but are not likely to be in play.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$EUR,$JPY,EUR/CHF,Featured,Korea,newslettersent,SPY,USD/CHF