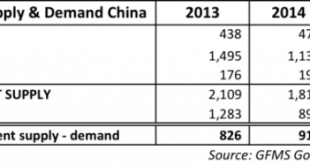

Submitted by Koos Jansen from Bullionstar.com Gold supply and demand data published by all primary consultancy firms is incomplete and misleading. The data falsely presents gold to be more of a commodity than a currency, having caused deep misconceptions with respect to the metal’s trading characteristics and price formation. Numerous consultancy firms around the world, for example Thomson Reuters GFMS, Metals Focus,...

Read More »Spectacular Chinese Gold Demand Fully Denied By GFMS And Mainstream Media

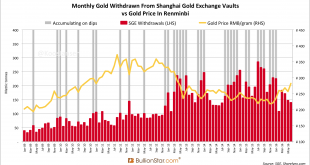

Submitted by Koos Jansen of BullionStar In the Gold Survey 2016 report by GFMS that covers the global gold market for calendar year 2015 Chinese gold consumption was assessed at 867 tonnes. As Chinese wholesale demand, measured by withdrawals from Shanghai Gold Exchange designated vaults, accounted for 2,596 tonnes in 2015 the difference reached an extraordinary peak for the year. In an attempt to explain the 1,729...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »Chinese Gold Demand 973 tonnes in H1 2016, Nomura SGE Withdrawals Chart False

Chinese wholesale gold demand, as measured by withdrawals from the vaults of the Shanghai Gold Exchange (SGE), reached a sizable 973 metric tonnes in the first half of 2016, down 7 % compared to last year. Although Chinese gold demand year to date at 973 tonnes is slightly down from its record year in 2015 – when China in total net imported over 1,550 tonnes and an astonishing 2,596 tonnes were withdrawn from SGE...

Read More »Venezuela’s Gold Reserves Plunge To Lowest Ever As Maduro Repays Debt With Gold

Several months ago, as Venezuela’s hyperinflating, imploding economy was spinning in freefall, leading to the dramatic episodes of total social collapse such as those profiled in “Scenes From The Venezuela Apocalypse: “Countless Wounded” After 5,000 Loot Supermarket Looking For Food“, we wrote that the country which recently had “run out of money to print its own money” was preparing to liquidate its remaining gold holdings to pay coming debt maturities. Then, courtesy of an analysis by...

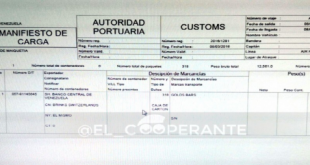

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another 12.5...

Read More »This Is How Venezuela Exported 12.5 Tonnes Of Gold To Switzerland On March 8, 2016 Via Paris

Submitted by Ronan Manly of Bullionstar Blogs Following on from last month in which BullionStar’s Koos Jansen broke the news that Venezuela had sent almost 36 tonnes of its gold reserves to Switzerland at the beginning of the year, “Venezuela Exported 36t Of Its Official Gold Reserves To Switzerland In January“, there have now been further interesting developments in this ongoing saga. It has now come to light that on Tuesday 8 March, the Banco Central de Venezuela (BCV) sent another...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org