Summary: Bank of Canada meets Wed. Look for a dovish hold. Foreigners continue to buy Canadian bonds and stocks. The EU-Canadian free-trade deal is facing challenges, with the most pressing one coming from Belgium. The Bank of Canada meets Wednesday. Last month officials acknowledged that growth could be somewhat lower than previously anticipated. Those fears have likely materialized, and the central bank...

Read More »FX Weekly Preview: Four Key Events in the Week Ahead

United States Of the forces driving prices in the week ahead, events appear more important than economic reports. There are four such events that investors must navigate. The Bank of Canada and the European Central Bank meet. The UK High Court will deliver its ruling on the role of Parliament in Brexit. The rating agency DBRS updates its credit rating for Portugal. The Bank of Canada is not going to change interest...

Read More »Weekly Speculative Positions: More Bearish Euros and CHF, Less Bullish the Yen

With the strong ISM non-manufacturing PMI last week, long positions on the dollar are increasing, while speculators increase their euro and Swiss Franc shorts. CHF net shorts increased to 9.4 K positions. That the euro has depreciated against CHF, is possibly caused by real, non-speculative money into CHF, i.e. money in the form of cash and stock purchases. We will get more information tomorrow when the SNB sight...

Read More »FX Daily, October 14: Firm Dollar Consolidating, Awaiting US Retail Sales

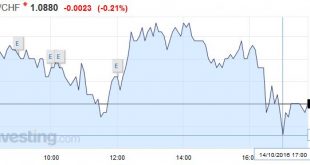

Swiss Franc EUR/CHF - Euro Swiss Franc, October 14 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm against most of the major currencies, but within yesterday’s ranges, which seems somewhat fitting amid the light new stream. The high-yielding Australian and New Zealand dollars are resisting the stronger greenback, while on the week the Aussie and the Canadian dollar are the...

Read More »FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

Swiss Franc The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow. EUR/CHF - Euro Swiss Franc, October 13 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm, and the euro has slipped below $1.10 for the first time since late-July. Although the dollar’s...

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

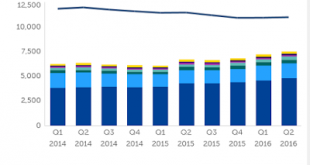

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More »FX Daily, October 12: May Concedes to Parliament, Sterling Rises after Pounding

Swiss Franc EUR/CHF Overview, October 12 2016(see more posts on EUR/CHF, ) - Click to enlarge FX Rates News that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling’s headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a...

Read More »Sterling: Has the Breaking Point been Reached?

Summary: Sterling’s decline is not longer coinciding with lower rates. Sterling’s decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been. Something has changed with sterling. It is not just last week’s flash crash that seems now to be more of a mark down than fat-finger, liquidity or...

Read More »FX Daily, October 11: The Dollar Remains Bid

Swiss Franc EUR CHF - Euro Swiss Franc, October 11 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is bid against all the major and most emerging market curerncies. An important driver is the backing up of US rates. The two-year yield, which is particularly sensitive to Fed policy is at it highest levbel since early June (~86 bp). The US 10-year yield is five basis points hihger...

Read More »Great Graphic: Euro is Approaching Year-Long Uptrend

Summary: The year-long euro uptrend comes in near $1.1035, just below the August lows. The technical are fragile, but the euro is below its lower Bollinger Band. The fundamental driver seems to be the backing up of US rates, and widening premium over Germany. This Great Graphic, composed on Bloomberg shows the euro against the dollar since the start of the year. It shows the trendline drawn off the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org