Swiss Franc The Euro has fallen by 0.03% to 1.1533 CHF. EUR/CHF and USD/CHF, October 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The EU’s leading negotiator whipsawed sterling yesterday. The net effect was to ease fears that the UK would leave the EU without the agreement Initial concerns that the negotiations had stalled sent sterling to nearly $1.3120. The...

Read More »Dollar Dropped like Hot Potato After Core CPI Disappointed

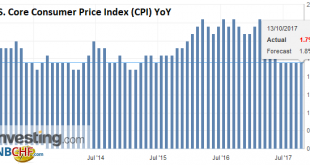

The dollar was bid before the US economic data. The market responded quickly upon seeing the disappointing 0.1% rise in core CPI. Given the base effect, the 0.1% increase kept the year-over-year rate at 1.7% for the fourth consecutive month. The dollar reversed lower. Retail sales were largely in line with expectations. The 1.6% headline increased missed expectations by 0.1%, which is exactly what the August series was...

Read More »FX Daily, September 14: New Trump Tactics Help Greenback and Rates

In the face of much cynicism and pessimism about the outlook for the Trump Administration’s agenda, we have repeatedly pointed out the resilience of the system of checks and balances. Many of the more extreme positions have been tempered, either on their own accord, such as naming China a currency manipulator or pulling out of NAFTA or KORUS, or the judiciary branch, such as on immigration curbs, or the legislative...

Read More »FX Daily, August 11: Geopolitical Tensions Remain Elevated into the Weekend

Swiss Franc The euro is up by 0.19% to 1.1348 CHF EUR/CHF and USD/CHF, August 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The downward pressure on US yields, with the 10-year slipping to 2.18%, nearly a two-month low, coupled drop in equities helped underpin the Japanese yen. The dollar traded below JPY109 for the first time since the middle of June. The greenback...

Read More »FX Daily, July 14: Aussie Scales New Highs for the Year, as the Greenback Remains on the Defensive

Swiss Franc The Euro has fallen by 0.02% to 1.1031 CHF. EUR/CHF - Euro Swiss Franc , July 14(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The Australian dollar has taken over leadership in the dollar bloc from the Canadian dollar. The Aussies are up about 0.35% today to extend this week’s gains to more than 2% and reach a new high for the year a little more than $0.7760. The Canadian dollar is...

Read More »FX Daily, June 14: FOMC and upcoming SNB

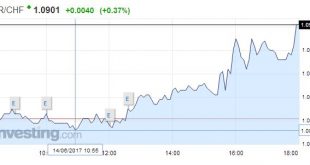

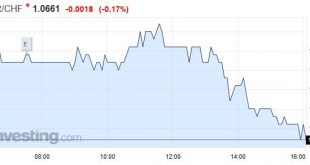

Swiss Franc The Euro has risen by 0.37% to 1.0901 CHF. This is a typical movement ahead of the SNB meeting tomorrow. This movement is probably unrelated to the Fed rate hike, given that the USD/JPY has fallen. It makes sense to go long CHF against JPY, if you bet on an inactive SNB. Inactive SNB would mean that the central bank will not speak about stronger FX Interventions or about lower rates. EUR/CHF - Euro Swiss...

Read More »FX Daily, April 14: Holiday Markets Remain on Edge

Swiss Franc EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean...

Read More »FX Daily, March 15: Greenback Softens Ahead of FOMC

Swiss Franc Switzerland Producer Price Index (PPI) YoY, February 2017(see more posts on Switzerland Producer Price Index, ) Source: Investing.com - Click to enlarge GBP/CHF Today is crucial for Swiss Franc exchange rates with a number of economic releases and political events happening around the world which are likely to have a direct bearing on the direction of the Swiss Franc. The US Federal Reserve...

Read More »FX Daily, October 18: Dollar Slips Broadly but not Deeply

Swiss Franc and Sterling (Tom Holian) According to Bank of England deputy governor Ben Broadbent the drop in the value of Sterling has helped to stop the UK economy from falling further since the shock of the Brexit vote. He went on to say ‘in the shape of the referendum, we’ve had exactly one of those shocks’ and added that the Bank of England would not interfere with monetary policy to boost the Pound’s value....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org