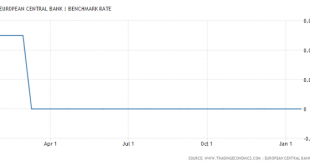

We discuss the rate differentials between Switzerland, Britain, Europe, Japan and the United States and how this Developed Financial Markets carry trade is incentivizing excessive risk taking with tremendous leverage and destabilizing the entire financial system in the process in this video. You want to know what is behind weekly market records, borrowed money via punchbowl central bank liquidity. This ends badly every...

Read More »How The Flash Crash Trader Was Scammed Out Of A $50 Million Fortune

The sad saga of Navinder Sarao, who on April 20, 2015 became the scapegoat for the May 2010 flash crash and was sentenced to up to 360 years in prison - he will find out later this year the actual length of his prison sentence - got its latest twist today thanks to a fascinating report how in addition to having lost his freedom, Nav also lost all of trading fortune, some $50 million of it. As Bloomberg's Liam Vaughn recounts, "it took Navinder Singh Sarao a long time to accept that he might...

Read More »Frontrunning: February 9

Airlines, Airports to Meet President Amid Travel-Ban Uncertainty (WSJ) Legal battle pits Trump's powers against his words (Reuters) Trump’s Oval Office Tweets Force CEOs to Choose Fight or Flight (BBG) Companies Plow Ahead With Moves to Mexico, Despite Trump’s Pressure (WSJ) Trump’s Labor Pick Loves Burgers, Bikinis, and Free Markets (BBG) NATO allies lock in U.S. support for stand-off with Russia (Reuters) Sessions Takes Reins at Justice Ready to Walk the Line for Trump (BBG) Washington...

Read More »The VIX Will Be Over 100 due to Central Bank Created Tail Risk

By EconMatters We discuss the manner in which Central Banks have destroyed financial markets, and have the stage for what I label as the Red Swan Event in this video. When the Swiss National Bank holds risky Tech stocks in its portfolio, we are in unchartered territory! We had the Financial Crisis of 2008, and instead of learning from the mistakes of incentivizing excessive risk taking, the Central Banks were allowed to...

Read More »Lagarde Urges Wealth Redistribution To Fight Populism

IMF Managing Director Christine Lagarde, Italian Finance Minister Pier Carlo Padoan and Founder, Chairman and Co-CIO of Bridgewater Associates, Ray Dalio - Click to enlarge As we scoffed oveernight, who better than a handful of semi, and not so semi, billionaires – perplexed by the populist backlash of the past year – to sit down and discuss among each other how a “squeezed and Angry” middle-class should be fixed. And...

Read More »Gold Bars Worth $800,000 Owned By Prince

Prince, RIP, owned gold bars worth just over $800,000 according to the statement filed in a Minnesota court last Friday. At the time of his death, Prince had taken delivery of and had in his possession 67 gold bars, 10 ounce gold bars, valued at $836,166.70. That’s according to an asset inventory compiled by Bremer Trust released by the Carver County District Court, as first reported by the Minneapolis Star Tribune....

Read More »Gold Price In GBP Up 4 percent On Brexit and UK Risks

Gold Price In GBP Rises 4% On Brexit and UK Economy Risks – Pound fell 2% against gold yesterday after Theresa May created Brexit concerns – May’s ‘Hard Brexit’ denial does not calm markets growing fears – Investors concerned about lack of government strategy and uncertainty – UK Prime Minister bizarrely blames media and “those who print things” for sterling depreciation – GBP gold builds on 31% gain in 2016 with 4%...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Gold Rises In All Currencies In 2016 – 9 percent In USD, 13 percent In EUR and 31.5 percent In GBP

– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »Risk Reward Analysis for Financial Markets

By EconMatters We focus this video regarding the potential upside for stocks versus the considerable downside risk for investors. All Technical Analysis is flawed and backward looking, it is a Critical Thinking flaw to extrapolate the future from the most recent past. I want to know the next market move, and not still be stuck on the most recent market move. And the most important fact of all is valuations, stocks are in a bubble right now due to Central Banks extreme monetary...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org