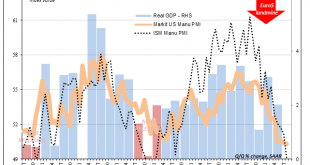

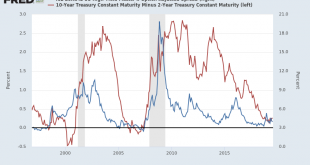

Bond yields have tumbled this morning, bringing the 10-year US Treasury rate within sight of its record low level. The catalyst appears to have been the ISM’s Manufacturing PMI. Falling below 50, this widely followed economic indicator continues its rapid unwinding. Back in November 2018, at just about 59 the overall index had still been close to its multi-decade high. Over the next nine months through the latest update for August 2019, it has shed almost 10 points....

Read More »Monthly Macro Monitor: We’re Not There Yet

It’s been a slow turnin’ From the inside out A slow turnin’ But you come about Slow learnin’ But you learn to sway A slow turnin’ baby Not fade away Now I’m in my car I got the radio on I’m yellin’ at the kids in the back ‘Cause they’re bangin’ like Charlie Watts Slow Turning by John Hiatt “How did you go bankrupt?” Bill asked. “Two ways”, Mike said. “Gradually and then suddenly.” The Sun Also Rises, By Ernest...

Read More »Trade Wars Have Arrived, But It’s Trade Winter That Hurts

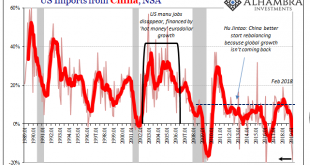

There is truth to the trade war. That’s a big problem because it’s not the only problem. It isn’t even the main one. Given that, it’s easy to look at tariffs and see all our current ills in them. The Census Bureau reports today that the trade wars have definitely arrived. In March 2019, US imports from China plummeted by nearly 19% year-over-year. In the entire series which goes back to 1988, there are only three...

Read More »Global Asset Allocation Update

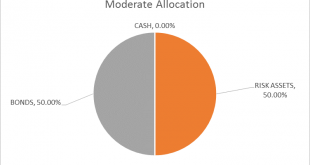

Note: This will be a short update. We are shifting the timing of some of our reports. The monthly Global Asset Allocation update will now be published in the first week of the month, aiming for the first of each month. I’ll put out a full report next week. The Bi-Weekly Economic Review is shifting to a monthly update, published on the 15th of each month. We are doing this to make room for some new reports, podcasts and...

Read More »US Trade Settles Down Again

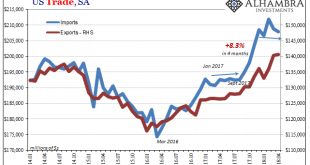

US trade is further leveling off after several months of artificial intrusions. On the import side, in particular, first was a very large and obvious boost following last year’s big hurricanes along the Gulf Coast. Starting in September 2017, for four months the value of imported goods jumped by an enormous 8.3% (revised, seasonally-adjusted). Most of the bump related to consumer and capital goods. Since December,...

Read More »FX Traders Have To (Re)Learn A New Skill

Dear FX traders: forget the dot plot, and prepare to learn a new – or to some forgotten – skill: how to read trade flows. As Bloomberg’s Vincent Cignarella and Andrea Wong point out, currency traders accustomed to analyzing the Fed’s dot plot and monthly U.S. jobs figures to predict the direction of the world’s reserve currency are having to learn, or in some cases re-learn, a largely forgotten ability: how to...

Read More »China Says It Is Ready To Assume “World Leadership”, Slams Western Democracy As “Flawed”

Over the weekend China used the Trump inauguration to warn about the perils of democracy, touting the relative stability of the Communist system as President Xi Jinping heads toward a twice-a-decade reshuffle of senior leadership posts. Without directly referencing the new president, China wrote that democracy has reached its limits, and deterioration is the inevitable future of capitalism, according to the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org