I had a brief talk on the set with of Fox Business with Varney & Co today, but there is no video available. We began by talking about stocks. For several weeks, I have been suggesting to viewers that the S&P 500 could recover to 2700. Last Friday, the S&P 500 gapped higher and reached 2675. I did not like the gap and thought it would be quickly filled. That was yesterday. And after IBM earnings surprise and...

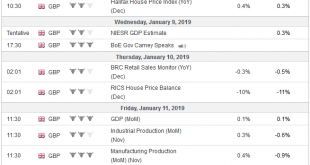

Read More »FX Weekly Preview: Things to Watch in the Week Ahead

“The sky is falling. The sky is falling,” they cried, as equities plunged in December. It is signaling a recession, we were told. Instead, global equities have begun the year with a strong advance. The S&P 500 gapped higher ahead of the weekend, extending this year’s rally to about 14%. It has now retraced more than 50% of the decline, not from the December high but from the record high in late September. It has...

Read More »FX Daily, January 15: New Phase Begins with UK Vote

Swiss Franc The Euro has risen by 0.17% at 1.1272 EUR/CHF and USD/CHF, January 15(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Several of the equity benchmarks are flirting with six-week highs, including MSCI Asia Pacific Index and the Emerging Markets Index. The Dow Jones Stoxx 600 is trying to extend its advancing streak for a third week, something not...

Read More »FX Daily, January 11: Trade Optimism and the Recovery in Oil Boosts Risk Appetites

Swiss Franc The Euro has fallen by 0.26% at 1.1287 EUR/CHF and USD/CHF, January 11(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Optimism on trade talks between the US and China coupled with the biggest rally in WTI in two years (11%+) have helped keep the equity market recovery intact.The MSCI Asia Pacific Index rose today, the eighth time in the past ten...

Read More »FX Weekly Preview: For the Millionth Time, Markets Exaggerate

The S&P 500 fell more than 12% in a few weeks. The 10-year Treasury yield fell nearly 40 bp. There were cries that the sky was falling. A recession is imminent, we are warned by prognosticators. The Fed went ahead and raised interest rates on March 21, 2018, and the S&P 500 proceeded to gap lower the next day and continued to sell-off the following day. Investors did not like the unanimous decision. Yet far from...

Read More »Week Winding Down on Firm Note, but Wild Ride may Not Be Over

Overview: The biggest reversal in the S&P 500 since 2010, allowing it to string the biggest two-day rally in three years helped lift Asian and European shares today. All the Asia-Pacific equity markets advanced today but Japan, where the strength of the yen saw the Nikkei and Topix buck the move. European equities. The 1.4% rally in the Dow Jones Stoxx 600 near midday in Europe retraces 2/3 of this...

Read More »Some Thoughts on What is Happening

People do not just disagree on what should and will happen, but they disagree on what has happened. As William Faulkner instructed: “The past is not dead. Actually, it’s not even past. This is clear in the narratives about the sharp drop in equity markets. It seems that the most common explanation places the onus on the Federal Reserve. Fed Chair Powell’s was seemingly hawkishness in early October (during a time when...

Read More »FX Daily, December 21: Markets Stumble into the Weekend

Swiss Franc The Euro has risen by 0.04% at 1.1308 EUR/CHF and USD/CHF, December 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: There is little reprieve from the equity meltdown ahead of the weekend. Major markets in the Asia-Pacific region, including Japan, China, India, and Australia pushed lower. The MSCI index of the region is near 15-month lows. The Dow...

Read More »FX Daily, December 20: Stocks Slump and the Dollar Slides as Market Concludes Fed is Mistaken

Swiss Franc The Euro has risen by 0.20% at 1.1334 EUR/CHF and USD/CHF, December 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Once again the US equity market failed to hold on to even minimal upticks. The sharply lower close spurred follow-through selling in global equities. Few have been spared the wrath of investors who apparently were disappointed with the...

Read More »FX Daily, December 18: Stock Rout Deepens, Casts Shadow over Holiday Spirit

Swiss Franc The Euro has risen by 0.12% at 1.1277 EUR/CHF and USD/CHF, December 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The 2% slide in the S&P 500 to new lows for the year yesterday hit Asian and European equities today. Bond yields are lower, and the dollar is softer against most major currencies. The dramatic equity losses and some disappointing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org