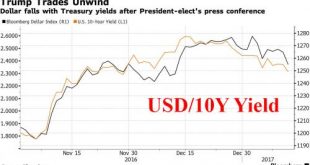

Risk assets declined across the globe, with European, Asian shares and S&P 500 futures all falling, while the dollar slumped against most currencies after a news conference by President-elect Donald Trump disappointed investors with limited details of his economic-stimulus plans, and the Trumpflation/reflation trade was said to be unwinding. "The risk was always that a president like Trump would end up upsetting that consensus (of faster U.S. growth, stronger dollar) view by introducing...

Read More »Frontrunning: December 20

Trump wins Electoral College vote; a few electors break ranks (Reuters) European Stocks Head for a One-Year High (BBG) Japan's Central Bank Keeps Policy Unchanged, Upgrades Economic Outlook (BBG) Russia and Turkey vow to keep detente on track after murder (FT) The Political Implications of Events in Ankara and Berlin (BBG) Trump condemns Berlin attack, says things 'only getting worse' (Reuters) Merkel: "No Doubt Berlin Crash Was a Terror Attack" (BBG) Gunman in Zurich mosque shooting is dead...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org