Last week, we shined a spotlight on a crack in the monetary system that few people outside of Switzerland (and not many inside either) were aware of. There is permanent gold backwardation measured in Swiss francs. Everyone knows that the Swiss franc has a negative interest rate, but so far as we know, Keith is the only one who predicted this would lead to its collapse (and he was quite early, having written that in...

Read More »Yield Curve Compression – Precious Metals Supply and Demand

Hammering the Spread The price of gold fell nine bucks last week. However, the price of silver shot up 33 cents. Our central planners of credit (i.e., the Fed) raised short-term interest rates, and threatened to do it again in December. Meanwhile, the stock market continues to act as if investors do not understand the concepts of marginal debtor, zombie corporation, and net present value. People believe that the Fed...

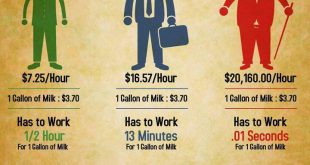

Read More »Why Are Wages So Low, Report 23 Sep 2018

Last week, we talked about the capital consumed by Netflix—$8 billion to produce 700 shows. They’re spending more than two thirds of their gross revenue generating content. And this content has so little value, that a quarter of their audience would stop watching if Netflix adds ads (sorry, we couldn’t resist a little fun with the English language). So it is with wry amusement that, this week, Keith heard an ad for an...

Read More »Another Gold Bearish Factor, Report 26 August 2018

Last week, we said that the consensus is that gold must go down (as measured in terms of the unstable dollar) and then will rocket higher. We suggested that if everyone expects an outcome in the market, the outcome is likely not to turn out that way. We also said that this time, there is likely less leverage employed to buy gold and that gold is less leveraged as well. And this, combined with a contrarian perspective on...

Read More »Submerged Lighthouse Syndrome – Precious Metals Supply and Demand

Fundamental Developments – The Gap Keeps Widening Last week, the lighthouse went down 24 meters (gold went down $24), or 50 inches (if you prefer, silver went down 50 cents). However, let’s take a look at the only true picture of supply and demand. Are the fundamentals dropping with the market price? They done whacked our lighthouse! [PT] Image credit: Skip Willits - Click to enlarge Gold and Silver...

Read More »Fundamental Price of Gold Decouples Slightly – Precious Metals Supply and Demand

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. The Fundamental Price has Deteriorated, but… Let us look at the only true picture of supply and demand in the gold and silver markets, i.e., the basis. After peaking at the end of April, our model of the fundamental price of gold came down to the level it reached last November. $1,300. Which is below the level it...

Read More »Monetary Consequence of Tariffs, Report 12 August 2018

Last week in Monetary Paradigm Reset, we talked about the challenge of explaining a new paradigm. We said: “The hard part of accepting this paradigm shift, was that people had to rethink their entire view of cosmology, theology, and philosophy. In the best case, people take time to grapple with these challenges to their idea of man’s place in the universe. Some never accept the new idea.” We were talking about the fact...

Read More »Monetary Paradigm Reset, Report 5 August 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Explaining a new paradigm can be both simple and impossible at the same time. For example, Copernicus taught that the other planets and Sun do not revolve around the Earth. He said that all the planets revolve around the Sun, including Earth. It isn’t hard to say, and it isn’t especially hard to grasp. Indeed, one of its...

Read More »A Dire Warning, Report 29 July 2018

Let’s return to our ongoing series on the destruction of capital, and how to identify the signs. Steve Saville posted a thoughtful article this week entitled The “Productivity of Debt” Myth. His article provides a good opportunity to add some additional thoughts. We have written quite a lot on this topic. Indeed, we have a landing page for marginal productivity of debt (MPoD) with four articles so far. Few economists...

Read More »Crying Wolf, Report 22 July 2018

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Quantity Theory Revisited The price of gold fell another ten bucks and that of silver another 28 cents. Perspective: if you’re waiting for the right moment to buy, the market is offering you a better deal than it did last week (literally, the price of gold is a 7.2% discount to the fundamental vs. 4.6% last week). If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org