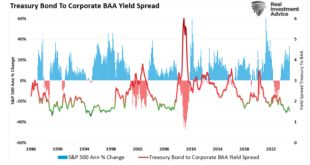

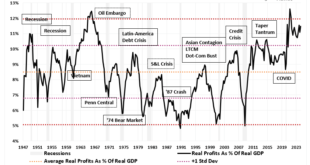

Credit spreads are critical to understanding market sentiment and predicting potential stock market downturns. A credit spread refers to the difference in yield between two bonds of similar maturity but different credit quality. This comparison often involves Treasury bonds (considered risk-free) and corporate bonds (which carry default risk). By observing these spreads, investors can gauge risk appetite in financial markets. Such helps investors identify stress...

Read More »Yardeni And The Long History Of Prediction Problems

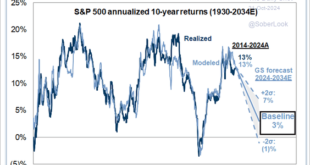

Following President Trump's re-election, the S&P 500 has seen an impressive surge, climbing past 6,000 and sparking significant optimism in the financial markets. Unsurprisingly, the rush by perma-bulls to make long-term predictions is remarkable. For example, Economist Ed Yardeni believes this upward momentum will continue and has revised his long-term forecast, projecting that the S&P 500 will reach 10,000 by 2029. His forecast reflects a mix of factors...

Read More »Exuberance – Investors Have Rarely Been So Optimistic

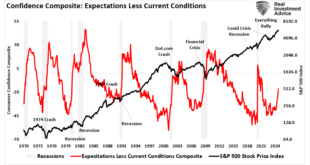

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board's Sentiment Index. To wit: "Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts." (Note: this survey was completed before the Presidential Election.) We also discussed households' allocations to equities, which,...

Read More »Exuberance – Investors Have Rarely Been So Optimistic

Investor exuberance has rarely been so optimistic. In a recent post, we discussed investor expectations of returns over the next year, according to the Conference Board’s Sentiment Index. To wit: “Consumer confidence in higher stock prices in the next year remains at the highest since 2018, following the 2017 “Trump” tax cuts.“ (Note: this survey was completed before the Presidential Election.) We also discussed households’ allocations to equities, which,...

Read More »Trump Presidency – Quick Thoughts On Market Impact

The prospect of a Trump presidency has led to much debate and speculation about how markets might react. Depending on what policies are eventually passed, there are potential risks and opportunities in both the stock and bond markets. While the market surged immediately following the election, many potential future headwinds may impact returns from economic growth, monetary and fiscal policy, and geopolitical events. Here are some quick thoughts about what we at...

Read More »Key Market Indicators for November 2024

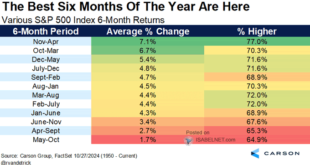

Key market indicators for November 2024 present a complex but opportunity-filled environment for traders and investors. Following the first phase of Federal Reserve rate cuts and growing global uncertainties, the technical landscape suggests several notable shifts. Let’s explore the key market indicators to watch. Note: If you are unfamiliar with basic technical analysis, this video is a short tutorial. [embedded content] Seasonality and Breakout Patterns...

Read More »Lower Forward Returns Are A High Probability Event

I was emailed several times about a recent Morningstar article about J.P. Morgan’s warning of lower forward returns over the next decade. That was followed up by numerous emails about Goldman Sachs’ recent warnings of 3% annualized returns over the next decade. While we have previously covered many of these article’s points, a comprehensive analysis is needed. Let’s start with the overall conclusion from JP Morgan’s article: “The investment bank’s models...

Read More »Greed And How To Lose 100% Of Your Money

In the movies, greed is a trait often exhibited by the rich and powerful as a means to an end. Of particular note is the famous quote from Michael Douglas in the 1987 movie classic “Wall Street:” “The point is, ladies and gentlemen, that greed, for lack of a better word, is good. Greed is right, greed works. Greed clarifies, cuts through, and captures the essence of the evolutionary spirit. Greed, in all of its forms; greed for life, for money, for love,...

Read More »Weekly Market Pulse: Questions

As we enter the final quarter of 2024, there are a lot of questions facing investors. There are, of course, always a lot of questions because investors are always dealing with the future, but today’s environment does seems to have more than usual. Some of these questions concern short-term considerations and while they are important, it is more important to remain focused on the long-term trends. Here’s what I’m thinking about lately: Let’s get the one everyone is...

Read More »GDP Report Continues To Defy Recession Forecasts

The Bureau of Economic Analysis (BEA) recently released its second-quarter GDP report for 2024, showcasing a 2.96% growth rate. This number has sparked discussions among investors and analysts, particularly those predicting an imminent recession. There are certainly many supportive data points that have historically predicted recessionary downturns. The reversal of the yield curve inversion, the 6-month rate of change in the leading economic index, and most...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org