Larry Summers - Click to enlarge At an event in Davos, Switzerland earlier today, Former U.S. Treasury Secretary, Larry Summers, argued that Central Bank independence from national governments should be scrapped in favor of a coordinated effort between politicians, central bankers and treasury to engineer inflation. Seems reasonable, right?…what could possibly go wrong? According to Market Watch, Summers argued that...

Read More »Jim Grant Puzzled by the actions of the SNB

Retaken from Christoph Gisiger via Finanz und Wirtschaft, James Grant, Wall Street expert and editor of the investment newsletter «Grant’s Interest Rate Observer», warns of a crash in sovereign debt, is puzzled over the actions of the Swiss National Bank and bets on gold. From multi-billion bond buying programs to negative interest rates and probably soon helicopter money: Around the globe, central bankers are...

Read More »Cashless Society – Is The War On Cash Set To Benefit Gold?

Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More »Rogoff Warns “Cash Is Not Forever, It’s A Curse”

Submitted by Christoph Gisiger via Finanz und Wirtschaft, Kenneth Rogoff, Professor of Public Policy at Harvard University, postulates to get rid of cash. In his opinion, killing big bills would hamper organized crime and make negative interest more effective. Kenneth Rogoff makes a provocative proposal. One of the most influential economists on the planet, he wants to phase out cash. «Paper currency lies at...

Read More »Monetary Policy When Interest Rates are Near Zero

In the 18th Geneva Report on the World Economy, Laurence Ball, Joseph Gagnon, Patrick Honohan and Signe Krogstrup ask whether “central banks can do [more] to provide stimulus when rates are near zero; and … whether policies exist that would lessen future constraints from the lower bound.” They are optimistic and argue that the unconventional policies of recent years can be extended: “[I]t is likely that rates could go somewhat further than what has been done so far without adverse...

Read More »Gold Wins In Three Out Of Four Scenarios, Macquarie Warns “None Of Them Are Good For The Economy”

Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More »S&P To Open At New Record High As Commodities Rise, China Trade Disappoints

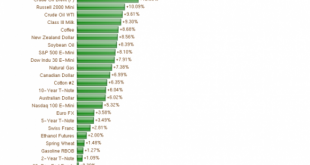

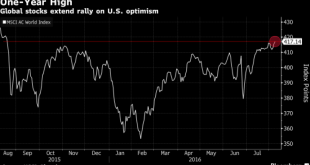

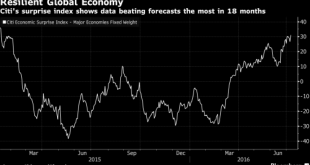

The meltup continues with the S&P500 set to open at new all time highs as futures rise 0.2% overnight, with European, Asian stocks higher, as job data pushed MSCI Asia Pacific Index towards highest close since Aug. 2015. Germany, U.K. economic data seen positive, with dollar, oil rising, and gold declining. Global equities advanced with commodities and emerging markets on speculation the U.S. economy is strong enough to sustain growth while only triggering a gradual increase in interest...

Read More »Richard Koo: If Helicopter Money Succeeds, It Will Lead To 1,500 percent Inflation

After today’s uneventful Fed announcement, all eyes turn to the BOJ where many anticipate some form of “helicopter money” is about to be unveiled in Japan by the world’s most experimental central bank. However, as Nomura’s Richard Koo warns, central banks may get much more than they bargained for, because helicopter money “probably marks the end of the road for believers in the omnipotence of monetary policy who have...

Read More »Central Bank Wonderland is Complete and Now Open for Business — The Epocalypse Has Fully Begun

The following article by David Haggith was first published on the Great Recession Blog. Summer vacation is here, and the whole global family has arrived at Central-Bank Wonderland, the upside-down, inside-out world that banksters and their puppet politicians call “recovery.” Everyone is talking about it as wizened traders puzzle over how stocks and bonds soared, hand-in-hand, in face of the following list of economic...

Read More »S&P 500 To Open At All Time Highs After Japan Soars, Yen Plunges On JPY10 Trillion Stimulus

Last Thursday, when we reported that Ben Bernanke was to "secretly" meet with Kuroda and Abe this week (he is said to have already met with Japan's central bank head earlier today), we said that "something big was coming" out of Japan which had "helicopter money" on the agenda. And sure enough, after a dramatic victory for Abe in Japan's upper house elections which gave his party an even greater majority, Abe announced the first hints of helicopter money when Nikkei reported, and Abe...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org