Published: 12th May 2016 Download issue: Central banks contributed to halting the financial crisis (starting with the US Federal Reserve’s first quantitative easing package, launched in late 2008), with successive rate cuts helping companies and households in the West to deleverage. The Bank of Japan (BoJ) and European Central Bank (ECB) followed with aggressive policies at a later stage, when the US recovery was already underway. Central banks’ commitment to their mandates has been...

Read More »China: Something has to give

Published: 12th April 2016 Download issue: A trip I took to Hong Kong and Singapore in March proved a useful way to gauge the mood of clients on China’s doorstep. Overall, my meetings with these clients—all entrepreneurs with significant investments in the Middle Kingdom— tended to confirm what other observers have been saying: the Chinese authorities have the resources to ensure the economy attains 6.5%-7% growth this year, and maybe even next year as well, but things may get complicated...

Read More »Financial markets looking for a second wind

Published: 17th March 2016 Download issue: Financial markets search for a second wind Equity markets in developed economies rebounded in February, after spending December and January in an attitude of crisis. We think that this is just a tactical rebound, rather than a return to the bull market that prevailed on equity markets from 2009 to 2014. The fundamentals that limit the upside for equities have not changed; meanwhile, the limits of central bank policy are becoming increasingly...

Read More »2016 off to a turbulent start

Published: 12th February 2016 Download issue: A turbulent start to a volatile year Global markets had a very difficult start to 2016, with equity markets experiencing one of the largest January falls in history, currency markets also seeing major disruption, and a sharp widening of spreads on high yield corporate bonds. By the end of the month, though, there were signs that a rebound was underway. Although the magnitude of the sell-off was clearly a concern, these developments are not out...

Read More »Health and technology

Published: 22nd December 2015 Download issue: Health matters to all of us: we want to live longer and better lives as our standards of living rise. In this issue of Pictet Report, we take a look at some exciting developments in the diagnosis and treatment of illnesses, and at new models for providing affordable and accessible healthcare. The most significant factor in improving healthcare today is technological innovation – in particular, the falling costs of DNA sequencing and the...

Read More »2016: growth, but no momentum

Published: 16th December 2015 Download issue: A case of lacklustre Goldilocks The coming year can just about be described as a ‘Goldilocks’ environment (not too hot, not too cold), but not a very appealing one. It is likely to be characterised by weak inflation, an absence of momentum in economic growth, concerns about the effectiveness of monetary policy, ongoing weakness in emerging markets, and periods of elevated volatility in financial markets. This scenario for 2016, as outlined in...

Read More »The markets’ pole star is fading

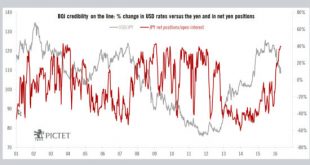

Published: 11th November 2015 Download issue: Since 2009, major central banks such as the US Federal Reserve, the European Central Bank (ECB), the Bank of Japan (BoJ) and others have largely determined the trends in the major asset classes of both emerging and developed countries: equities, sovereign and corporate bonds, and currencies. Investors found their guiding light in the central banks. Markets are once again likely to find themselves under their influence in 2016, but without as...

Read More »Higher market volatility should not preclude a rebound in DM equities

Published: 15th October 2015 Download issue: The Vix, a widely used measure of equity-market volatility, was in a systemic risk regime for 15 days this year, compared with just two days in 2014 and none at all in 2013, as shown by the chart below. This year’s experience of volatility is still not extensive in a historical comparison, but it still represents a marked change from very subdued conditions in the previous two years. What explains the change? Higher market volatility at present...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org