Published: 6th February 2017Download issue:Donald Trump’s presidential win has unleashed animal spirits in the US that are likely to continue to drive equities forward in 2017. So argues Frank Bigler, head of equity investment research at Pictet Wealth Management, in the latest special edition of Perspectives. There are undoubtedly risks, but for the moment, “the overall direction of the market is still up,” according to Bigler “and any pull-back would be taken as an opportunity to...

Read More »The age of intelligent machines

Published: 28th December 2016Download issue:Humankind is moving from an information age to the age of intelligent machines, with consequences for the world of work, the economy and society. The transition is driven by the explosion in the amount of digital data that is now available, artificial intelligence (AI) programmes that can analyse the data for the benefit of humanity, and intelligent robots that are able to work independently.The Winter 2016 edition of Pictet Report includes a talk...

Read More »From deflation to reflation, from bonds to equities

Published: 8th December 2016Download issue:Although Pictet Wealth Management does not expect a significant acceleration in real global economic growth next year, it believes 2017 will see an upturn in price pressures that spark a rise in nominal GDP growth and provides momentum for global reflation.In December’s Perspectives, Pictet Wealth Management’s head asset of asset allocation and macro research, Christophe Donay, discusses the implications of this, his central scenario, for the global...

Read More »The Family Consilium 2016

Published: 30th November 2016Download issue:This Chronicle presents the highlights from The Family Consilium held in Gstaad in June 2016. Topics covered include: emerging disruptions in geopolitics, disruptive forces in technology, how investors might respond to the changing financial environment, and strategies to manage the challenges of passing wealth from one generation to the next. Other highlights are Elif Shafak, Turkey’s most-read female author, on the growing political opposition to...

Read More »Time is ripe for change in monetary policy style

Published: 7th November 2016Download issue:In spite of large doses of policy easing, inflation and global growth remain tepid. With the effectiveness of existing monetary policy styles therefore being increasingly questioned, the November 2016 issue of Perspectives looks at three of the most plausible alternatives.One is asset-price targeting. Could central banks assume responsibility for ensuring the stability of asset prices as well as price stability? Christophe Donay, head asset of asset...

Read More »Gauging the economic plans of U.S. presidential candidates

Published: 11th October 2016Download issue:Both main candidates in the US presidential election have outlined their plans in numerous areas. Whoever wins, both are promising to raise government spending, especially on infrastructure. Writing in the October issue of Perspectives, Pictet Wealth Management’s chief economist Bernard Lambert outlines various scenarios. Should Hilary Clinton win the presidency but the Democrats fail to win a majority in the House of Representatives in...

Read More »Private equity, an antidote to prospect of weak returns?

Published: 13th September 2016Download issue:The summer months were good for risk assets, though things may get bumpier in the months ahead. But alongside this study in chiaroscuro, the September issue of Perspectives offers a brighter picture of investment opportunities.Pictet chief strategist Christophe Donay admits that “prospects for portfolio returns look far weaker than they did in the past” as the extraordinary measures introduced by central banks to combat low growth and inflation...

Read More »Family brands

Published: 9th August 2016Download issue:In the Summer 2016 issue of Pictet Report, Pictet managers and analysts set out the megatrends behind the success of premium brands and the financial pillars that make them attractive to investorsPremium brands have proved to be profitable long-term investments, offering strong revenue growth, superior operating margins and robust balance sheets over the long term. There are four fundamental megatrends behind their success in driving returns, whether...

Read More »Investing in a post-Brexit world

Published: 11th July 2016Download issue:Brexit should not lead to a repeat of the financial crisis of 2007-2008. So argue Pictet analysts and economists in the July issue of Perspectives. Central banks are better prepared and banks are less leveraged. In the last resort, the European Central Bank can be expected to step in again should financial stress noticeably increase in the weeks ahead. Longer term, an ideal post-Brexit scenario for European financial markets would be a renewed push for...

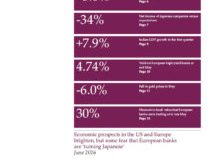

Read More »In the June 2016 issue of ‘Perspectives’

Published: 14th June 2016Download issue:Will Knut Wicksell be proved right? The Swede’s theories include the notion that there is a ‘natural’ level of interest rates, consistent with the economy operating at its full potential without overheating. But the actions of central banks have forced interest rates to artificially low levels in recent times, well below their ‘natural’ levels. If nature should reassert its predominance again, so the theory goes, then rates could shoot up, leading to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org