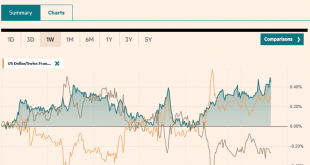

Swiss Franc The Euro has risen by 0.17% to 1.0859 EUR/CHF and USD/CHF, July 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are winding down what has been a challenging week that has seen equity markets slide and the dollar and bonds rally. The MSCI Asia Pacific fell for the fourth consecutive session, but the more interesting story may be the intrasession recovery that could set the...

Read More »FX Daily, July 08: Capital Markets Remain Unhinged

Swiss Franc The Euro has fallen by 0.51% to 1.0852 EUR/CHF and USD/CHF, July 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The dramatic move in the capital markets continues. The US dollar is soaring as yields and equities slide. The US 10-year yield has fallen below 1.30 to 1.26% European benchmark yields are 1-4 bp lower, while Australia and New Zealand have seen a 7-9 bp drop today. Signals that the...

Read More »FX Daily, May 31: China Raises Reserve Requirement for FX, Stemming the Yuan’s Rise

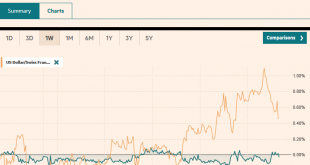

Swiss Franc The Euro has risen by 0.22% to 1.0986 EUR/CHF and USD/CHF, May 31(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: US and UK markets are closed for holidays today, contributing to the rather subdued price action today. The MSCI Asia Pacific Index rallied two percent last week, the most in three months, and most markets began off the week with modest gains. Japan, Australia, and Singapore, for...

Read More »Six Point Nine Times Two Equals What It Had In Twenty Fourteen

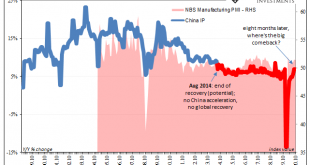

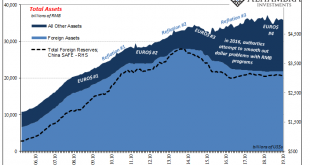

It was a shock, total disbelief given how everyone, and I mean everyone, had penciled China in as the world’s go-to growth engine. If the global economy was ever going to get off the ground again following GFC1 more than a half a decade before, the Chinese had to get back to their precrisis “normal.” In 2014, the clock was ticking but expectations were extremely high nonetheless. In September 2014, however, massive setback. Though it had been building all year by...

Read More »FX Daily, October 12: Yuan in Spotlight in Consolidative Session

Swiss Franc The Euro has fallen by 0.15% to 1.0738 EUR/CHF and USD/CHF, October 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Led by 2-3% gains in Hong Kong and China, the MSCI Asia Pacific Index rose for the sixth consecutive session is pressing against the high for the year. European stocks are firmer, and the Dow Jones Stoxx 600 is up around 0.5% near midday, and shares are also trading firmer. The...

Read More »The War On Cash – COVID Edition Part I

The corona crisis has already taken a very high toll and caused deep damage in our societies and our economies, the extent of which is yet to become apparent. We have seen its impact on productivity, on unemployment, on social cohesion and on political division. However, there is another very worrying trend that has been accelerated under the veil of fear and confusion that the pandemic has spread. The war on cash, that was already underway for almost a decade, has been drastically...

Read More »FX Daily, April 24: Markets Limp into the Weekend

Swiss Franc The Euro has risen by 0.05% to 1.052 EUR/CHF and USD/CHF, April 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The reversal in US equities yesterday set the stage for today’s losses. All the Asia Pacific bourses fell today but Australia. For the week, the regional index is off more than 2%. Europe’s Dow Jones Stoxx 600 was flat for the week coming into today’s sessions. It is off around 0.5% in...

Read More »FX Daily, January 03: Geopolitics Saps Risk Appetite

Swiss Franc The Euro has fallen by 0.10% to 1.0837 EUR/CHF and USD/CHF, January 3(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Iran’s Ayatollah Ali Khamenei has threatened “severe retaliation” for the US attacked that killed an important head of a force within the Islamic Revolutionary Guard. At the same time, reports indicate that North Korea’s Kim Jong Un is no longer pledging to halt its nuclear weapons...

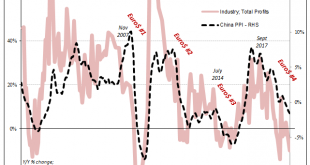

Read More »Nothing Good From A Chinese Industrial Recession

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was. That was the month the real recovery was supposed to have started. Instead, we can...

Read More »China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled. If you thought the Western media was liberal with the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org