Overview: The deluge of Treasury supply is nearly over for this week. On tap today are 4- and 8-week T-bills and $23 bln 30-year bonds to finish the quarterly refunding. The sales will come after the July CPI print that is expected to see the first year-over-year increase since last June. The market is going into the report with about a 15% chance of a Fed hike next month discounted. Meanwhile, September crude oil extended its recover from $80 seen on Tuesday to a...

Read More »Big Governments’ One-Two Punch: Scope Creep, Then Wartime Deprivation

Voluntary cooperation gets commandeered by the government gradually in peacetime, then suddenly through war. Peace, then World War I Starting in 1894, the USA no longer had a small-government major party. In both major parties, majorities of elected representatives were the USA’s crony-socialist Progressives. Immediately, Progressives began working to consolidate their political control. They replaced voter-informing caucuses with voter-isolating primaries. They...

Read More »The Soviet Abuse of Indigenous Peoples

Socialists and communists claim to support the rights of "indigenous" peoples. However, that support rings hollow given how the USSR abused the native peoples of Siberia, all while American socialists and communists uncritically supported the Soviet Union. Original Article: "The Soviet Abuse of Indigenous Peoples" [embedded content]...

Read More »Politics Has Infected Everything in Our Society, Especially the Media

One of the few things that most Americans agree about today is that there are serious problems with the current news-media environment. Conservatives have spent decades denouncing the “liberal media,” labeling it a thinly veiled arm of the Democratic Party and, recently, of Big Pharma. Meanwhile, Progressives seem to blame billionaire-created Fox News for just about every problem facing America. Even the establishment media folks are fretting over their colleagues’...

Read More »After Strong Demand for US Three-Year Notes, Treasury will Sell $38 bln 10-year Notes

Overview: The first leg of the US refunding was well received, with the three-year note being scooped up by investors, driving the yield below it was trading in the when-issued market. Today, the Treasury sells $38 bln 10-year notes, whose auctions have been less than stellar recently. The US 10-year yield reached 4.20% last week and is now straddling 4%. Italian bonds are also firm as the Italian government clarifies the new tax on banks' windfall profits. Other...

Read More »Credit Crunch: The Money Supply Has Shrunk For Eight Months In a Row

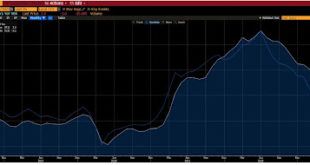

Money supply growth fell again in June, remaining deep in negative territory after turning negative in November 2022 for the first time in twenty-eight years. June's drop continues a steep downward trend from the unprecedented highs experienced during much of the past two years. Since April 2021, money supply growth has slowed quickly, and since November, we've been seeing the money supply repeatedly contract—year-over-year— for six months in a row. The last time the...

Read More »Liberalism and Peace

Recorded at the 2003 Supporters Summit: Prosperty, War, and Depression. Ralph Raico discusses how from Jefferson to Madison, and on to Bastiat, Molinari, and Spencer, the "classical" liberals routinely denounced war as the enemy of freedom, prudence, and natural rights. Instead, militarism and imperialism have long been the domain of the enemies of private property and other apologists for the state. (32:19) [embedded content]...

Read More »States Can Curb Federal Power through “Soft Secession”

The use of interstate compacts by US states shows that the states don't need the federal government to dictate or manage interstate relations. Original Article: "States Can Curb Federal Power through "Soft Secession"" [embedded content] Tags: Featured,newsletter

Read More »Breaking Free: How Open Protocols Foster Entrepreneurship, Spontaneous Order, and Individual Sovereignty

In the dynamic and ever-evolving digital landscape, open protocols have emerged as a powerful force, challenging closed-source models and reshaping industries. Beyond their technical merits, open protocols embody fundamental economic principles that foster innovation, competition, decentralized decision-making, and even censorship resistance. By embracing open protocols, societies can harness the creative energies of individuals and entrepreneurs, empowering them to...

Read More »“Greed” Didn’t Kill the Pac-12. Entrepreneurial Failure Did

For college football fans, it’s already been a wild August week before the first kickoff. Reminiscent of the Europe of old, and, hopefully, the America of the future, the collegiate athletic landscape in the last several years has witnessed a massive redrawing conference kingdom borders. The most powerful empires are the SEC and the Big Ten, with the former adding the Universities of Texas and Oklahoma and the latter pursuing manifest destiny in the West with the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org