U.S. presidential candidate Vivek Ramaswamy took aim at the Federal Reserve recently: The reality is, if the dollar is volatile, it’s as bad as if the number of minutes in an hour fluctuated. None of us would be here at the same time. […] When the number of dollars [in relation] to a unit of gold or an agricultural commodity is wildly fluctuating, money doesn’t go to the right projects. It’s just wild—it doesn’t make any sense. That’s been an impediment to economic...

Read More »Why the “Just Wage” Theory Doesn’t Make Much Sense

The concept of the "fair wage" or the "just wage" is centuries old. It dates back at least to the Middle Ages and was founded on the idea that "just" prices of goods must be sufficient to provide "a reasonable wage to maintain the craftsman or merchant in his appropriate station of life." In its modern form, the idea of the just wage is often known as a "living wage." But whatever its form, the notion comes down to the idea that an employer must pay his workers a...

Read More »There Is No Fed Magic Trick to Achieve a Soft Landing

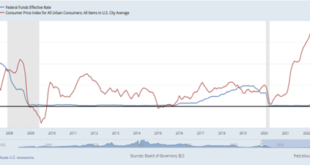

Economic growth in the United States accelerated to a 2.4 percent annualized rate in the second quarter of 2023, picking up from 2.0 percent in the first quarter, and climbing well above the 1.8 percent rate predicted by economists. Many analysts are surprised that the US economy has continued to expand at a robust pace despite the Federal Reserve’s (Fed) aggressive tightening on monetary policy. The Fed raised interest rates by more than 500 basis points (bps) since...

Read More »CBDCs: The Ultimate Tool of Financial Intrusion

While the government promotes CBDCs as tools for "inclusion," it is more likely that they will be another vehicle for federal intrusion. Original Article: "CBDCs: The Ultimate Tool of Financial Intrusion" [embedded content] Tags: Featured,newsletter

Read More »Updating Böhm-Bawerk and Fixing Finance

Peter Lewin joins Bob to discuss his work with Nicolás Cachanosky on uniting Austrian capital theory with mainstream finance. Peter's New Book on Capital and Finance: Mises.org/LewinBook Updating Böhm-Bawerk and Fixing Finance Video of Updating Böhm-Bawerk and Fixing Finance Join us in Nashville on September 23rd for a no-holds-barred discussion against the regime. Use Code "HA23" for $45 off admission:...

Read More »Understanding Hegel from a Straussian Viewpoint

This book offers an account of Hegel that will surprise many readers—at least it surprised me. The political philosopher Leo Strauss often criticized “historicism,” the view that human beings do not have a fixed nature or essence. Instead, as José Ortega y Gasset put it, “Man, in a word, has no nature; what he has is—history.” G.W.F. Hegel was one of the foremost historicists, so you might expect Strauss to attack him. But, although he does suggest that Hegel’s...

Read More »The Unwelcome Return of Covid Restrictions and Lockdowns

The covid restriction machinery is being ramped up in time for fall, despite the fact that covid poses little danger. Original Article: "The Unwelcome Return of Covid Restrictions and Lockdowns" [embedded content] Tags: Featured,newsletter

Read More »The Big Shift: The decline of Western politics

Part II of II The big shift Of course, this is the Left, but also the Right, of the good old days. The days of gentlemanly conduct and of real sportsmanship during a debate. These were the days when cultivated, curious and humble people argued passionately, but honourably. These were the days of decency, of common courtesy and civility. But also these were the days of ideological integrity and consistency. For example, the arguments and the...

Read More »How a CBDC Created Chaos and Poverty in Nigeria

It is no coincidence that Nigeria, with a population of over two hundred million, became the first serious global testing ground for central bank digital currencies (CBDC) implementation. Not only is it the wealthiest country on the continent where the globalists are making plans, but Nigeria also possesses significant hydrocarbon and metals reserves and talented citizens. For these reasons, it can serve as a relatively good example for the rest of the poorest...

Read More »China’s Measures Begin to Find Traction, US Employment Report on Tap

Overview: Beijing's seemingly steady stream of measures to support the economy and steady the yuan are beginning to produce the desired effect. The yuan is snapping a four-week decline and the CSI 300 halted a three-week drop. Some economists estimate that the bevy of measures may be worth as much as 1% for GDP. The dollar is narrowly mixed ahead of the US employment data, which is expected to see the pace of job growth slow to around 170k. Of note, the Mexican peso...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org