In his book Omnipotent Government, Ludwig von Mises traces the shift in Europe from individualism to state omnipotence, highlighting the disastrous effects of empowering government to run every aspect of social and economic life:Men now seem eager to vest all powers in governments, i.e., in the apparatus of social compulsion and coercion. They aim at totalitarianism, that is, conditions in which all human affairs are managed by governments. They hail every step...

Read More »Jean-Baptiste Say: Neglected Champion of Laissez-Faire

Beyond some rudimentary facts, very little is available in English about the life of J.B. Say. He was born in Lyons, France, to middle-class Huguenot parents, and spent most of his early years in Geneva and London. As a young man, he returned to France in the employ of a life insurance company, and soon became an influential member of a group of strongly pro-free- market intellectuals. Indeed, Say was the first editor of La Decade Philosophique , a journal...

Read More »The Fort Knox Gold Was Stolen From the American People

What is the Mises Institute? The Mises Institute is a non-profit organization that exists to promote teaching and research in the Austrian School of economics, individual freedom, honest history, and international peace, in the tradition of Ludwig von Mises and Murray N. Rothbard. Non-political, non-partisan, and non-PC, we advocate a radical shift in the intellectual climate, away from statism and toward a private property order....

Read More »Now What?

Sorry for the disruption of the regular commentary. Still, the monthly will be posted tomorrow. There is a key divide in the market. One camp sees the US tariff threats as bluster and a negotiating tactic. The other camp, which I find myself in, thinks something more serious is happening. The US voted against Europe and with Russian and Iran at the UN for the first time in 45 years on European issues. Martin Wolf, the erstwhile economic editor at the Financial...

Read More »Now What?

Sorry for the disruption of the regular commentary. Still, the monthly will be posted tomorrow. There is a key divide in the market. One camp sees the US tariff threats as bluster and a negotiating tactic. The other camp, which I find myself in, thinks something more serious is happening. The US voted against Europe and with Russian and Iran at the UN for the first time in 45 years on European issues. Martin Wolf, the erstwhile economic editor at the Financial...

Read More »Let’s Be Realistic

[The Lecturer’s Art: Gems of American History by Walter A. McDougall. Encounter Books, 2025. xxii + 291 pp.]The historian Walter McDougall is not a libertarian, but he criticizes the Progressives and Woodrow Wilson in a similar way to Murray Rothbard. He does so from the perspective of “realism.” Although people benefit from cooperation, realists maintain, their desires for wealth and power often lead them to act in ways that violate morality and go against their...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

Read More »CAPE-5: A Different Measure Of Valuation

One of the most referenced valuation measures is Dr. Robert Shiller's Cyclically Adjusted Price-Earnings Ratio, known as CAPE. Valuations have always been, and remain, an essential variable in long-term investing returns. Or, as Warren Buffett once quipped: “Price Is What You Pay. Value Is What You Get.” One of the hallmarks of very late-stage bull market cycles is the inevitable bashing of long-term valuation metrics. In the late 90s, if you were buying...

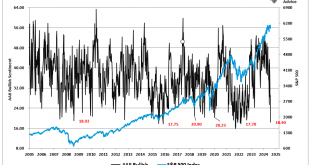

Read More »Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index...

Read More »Retail Investors Are Suddenly Bearish

The American Association of Individual Investors (AAII) sentiment indicator claims that 60.6% of the retail investors are bearish. The percentage of bears in its survey increased sharply from 40.5% at the prior reading on February 19. The AAII retail investor survey is now the most bearish it has been since September 2022. More stunning, this is only the sixth time since 1987 that bearish sentiment has been above 60%. Furthermore, the five-week change in the index...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org