CEPR/SUERF/CB&DC webinar with Darrell Duffie, Todd Keister, Harald Uhlig, Dirk Niepelt. Youtube Digitisation rapidly changes money, banking and finance. Are these changes fundamental and radical—or part of a continuous process of technological progress and efficiency improvement? Do academics have to re-think money, banking and finance—or do conventional theories apply? And do finance professionals and regulators need to re-assess their frameworks and tools to keep up with the...

Read More »Smart Banknote CBDC

Orell Füssli news release: Orell Füssli Ltd. Security Printing and AUGENTIC GmbH announced their partnership on a “Smart Banknote CBDC” solution including trustwise.io’s Distributed Ledger Technology (DLT) a week ago. A smart banknote is a physical banknote that interacts with a CBDC solution and acts as a transitional device between traditional and CBDC based payment systems. A smart banknote can be used like a classic banknote; however, the owner can redeem his cold wallet (physical...

Read More »History Of Money and Evolution Suggests a Crash is Coming

Today’s guest is as much a historian and anthropologist as he is an expert on market events. Jon Forrest Little joins Dave Russell on GoldCore TV today and brings some fascinating insights into what we are currently seeing when it comes to political decisions, financial events and human reactions. From what we can learn from the Romans through to why we need to consider gold’s utility rather than its price, this is an interview bringing a new perspective as to why we...

Read More »The Knockout Blow to Crypto

A New Type of Fighter Bonus The UFC has started paying fan bonuses to its fighters in Bitcoin. The UFC buys crypto at a fixed dollar amount and pays their fighters a bonus in cryptocurrency. As someone who loves the UFC and monetary economics, I wanted to offer an alternative solution to the UFC and its athletes. The Problems with Crypto This takedown of crypto will focus on the speculative aspect of cryptocurrencies. Crypto’s greatest draw is also its fatal flaw....

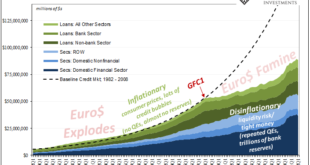

Read More »The Everything Data’s (Z1) Verdict: Not Inflation, Only More Of The Same

The only thing that changed was the CPI. What distinguishes 2021-22 from the prior post-crisis period 2007-20 is merely the performance of whatever consumer price index. This latter has been called inflation, yet the data conclusively support the market verdict pricing how it never was. What data? The “everything” data, the most comprehensive financial and monetary compendium yet available: The Financial Accounts of the United States, or Z1. While this doesn’t quite...

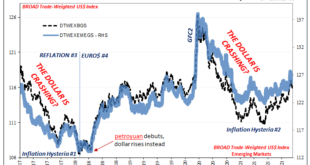

Read More »China’s Petroyuan, Uncle Sam’s Checkbook, The Fed’s Bank Reserves: Who Really Sits On King Dollar’s Throne? (trick question)

A full part of the inflation hysteria, the first one, was the dollar’s looming crash. The currency was, too many claimed, on the verge of collapse by late 2017, heading downward and besieged on multiple fronts by economics and politics alike. Basically, the Fed had “printed” too much “money” and the Chinese playing some “long game” were purportedly ready at any moment to snatch the role of world reserve by manipulative force from the out-to-lunch Americans. Those...

Read More »“Bargeld hat keine ökonomische Notwendigkeit (Cash, not Essential),” Jan 2022

Wirtschaft Regional, January 7, 2022. PDF. Interview on private and public money, digital payments, Bitcoin, cash.

Read More »“Bargeld hat keine ökonomische Notwendigkeit (Cash, not Essential),” WR, 2022

Wirtschaft Regional, January 7, 2022. PDF. Interview on private and public money, digital payments, Bitcoin, cash.

Read More »Taper Discretion Means Not Loving Payrolls Anymore

When Alan Greenspan went back to Stanford University in September 1997, his reputation was by then well-established. Even as he had shocked the world only nine months earlier with “irrational exuberance”, the theme of his earlier speech hadn’t actually been about stocks; it was all about money. The “maestro” would revisit that subject repeatedly especially in the late nineties, and it was again his topic in California early Autumn ’97. As Emil Kalinowski and I had...

Read More »Interview, Riksbank RN, 2021

Riksbank Research News 2021, December 2021. PDF (pp. 2–3), HTML. Q: You have been leader of the CEPR Research and Policy Network on FinTech and Digital Currencies since 2021 and explored issues at the heart of monetary theory and payment systems in your research. What do you think is new about digital central bank money and what makes it different from other digital means of payment? A: Societies have been using digital means of payment for decades. Commercial banks use digital claims...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org