Submitted by Ronan Manly, BullionStar.com News has just emerged in the gold market that the giant Swiss precious metals refiner Argor-Heraeus has held discussions to be acquired, and that the likely outcome is an acquisition by a private equity group. This private equity group is believed to be London-based WRM CapInvest, part of Zurich headquartered WRM Capital. Other interested buyers are also believed to have examined a bid for Argor-Heraeus, including Japanese refining group Asahi...

Read More »Cashless Society – Is The War On Cash Set To Benefit Gold?

Submitted by Jan Skoyles via GoldCore.com, Introduction Cash is the new “barbarous relic” according to many central banks, regulators, and some economists and there is a strong, concerted push for the ‘cashless society’. Developments in recent days and weeks have highlighted the risks posed by the war on cash and the cashless society. The Presidential campaign has been dominated for months and again this week by the...

Read More »FX Daily, September 27: US Debate Lifts Peso, but Leaves the Dollar Non-Plussed

Swiss Franc Click to enlarge. FX Rates The first US Presidential debate may not sway many voters but has lifted the Mexican peso. The peso, which has fallen by about 1.3% over the past two sessions, has stormed by 1.5% today as the seemingly biggest winner of the debate. Snap polls immediately following the debate gave the edge to Clinton. FX Performance, September 27Source Dukascopy. Click to enlarge....

Read More »Great Graphic: Net Mexican Migration to the US–Not What You Might Think

Summary: Net migration of Mexicans into the US has fallen for a decade. The surge in Mexican migration into the US followed on the heels of NAFTA. Although Trump has bounced in the polls, and some see this as negative for the peso, rising US interest rates and the slide in oil price are more important drivers. There has been much discussion in the US presidential campaign about immigration, especially from...

Read More »Negative and the War On Cash, Part 2: “Closing The Escape Routes”

Submitted by Nicole Foss via The Automatic Earth blog, Part 1 Here. History teaches us that central authorities dislike escape routes, at least for the majority, and are therefore prone to closing them, so that control of a limited money supply can remain in the hands of the very few. In the 1930s, gold was the escape route, so gold was confiscated. As Alan Greenspan wrote in 1966: In the absence of the gold...

Read More »US Futures Rebound, European Stocks Higher As Oil Rises

The summer doldrums continue with another listless overnight session, not helpd by Japan markets which are closed for holiday, as Asian stocks fell fractionally, while European stocks rebounded as oil trimmed losses after the the IEA said pent-up demand would absorb record crude output (something they have said every single month). S&P futures have wiped out almost all of yesterday's losses and were up over 0.2% in early trading. Europe's Stoxx 600 rose 0.4% with miners and energy...

Read More »FX Daily, July 01: Markets Head Quietly into the Weekend

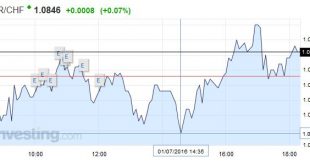

EUR/CHF stronger in Brexit week The EUR/CHF finished the week after Brexit with slight improvement of 0.18% (see the FX performance table below). The scare mongering by the Swiss media was misplaced. The euro even recovered from a dip after BoE governor Carney’s comments on Thursday. We do not see strong SNB interventions at this elevated price level. We judged that the interventions happened below 1.08. Click to...

Read More »EU Plans $290K Per Person Fine For Countries Refusing “Fair Share” Of Refugees; Angry Response Ensues

As Norway offers cash for refugees to leave, announcing that they won’t be accepting any more refugees from the EU, and Switzerland prepares its military to close down borders, the EU has seemingly had enough of every country acting as if it has any type of sovereignty left. The European Commission has announced that it is going to pull rank on everyone, and in Obama-like fashion, will be fining countries for not taking their fair share of refugees. Here is a detailed summary of all that...

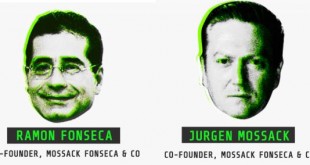

Read More »Panama Tax Haven Scandal: The Bigger Picture

A Huge Leak The “Panama Papers” tax haven leak is big … After all, the Prime Minister of Iceland resigned over the leak, and investigations are taking place worldwide over the leak. But Why Is It Mainly Focusing On Enemies of the West? But the Panama Papers reporting mainly focuses on friends of Russia’s Putin, Assad’s Syria and others disfavored by the West. Former British Ambassador Craig Murray notes: Whoever leaked the Mossack Fonseca papers appears...

Read More »Mossack Fonseca: The Nazi, CIA And Nevada Connections… And Why It’s Now Rothschild’s Turn

For all the media excitement about the disclosed names in the "Panama Papers" leak, in this case represented by the extensive list of Mossack Fonseca clients, this is not a story about which super wealthy individuals did everything in their power, both legal and illegal, to avoid taxes, preserve their financial anonymity, and generally preserve their wealth. After all, that's what they do, and it should not come as a surprise that they will always do that, especially following last year's...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org