The CIO office’s view of the week ahead.Last week brought some unexpected news in trade relations, with President Trump putting the threat of tariffs on EU car imports on hold and promising to re-examine those recently imposed on European steel and aluminium imports. At first look, it seems like wise heads are beginning to prevail in Washington. And with US companies becoming more vociferous in their concerns about tariffs, Trump himself needed to show his “art of the deal” was bearing...

Read More »Weekly View – why isn’t Trump happy?

The CIO office’s view of the week ahead.After recent criticism of the Fed from Donald Trump’s top economic advisor, Larry Kudlow, last week the US president himself said that he was “not happy” about the Fed’s rate-hiking campaign. Traditionally, US presidents have refrained from commenting on Fed decisions as a way of affirming the central bank’s independence, but these apparently casual remarks increase the suspicion that the political heat on the US central bank is being cranked up.And...

Read More »Weekly View – opposing forces

The CIO office’s view of the week ahead.A new list of US tariffs was unveiled last week. These tariffs, which could be implemented in September, will undoubtedly trigger countermeasures by the Chinese. But markets chose to look past these tensions to a US economy that still appears robust. Consumer and corporate confidence remain high and Q2 GDP growth is likely to be in the vicinity of 4%. In spite of an increasingly tight labour market, underlying inflation remains tame, while the US...

Read More »Weekly View – markets live another day

The CIO office’s view of the week ahead.Last week saw some welcome stabilisation in markets, even though the first wave of US tariffs against Chinese products kicked in on Friday, followed immediately by Chinese counter-measures for an equivalent amount. Instead, investors remained focused on the dollar. The recent strength of the greenback has contributed much to emerging markets’ (EM) weakness. But the dollar index weakened at the end of last week following the release of average US...

Read More »Weekly View – assessing the strength of the US economy and corporates

The CIO office’s view of the week ahead.After the release of tepid consumer spending and business equipment figures for May, this week will be important in helping us gauge the prospects of the US economy, with the latest Fed minutes released on Thursday and US payroll figures a day later. The minutes should reflect our belief that the economy is in good shape, with growth in Q2 set to come in at a seasonally-adjusted quarter-on-quarter rate of 4.5%. We also expect US corporates to announce...

Read More »Weekly View – Greece out of the woods, Italy raising doubts

The CIO office’s view of the week ahead.The week gone by saw some good news in Europe in the form of a debt relief agreement for Greece that ends eight years of bailouts and gives that country some measure of spending flexibility. The agreement sparked an encouraging rally in Greek equities and bonds. The latest flash purchasing managers’ index (PMI) figures also suggested that business sentiment is steadying in the euro area, whose economy looks to have performed decently in Q2 2018. But...

Read More »Weekly View – Italian worries subside for now

The CIO office’s view of the week ahead.Last week was eventful, with Italian bond spreads rising sharply on the threat of fresh elections and then partially recovering when a government was eventually formed. We do not think that the crisis engulfing Italy has ended. After the summer, the new populist government’s unfunded fiscal plans could put Italian bond yields under renewed pressure. In spite of the downfall of Spanish prime minister Mariano Rajoy, there is less to worry about in Spain...

Read More »Reality check means markets face a pause

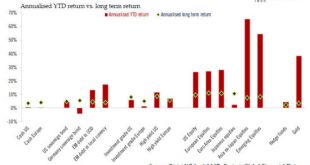

Risk assets had an exceptionally strong first quarter, but a repeat performance will require overcoming numerous obstacles.The first quarter was an exceptional one for risk assets—so exceptional that it is difficult to see how their performance can be repeated in the present quarter without some strong catalysts. According to our analysis, annualised returns on equities in the first quarter were up to three times higher than their historic average in the case of developed-market equities,...

Read More »Weekly View, 18 October 2016

Weekly View Pictet Wealth Management’s near-term view on the economy and financial markets18 October 2016.Last week saw profit-taking on equity markets. Chinese export data unsettled Asian markets (the MSCI Asia ex-Japan fell 2.4% in local currency), but had no notable effect on developed markets (the S&P500 lost 1% in local currency while the Stoxx 600 edged up 0.1%). Cyclicals did better than defensives.A turnaround in earnings growth forecasts following several disappointing years...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org